Artificial Intelligence in FinTech: maximise benefits by innovating responsibly

Artificial Intelligence: a trillion-dollar opportunity transforming all industries, globally.

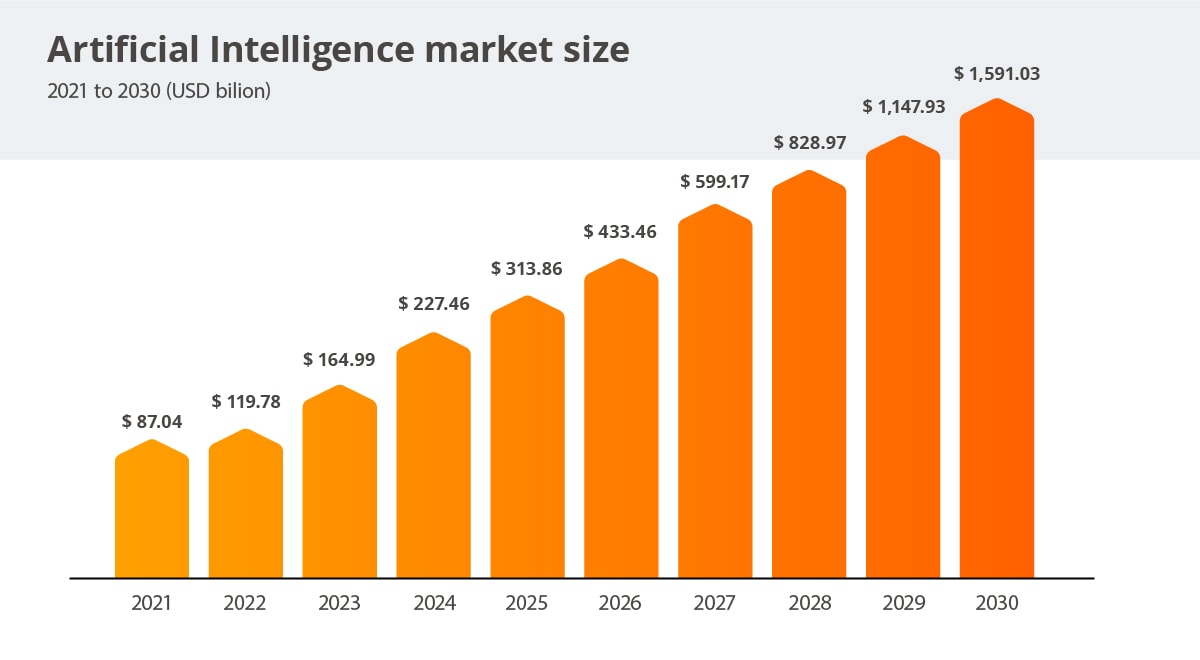

According to Precedence Research, in 2021 the global Artificial Intelligence market size was valued at $87.04 billion. Since its introduction, AI has been adopted across many sectors, retail, automotive, logistics and pharmaceutical being some of the most obvious ones. By 2030, the market is estimated to touch $1,597.1 billion, with a registered CAGR of 38.1% from 2022 to 2030.

Bloomberg estimates that by 2030, the global AI in fintech market size is expected to be worth $41.16 billion. This means that the global financial services industry will adopt and maximise the benefits of AI at an equally rapid pace. With great advantages come some risks and the need to mitigate them, to create memorable experiences for customers.

What is AI and why does everyone keep talking about it

Artificial Intelligence (AI) is the ability of computers/machines to perceive, reason, learn, interact with the environment, solve problems and even exercise creativity like humans. We are not quite completely there yet, though we are moving in that direction responsibly.

Given its huge potential, AI has an immense impact on how we work and perform. Today it is one of the hottest topics in the business world.

AI in the financial services industry

The world of finance is not different from other sectors. Fintechs and banks need to build and implement ‘best-in-class’ AI solutions to become more efficient, effective and create more memorable experiences for their customers and employees. An AI strategy must become an integral part of the corporate strategy for a sustainable competitive advantage. In the past few decades, the whole industry has undergone a huge transformation:

All these changes are the consequences of the introduction of new technologies and one of the technologies that has the biggest impact on the sector is AI.

Where are the opportunities for AI in the financial services industry?

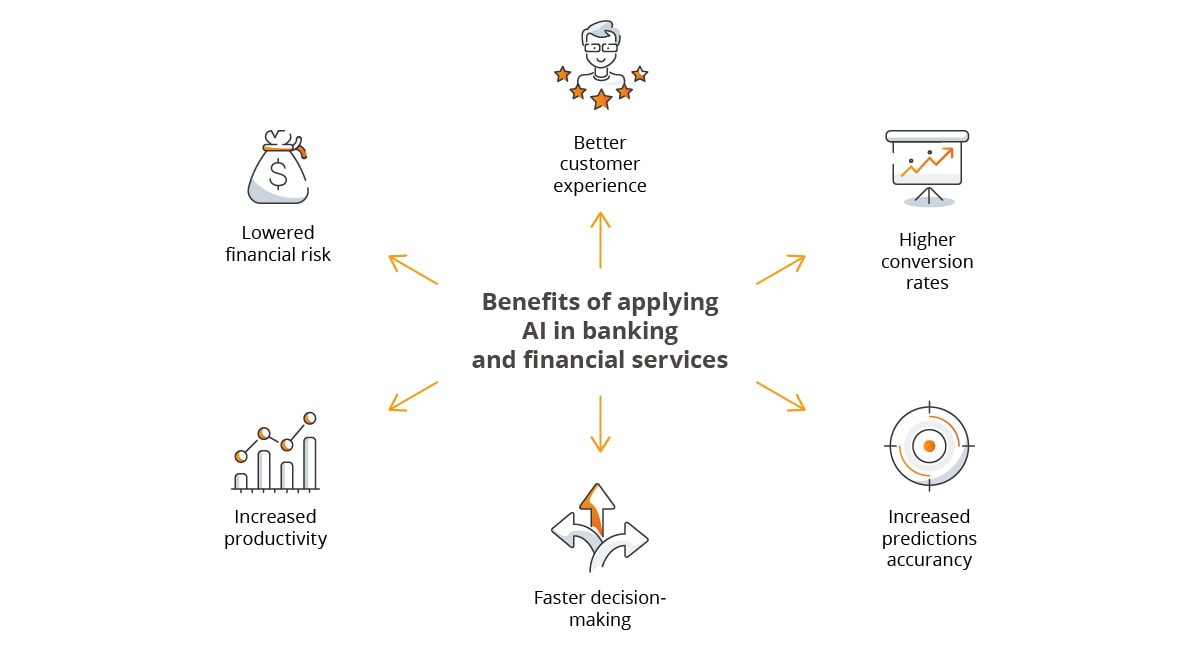

The immense value provided by federated learning, advanced machine learning and deep neural networks in financial services is unquestionable. In the financial services industry, AI helps to streamline processes such as credit decisioning and financial risk management; it also allows for personalised banking services, better and more efficient fraud detection, improved customer services and automation of back-office processes, meaning higher cost effectiveness.

AI can also completely transform the decision-making processes in the financial services industry. Financial service providers must be open to gathering, refining and analysing traditional as well as non-traditional sources of data.

Data and AI-driven decisions will help in increasing revenues, innovating customised and personalised products and services, improving risk assessments and accordingly delivering memorable customer experiences. Big Data is a key asset that gives financial services providers (fintechs and banks) a unique strategic advantage for enabling automated and predictive decision-making.

Where are you on the Artificial Intelligence journey?

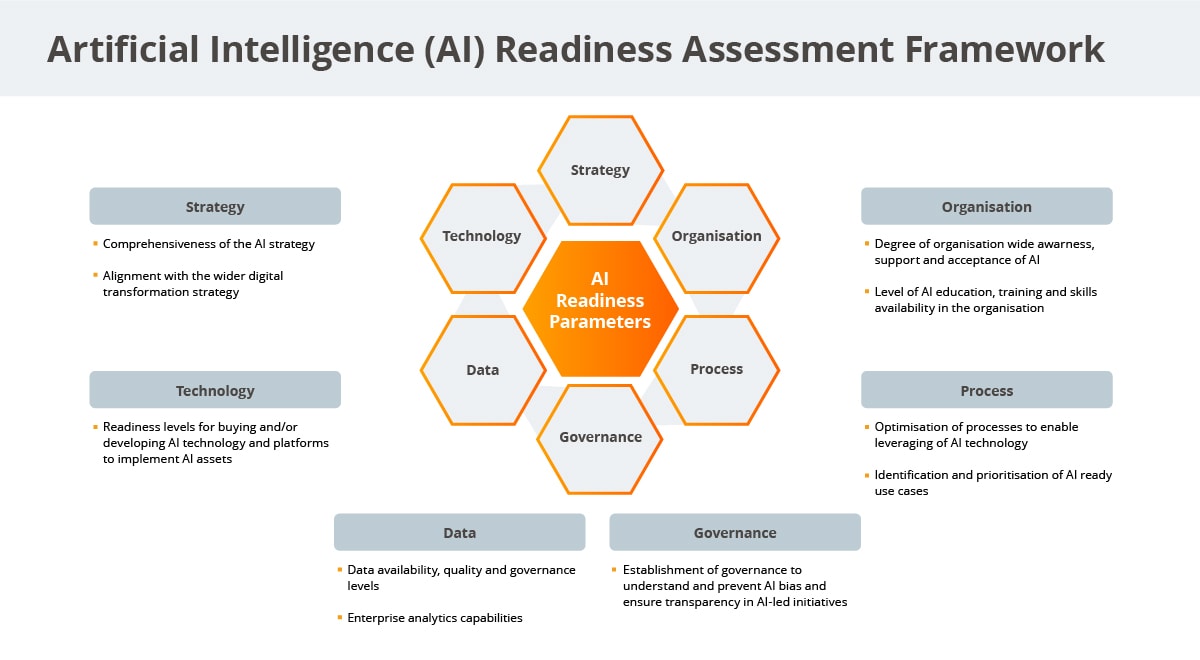

If you are one of those financial services providers keen to adopt AI, don’t rush to build and implement a quick-fix AI solution. Remember that capturing data comprehensively, organising it well and leveraging new modelling tools and techniques for learning from the data and gaining deep insights are all crucial in the process.

Start with an Artificial Intelligence Readiness Assessment Framework, as per illustration below.

Another important part is consultation with various stakeholders across the whole company – it is critical at all stages: from business case preparation to benefits realisation.

Artificial Intelligence transparency

In the financial services industry, transparency is a critical factor when it comes to maintaining trust in AI and your own reputation. It is not enough to know that a model works well. Financial services providers want to know how and why the model works, in detail. The sector is highly regulated so the approach must be different from the one used in other sectors. Algorithms for recommending the next video on YouTube may not need the same level of transparency as algorithms for recommending the next best trade or investment product for the customers.

Another challenge is interpretability in AI systems and the need to know why the AI solution made a certain decision and not the other.

The most important of them are adjusting weights of the inputs to assess the impact on the outputs or alternatively using surrogate modelling. With the recent advances in XAI or Explainable AI, they will soon become a crucial feature for the practical deployment of AI models.

To conclude, with competition in the financial services industry increasing rapidly, the early AI adopters, who will leverage AI to boost operational efficiency and transform their decision-making process, will emerge as winners.

…………………………………………………….

ABOUT THE AUTHOR

Sid Joshi is an ‘AI in Financial Services’ expert/speaker and Founder of FinTech Maximisers, a purpose-driven AI innovation start-up. The company’s purpose is to maximise the benefits of responsible AI for everyone in the global financial services industry.

Sid brings over two decades of international experience in advising world’s leading financial services companies on their digital and AI strategy and transformation journey. He leverages his financial services industry knowledge and passion for FinTech and AI-led innovation to drive the conceptualisation and implementation of effective solutions to solve complex business problems.

Sid has analysed the business and operating model (investment suitability) of a wide range of financial technology (FinTech) start-ups for diverse investors, leveraging a data-driven approach. He is also a financial technology (FinTech) educator/writer and his innovative solutions have been published in leading international journals such as US banker, Global Treasurer, Bank Technology News, Guides to cash, supply chain and treasury management and other publications.