Digital transformation in finance: what you have to know now

Adjusting your business to the new, digitised world is a must, no matter the industry. But there are those that need such digital transformation more than others, finance being one of them.

Let’s look at the process of digital transformation in finance in more detail and see how to go about it so that it is as smooth as possible.

What is a digital transformation?

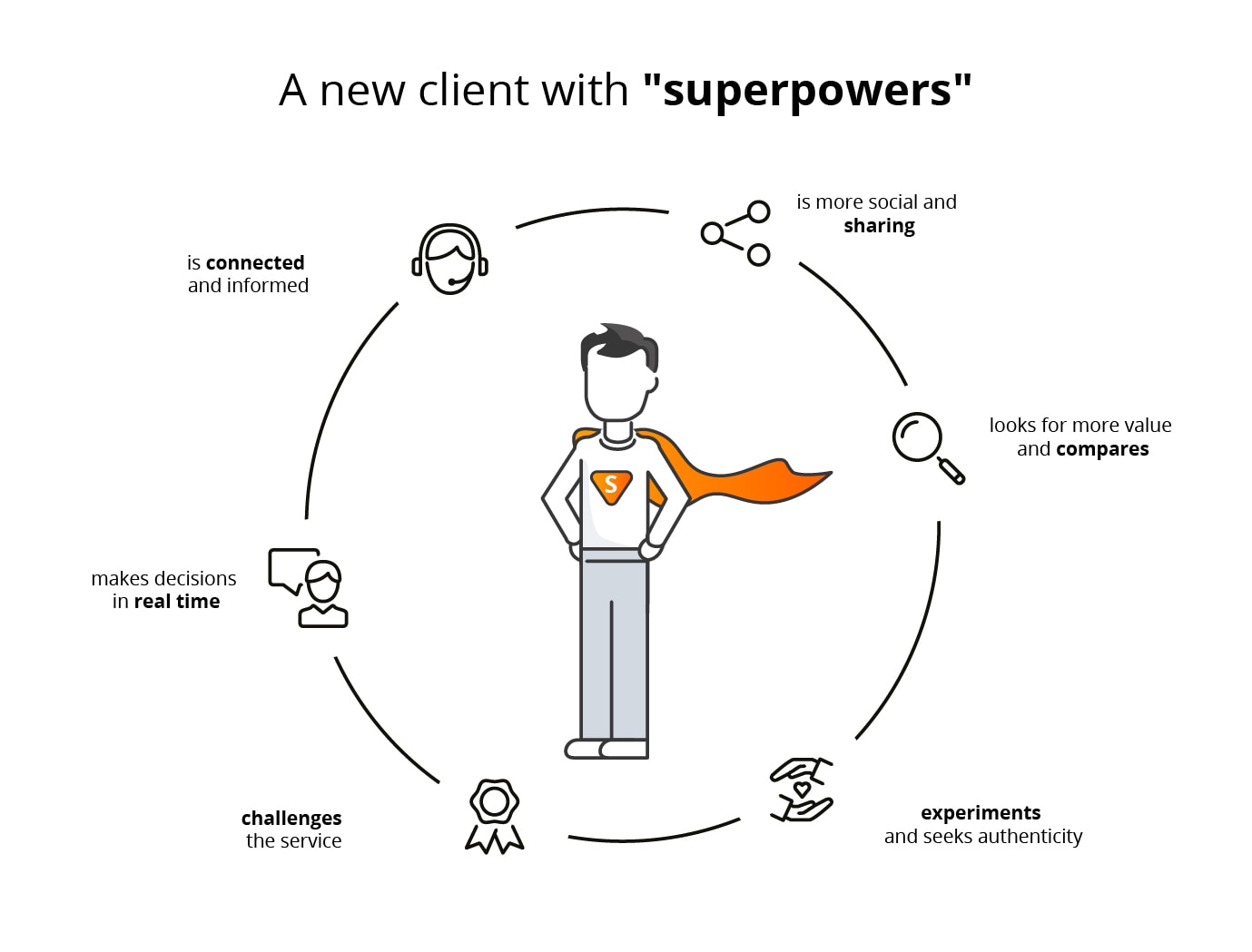

In the world where everything happens online, digital transformation became an imperative. Understood as an integration of digital technology in all areas of business, it changes the way companies serve new types of customers. But to respond to their needs, businesses must evaluate the way they work and the way they think. The most important stage in this process is understanding the changes that are taking place in society, markets, and customer habits.

Doing things as they “used to be done” is simply not good anymore, as is thinking that getting more digital savvy is only another IT strategy, rather than a process that involves every aspect of a company’s operation. These are the reasons why digital transformation can be tricky and time consuming.

Why banking and finance industries need digital transformation?

As all industries, banking and finance sectors were heavily impacted by the recent pandemic. Within a few months all the world went online, changing the ways we perceive things and the ways we operate. All of a sudden everyone wanted to have access to all the services via a computer or, even more challenging, on their mobiles. As stated in the most recent McKinsey’s Global Banking Annual Review:

This coupled with new customers’ expectations in terms of availability, personalisation, and simplification of their dealings with different companies meant that many financial institutions started putting even greater emphasis on new technologies.

At the same time fintech world accelerated. It became apparent that those players who introduce digital transformation quickly and smoothly would be the only ones to attract new customers. A huge rise in fintech start-ups meant that to stay in the game, larger institutions needed to think about their digital strategy more seriously.

Other important reasons for the great need for digital transformation in banking industry are regulations and new trends, such as cryptocurrencies, blockchain and biometrics. The sector is rapidly developing and to manage all those changes banks need to be able to adopt them and make them accessible. What’s more, the economic crisis means that costs are of even greater importance than they used to be, benefits get reduced and interest rates become negative. One of the best ways of addressing this problem is automatisation and use of new technologies.

Five most important challenges for finance institutions

Today, banking and finance industries are faced with many challenges. Here are the most pressing of them:

The need to become customer-centric, not product-centric anymore

It’s the customers’ world we live in and only those institutions that understand this fact will survive. Customers like being taken care of and they like services which are available on the go. To achieve that, banks need to become more agile and embrace new technologies.

Keeping the costs as low as possible

Digital transformation and automatisation allow financial institutions to save a lot of money. Going digital and moving certain services from branches to the virtual reality is a key as it allows to save on rent, salaries, and likewise training.

Being on top of cybersecurity issues

The huge increase in online customers mean an even bigger increase in cybercrimes. Research shows that online banking made up 96% of all banking transactions and it accounted for 93% of all fraud attempts in Q1 2021. This is why digital transformation needs to be linked very closely with new level of care around cybersecurity issues, meaning protecting clients and institutions, and working in a safe cloud environment.

Taking care of clients and of brand reputation

With so many companies and institutions offering similar services, today it is easier than ever to change one company for another. Often, it’s only about one click. This is why capturing the clients’ attention at the right time and in the right way is just the beginning. To keep them for longer, financial institutions need to engage with them regularly, giving them what they expect (ideally even more than that), and still keep them happy.

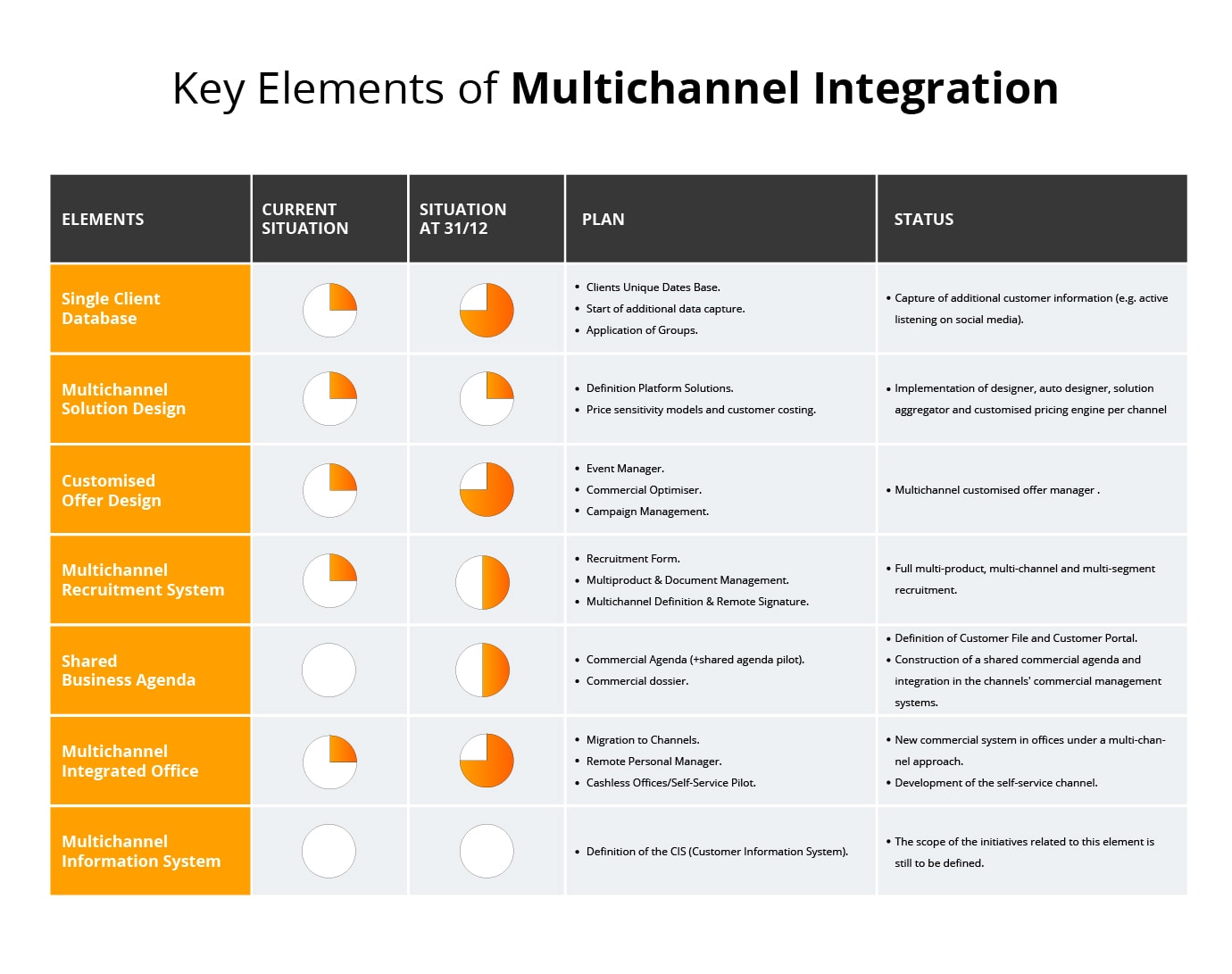

Using new channels and technologies and integrating them smoothly

The digital world keeps changing quickly and so should financial businesses. Integrating new channels and technologies (such as SEO, RSS) into their operations is the only way forward if they want to stay on top of all developments.

Why financial institutions need a reliable IT partner, experienced in the strategy building?

Given the huge number of benefits linked to the digital transformation in finance and banking industry, it is no wonder becoming more tech savvy is high at the list of priorities for many financial institutions.

They need to be ready for scaleup and for other revolutions which are happening as you read the text: cryptocurrencies, blockchain, NFTs, biometrics. Seems obvious, yet only 27% of banks launched a digital transformation strategy in 2021.

Why? The most common worry is simple: it is difficult to start building a completely new way of working without any experience in doing it. And finding, hiring, and retaining the right people for the job is extremely difficult, given the global lack of talented IT candidates.

Going through digital transformation is a great challenge and choosing and experienced IT Partner is one of the keys to its success. Future Processing is among the tech companies worth considering as they have worked with many important players from the finance industry.

_________________________

ABOUT THE AUTHOR

José Manuel Pérez Ariza – an experienced Director of Digital Transformation and Technology and Operations, senior professional reporting to the management committee with extensive experience in management, technology, operations, processes, quality and the development of people in multinationals in the financial sector.

He focuses on the income statement, the differential contribution of value, efficiency and effectiveness, quality, anticipation, leadership, commitment, team management. You can read more texts by him here.