Predicting stock prices and market shifts using AI

Most companies need to gain significant profits in order to run and continue to succeed in today’s increasingly vast market. With increased saturation comes increased competition, which in turn leads to more uncertainty as there are more competitors in the entire market to keep track of.

One of the best ways for companies to become or remain successful is to employ artificial intelligence (AI) processes that can predict stock prices and market shifts with great success. AI can enhance the process in both terms of efficiency and accuracy and allow companies to understand the market better to remain competitive.

Using numerical analysis to predict stock prices

The stock market can be difficult to predict due to its volatility. Despite the volatility, however, stock prices are not simply randomly generated numbers. Therefore, they can be analyzed as a sequence of discrete-time data or time-series observations taken at successive points in time on a daily basis. This type of forecasting, predicting future values based on historical data, works well with stock forecasting.

Due to the sequential nature of the data collected when using time-series observations, the data must be aggregated together in some fashion in order to perform an accurate stock market prediction. Out of various techniques, the most intuitive one is the moving average (MA), as it has the ability to account for fluctuations in the short term.

Moving Average

For MA, there are set used periods based on the length of investment; for example, 20-day, 50-day, and 200-day MA are used for short-term, medium-term, and long-term investments respectively.

The two types of MA that are most preferred by financial analysts are Simple MA and Exponential MA.

Simple MA

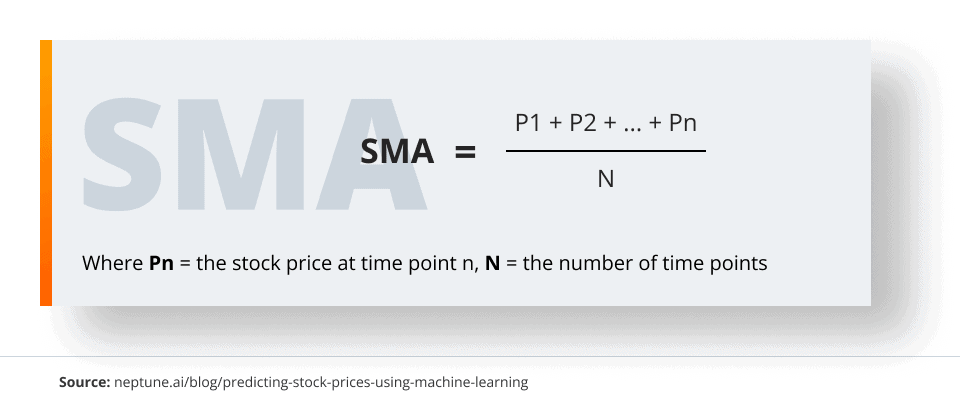

The formula for SMA is:

Exponential MA

Contrasting with SMA, which assigns equal weights to all historical data points, thereby adding emphasis on past data points more, EMA, short for Exponential Moving Average, applies more weight and emphasis to recent prices, such as the most recent stock prices in a 200-day MA.

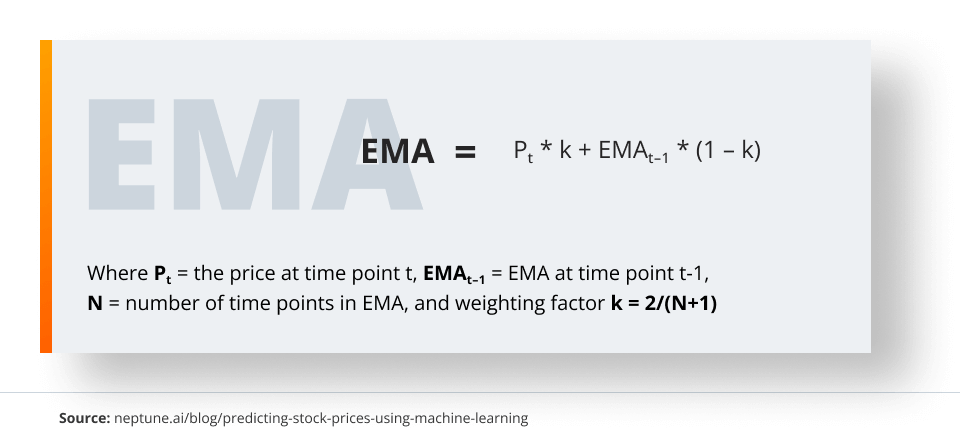

The formula to calculate EMA is:

The EMA has one distinct advantage over the SMA; by adding weight to more recent data points while neglecting more historical values, the EMA is much more responsive to price changes, allowing for more use in short-term trading.

Traditional approaches

Other techniques for using numerical analysis to predict the stock market are, overall, traditional approaches. There are four distinct methods in traditional stock price prediction that might vary in how they work but have one trait in common; they all attempt to understand the current stock market when conducting a stock market analysis in order to understand stock market trends, which would allow for increased success in predicting future stock prices.

Judgmental Bootstrapping is an approach that is derived from translating a stock market expert’s rules into a quantitative model that regresses the particular expert’s forecasts against the information that they utilize.

Game Theory is an approach that consists of watching other competitors and investors in order to learn their strategies and then utilize them to adjust investment decisions and stock trading accordingly in order to predict the stock market.

Extrapolation is overall a more common process in which a person or company creates simple estimations based on the observational range. One example of this would be to predict a future rise in stock price based on the rise throughout the current year. By extrapolating, companies can quickly project future values based solely on historical or current data.

Finally, Simple Regression Analysis is a causal approach in which all data points are plotted in order to determine the relationship between two variables, such as economic health and stock market performance. This approach does not account for any other confounding variables, just the two in the analysis.

All of these methods attempt to gather as much information about the market as possible because it is much easier to estimate the demand of a target market once its parameters are understood to a greater degree.

Benefits of incorporating AI into predictions

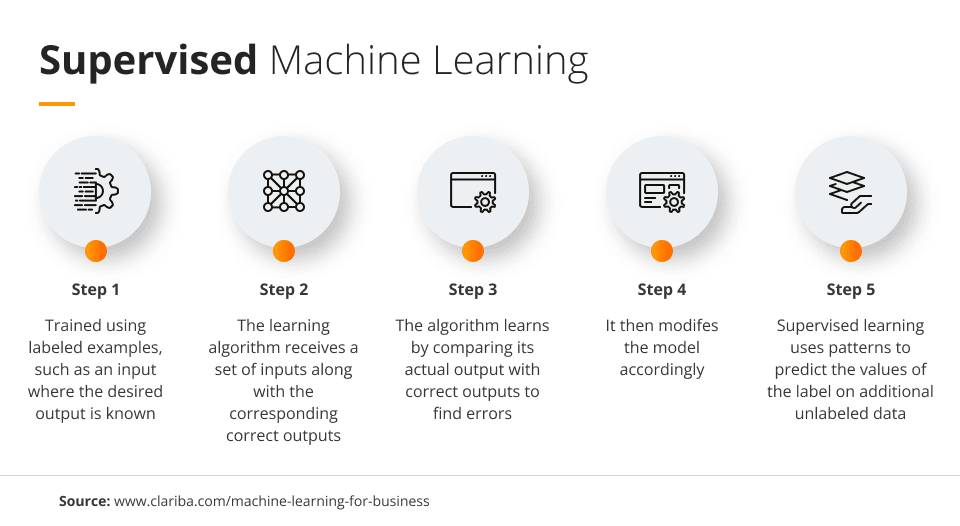

While numerical analysis has proven to be a somewhat effective technique for modeling the stock market and various shifts, in practice, these entities have far too many variables to reliably and accurately predict results, particularly in the modern era, where vast amounts of data points are the norm. As a result, firms are increasingly using artificial intelligence and machine learning to form more accurate predictions about the stock market.

Various machine learning algorithms have been trained to form more accurate predictions than any human analysis team could hope to generate. But what benefits does artificial intelligence bring to the stock market and trend projection specifically?

Deeper and more time-efficient analysis

Some of the most prominent benefits include the ability to analyze massive amounts of data quickly, identify patterns in stock market movements, and employ more complex algorithms than the traditional methods of technical analysis. AI and machine learning can improve portfolio performance by employing risk management strategies that reduce losses and maximize upside potential.

Additionally, these technologies enable stock traders to react faster to dynamic markets and capture opportunities that would otherwise go undetected.

Maximizing captured variables

Another way that artificial intelligence benefits predictions is by maximizing considered variables when predicting future stock market values. Machine learning algorithms employ a range of statistical learning techniques, such as linear and logistic regressions, clustering, and support vector machine learning, to reveal subtle patterns in stock data and accurately predict stock market performance.

Because these algorithms have the ability to incorporate contributing variables that would be invisible to the human eye, they provide more reliable stock market forecasts.

Comparing AI models

There are a variety of models that are used to perform stock market analysis and accurate predictions on stock prices and market shifts. These models include the simple moving average (SMA) model, the exponential moving average (EMA) model, the Echo State Networks (ESN) model, and the long short-term memory (LSTM) model.

These models perform similar tests but vary based on the investment decisions made and the methods used to get to those decisions. While a few of these models were previously discussed, this section of the article will further expand on them and compare their different helper functions.

Simple moving average (SMA) model

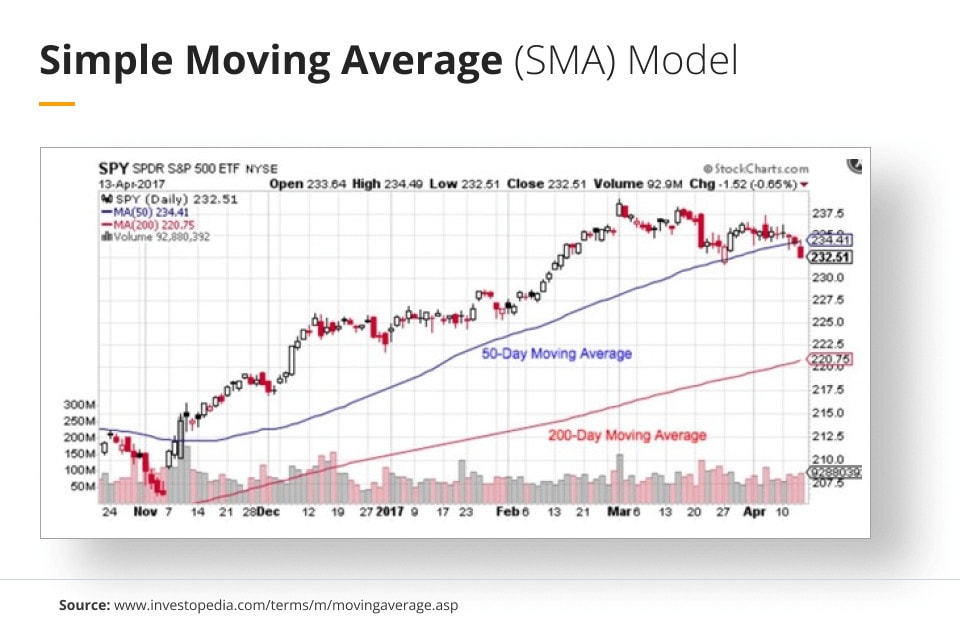

The most basic model is the simple moving average (SMA) model. This model calculates the average of a range of stock prices, also known as closing prices, over a specific number of periods in that range. The key aspect to know about the SMA model is that a shorter period of time results in a better indicator of short to medium stock movements.

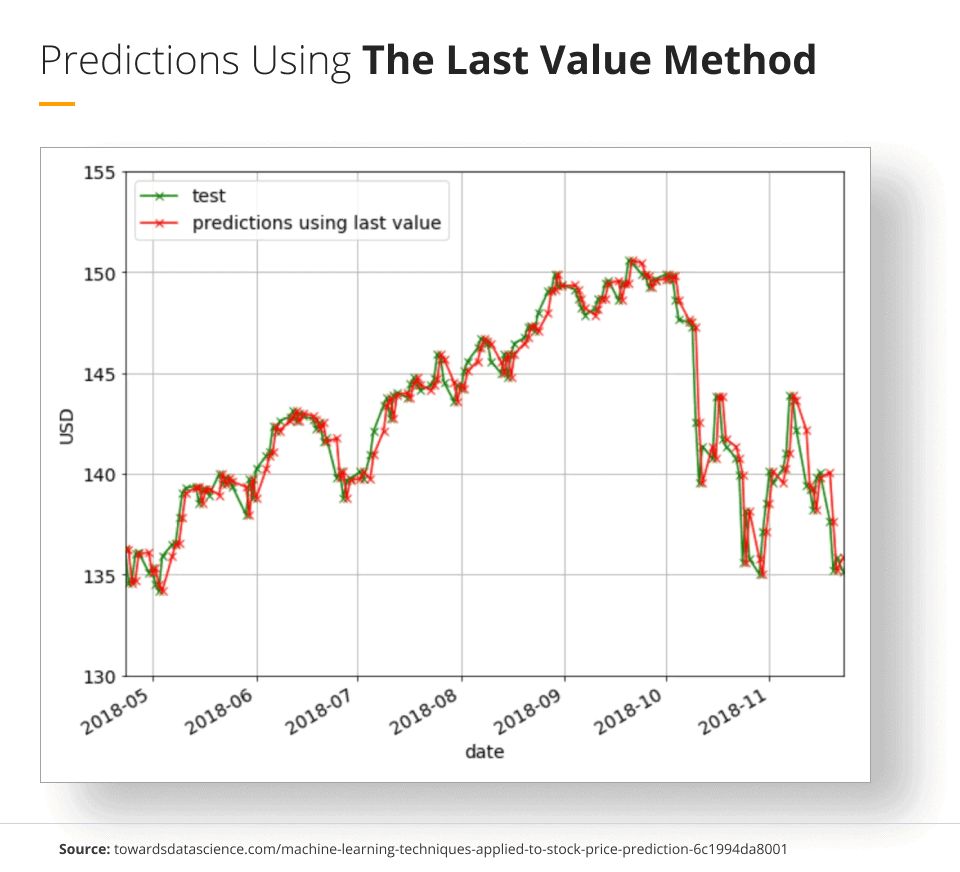

For example, a 50-day SMA is a better trend indicator than a 200-day SMA. While examining past movements in stock prices is the most obvious way to predict future prices, the SMA model has historically given predictions that have been less than the actual stock price. As seen in the graph below, the 200-day SMA produces lower prices in a model that already returns low prices. Therefore, shorter SMAs are often used.

Exponential moving average (EMA) model

The exponential moving average (EMA) model is used to predict facets of stock market prediction that the SMA model can not. The EMA model applies higher weights to recent prices, which differs from the SMA model, which assigns equal weights to all historical price points.

The advantage of assigning higher weights to recent prices is that the EMA is more responsive to price changes. Therefore, the EMA model is primarily used for short-term stock trading since stock price changes are more volatile in the short run as compared to the long run.

Therefore, investors will use the SMA model to accurately predict long-term stock prices, and they will use the EMA to predict short-term stock prices. Investors are willing to use both models because all models require the same memory and consume the same amount of resources.

Echo state networks (ESN) model

The echo state networks (ESN) model is one of the most recent and advanced models which accounts for the chaotic dynamics of the stock market. In fact, ESN is a fairly new invention within the recurrent neural networks (RNN) family. In short, neural networks use machine learning (ML) to portray behavior accurately. In the case of ESN, there is a hidden layer with several neurons flowing and loosely connected, which can capture the non-linear history information of input data.

Long short-term memory (LSTM) model

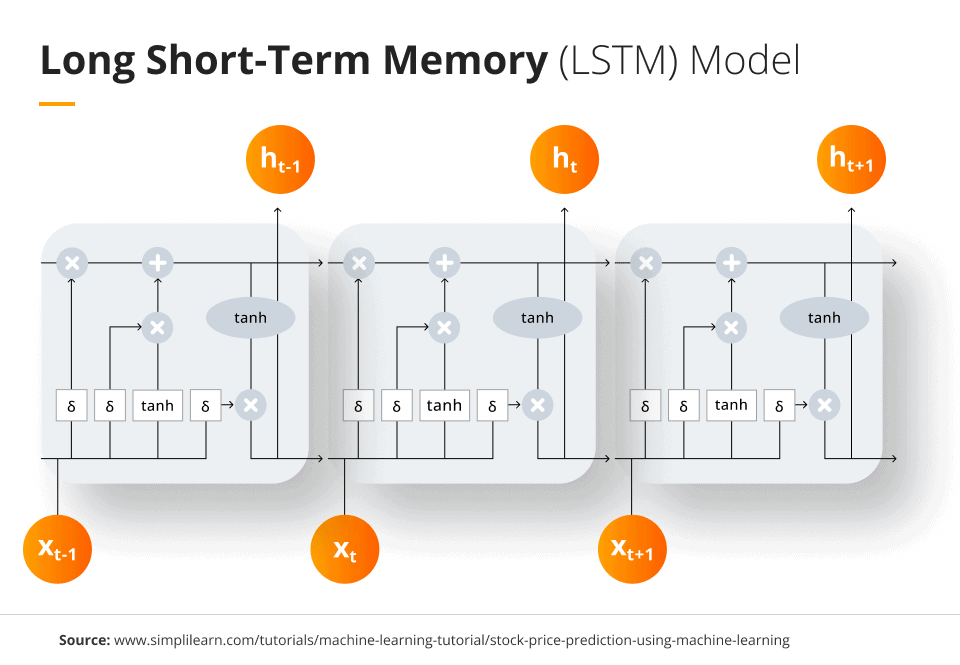

Finally, another advanced model used to predict stock prices and trends is the long short-term memory (LSTM) model. This model is similar to the ESN model in the sense that it can predict stock prices with high accuracy. The model works by capturing historical trend patterns to predict future values with RNN for learning long-term dependencies.

Therefore, the LSTM model is used for processing and predicting time-series data. The graphic below highlights the chain-like structure of the LSTM model, which is derived from its neural network layer that uses ML to predict prices.

Conclusion

AI implementation for a business can mean the difference in an increasingly technologically advanced market. Companies scour for the best methods they can use to compete with their competitors, and market shift and stock price prediction with artificial intelligence is one of the best solutions for this.

Predicting how the stock market will vary and shift over time is an extremely difficult task due to the inherent unpredictability of the future, but utilizing AI will allow businesses to approach this task with more confidence and allow them to achieve future success.