The future of price prediction

Price prediction allows companies to accurately evaluate the price of a good or service by evaluating its characteristics and context surrounding it, allowing businesses to make optimal purchases, reduce costs, and gain more profit. In today’s market, price prediction can mean the difference between success and decline for companies.

Introduction

Price prediction is an increasingly complex requirement for companies, and the leveraging of different artificial intelligence (AI) models for use in price prediction is a welcome trend for the future. While there are tangible benefits in accuracy and efficiency, limitations of forecasting must also be observed. Considering both perspectives is crucial in avoiding a digital leap of faith and making the best business decision.

Improving the accuracy of forecasting

Price prediction does not just involve implementing a forecasting tool to achieve more immediate success. Forecasting requires the right sets of data in order for programs to accurately perform price predictions.

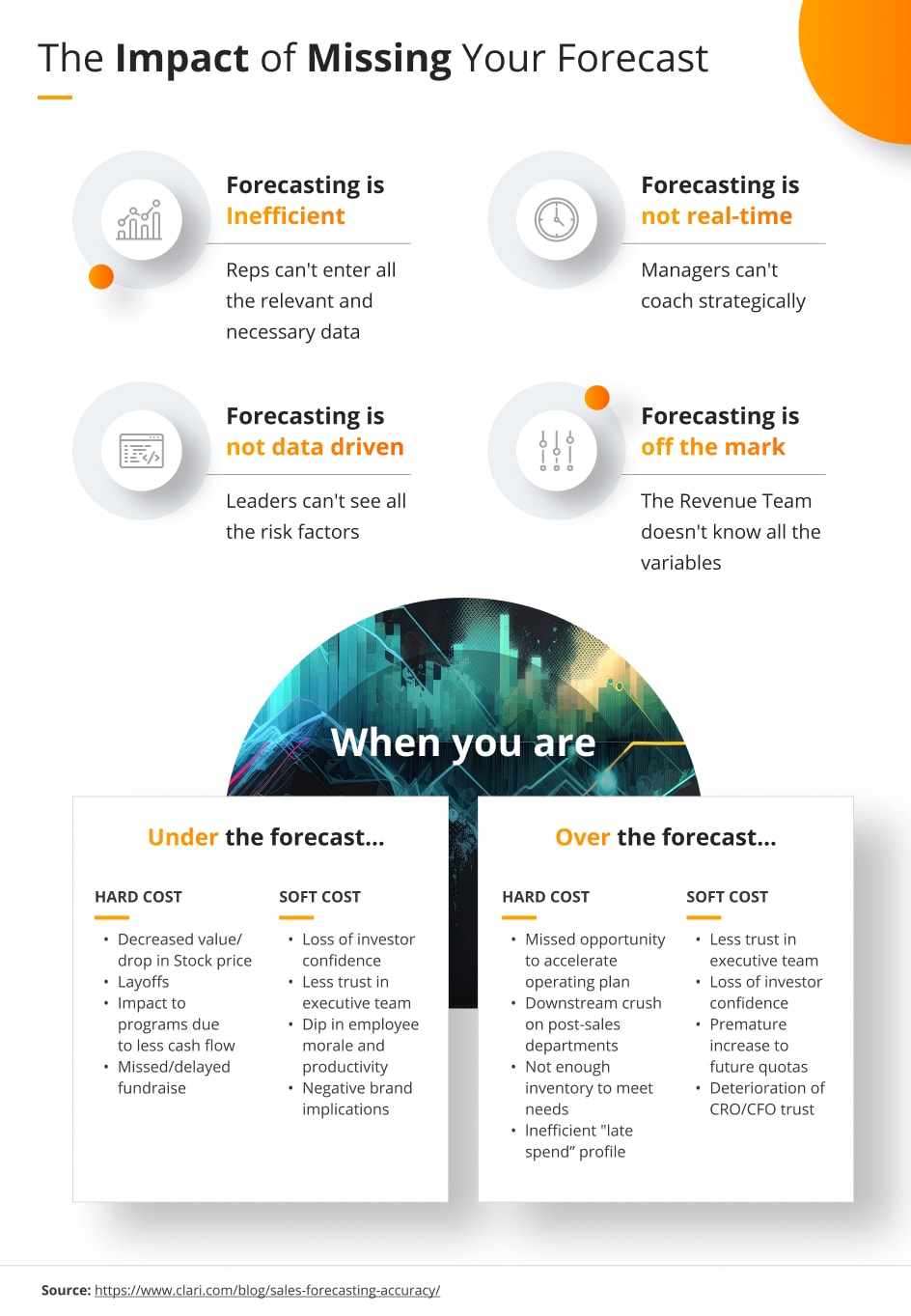

Inaccurate forecasts can quickly pile up and become detrimental for businesses that attempt to measure price volatility for their traditional pricing methods. The typical forecasting process is a pattern that continues to fail for some companies as it continuously leads to inaccurate projections over and over again.

To achieve future profits in different financial markets, companies must be able to accurately forecast future values. Below are four important considerations to improve accuracy.

Building a momentum case

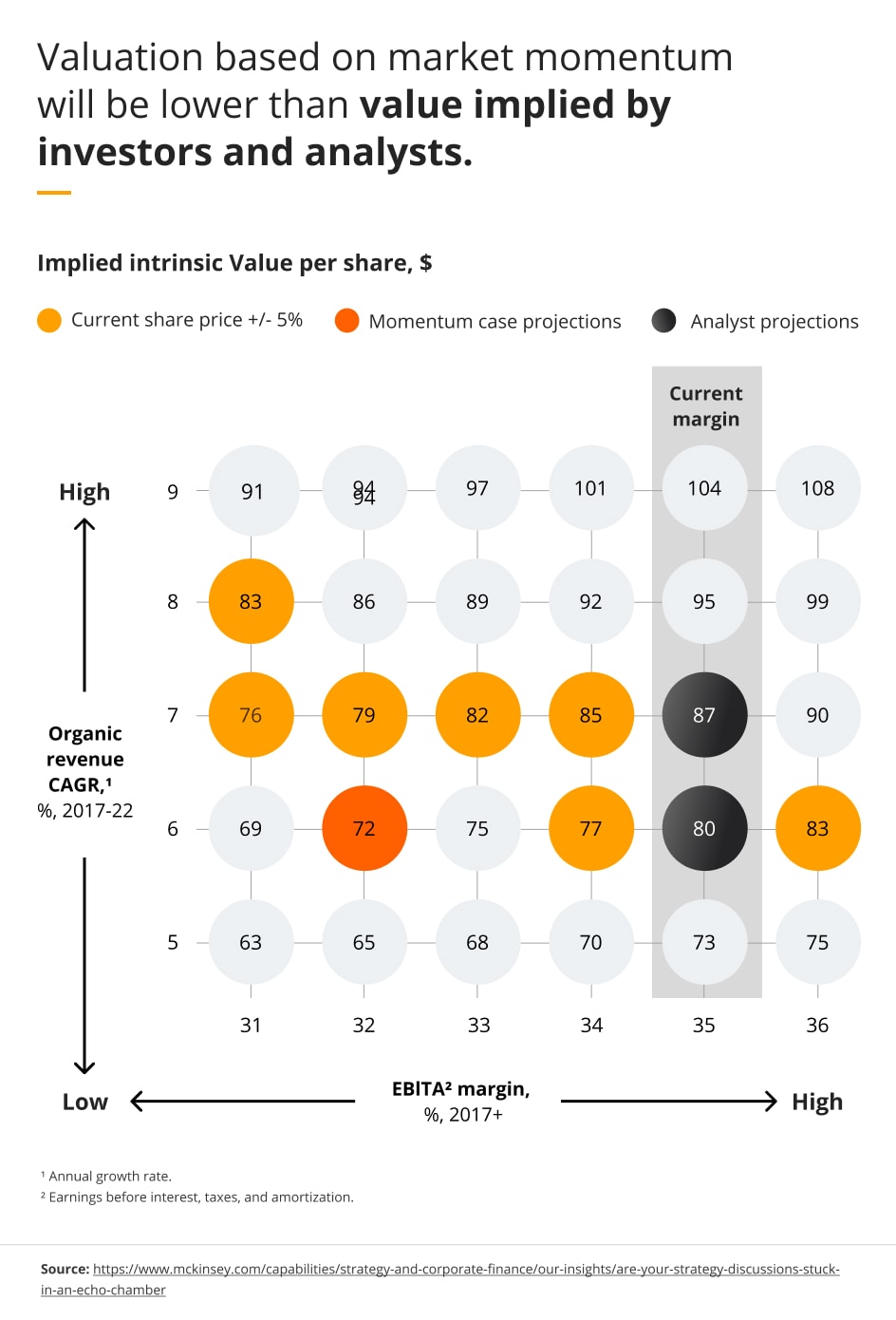

Many data collection and analysis teams spend most of their time looking at historical data to explain current outcomes; they analyze multiple data sources from prior to attempt to predict future events and future value. By doing so, they neglect the impact of external factors and impending market changes, as they neglect to look at the future and only do so for budgeting or strategic reasons.

An improved approach is to create a market-momentum case that relies on internal and external data as well as end-market trends to build the forecast. This approach allows a forecasting model to be built in layers; as more information is collected, it can be added to the base case.

By doing so, any initiatives or price strategies later developed can be accurately combined with financial data and the model’s prediction performance in order to holistically develop accurate price forecasts.

Using a variety of operational indicators and external inputs

Operational inputs are important leading indicators of performance, as they can help companies determine financial health months before reports are developed. Many times, however, operating data sit in separate systems that don’t mesh with financial enterprise resource planning (ERP) systems.

This then leads to people across the company using different indicators and external inputs to measure company health and predict prices, which can lead to a fundamental analysis error.

For example, some managers in a company look at individual performance, and some review indicators of financial performance, which can lead to varying results.

Exploring automation

Once business leaders have identified the most important inputs for a price forecasting model, they should consider ways to automate the process, such as machine learning and predictive analytics, and make it easier for business and operations teams to work together on forecasts.

From a technical standpoint, companies can use up to four strategies to ensure reliability in price assessment outputs.

Choosing the right AI model

The first step is to identify the most appropriate AI algorithm based on the amount and quality of available data points. In many instances, machine learning (ML) models can test multiple models to find the optimal choice with little employee involvement.

Leveraging data-smoothing and augmentation techniques

This technique is much more case-based, as it works when a period within a time series is not representative of the rest of the data.

For example, sales data during the COVID-19 pandemic varies greatly compared to pre-pandemic and post-pandemic resources. As such, data-smoothing could reduce its impact on statistical methods to measure price volatility.

Preparing for prediction uncertainties

Scenario-planning tools that let people insert a wide range of parameters are useful in countering prediction uncertainties due to their ability to account for various potential errors.

This is especially useful when forecasting models do not achieve sufficient accuracy or when only minimal historical data are available, which leads to a failure in regression analysis and predictive pricing.

Incorporating external data APIs

This option is also case-based and is useful when external data sources (for example, relating to weather, foot traffic, and area-specific statistics) need to be inputted towards the price prediction problem.

Measuring effectiveness at a fine-grained level

Once the forecast incorporates a range of internal and external inputs, teams can test the accuracy of each input, as well as the accuracy of estimates. Monitoring measures and key performance indicators (KPIs) usually overlooked in favor of more important ones that immediately deliver performance can be detrimental for companies in the long run; as such, company leaders should keep track of these and react accordingly in time.

An important case study showcasing this comes from McKinsey.

When the CFO and operations leader at one consumer-goods company reviewed underlying performance metrics for each of the business lines, they saw that a major business unit was being propped up by one rapidly growing product. Based on this insight, senior leadership decided to sell the underperforming parts of that business and double down where they saw profitable growth. The team had until that point not looked past the simple financial performance of the business unit to the product-level sales and profitability.McKinsey

If financial and operational planning leaders can maintain the forecast as a continuous model with feedback regulation implemented, then they can turn price forecasting failures into future profits.

Future viability of price prediction AI

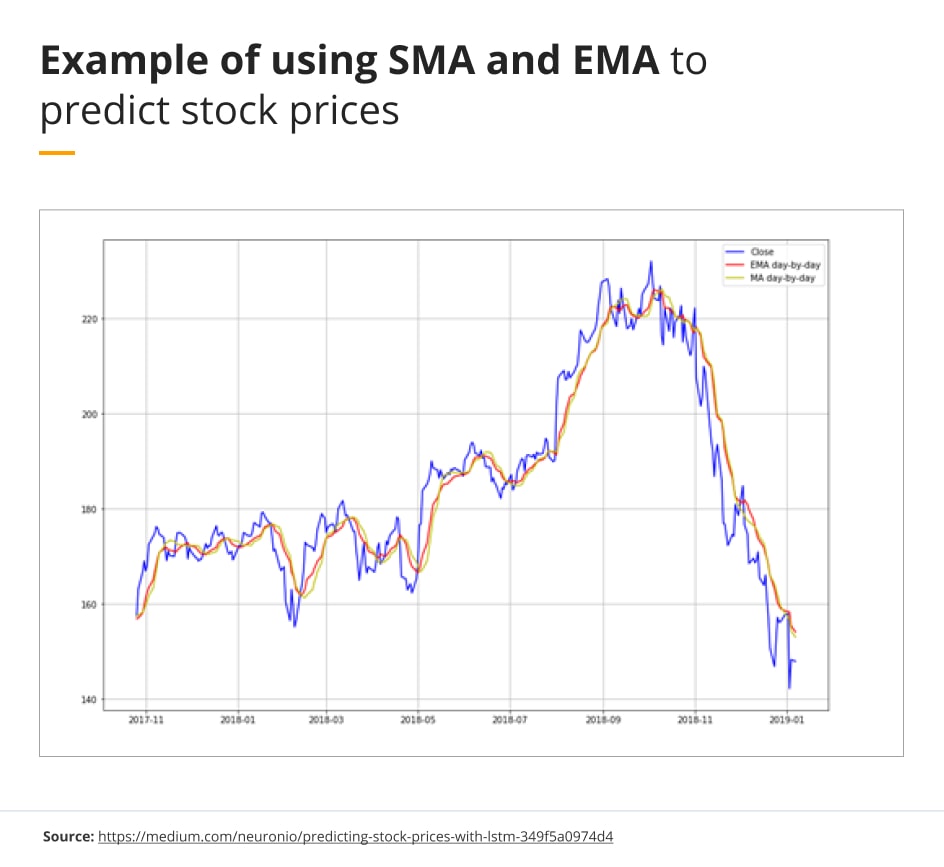

There are numerous ways to predict the price of stocks and price fluctuations, including moving average techniques like the simple moving average (SMA) model, which calculates the average of a range of stock prices over a specific number of time intervals in that range, and the exponential moving average (EMA) model which applies more weight and emphasis to recent prices.

The SMA and EMA models run a fundamental analysis of the historical prices of different stocks. Furthermore, the echo state networks model (ESN) uses recurrent neural networks (RNN) and machine learning (ML) to predict prices.

The long short-term memory (LSTM) model also used RNN to predict stock prices with high accuracy. The model below highlights an example of using SMA and EMA to predict stock prices.

There are also price prediction models that are used to predict the prices of commodities which use similar methods to stock price prediction models. Like stocks, commodities have extremely high price volatility. With our current knowledge of different price prediction models, which models will be most viable going into the future as technology and the business landscape develops?

The future scope of price prediction

Convolutional Neural Networks

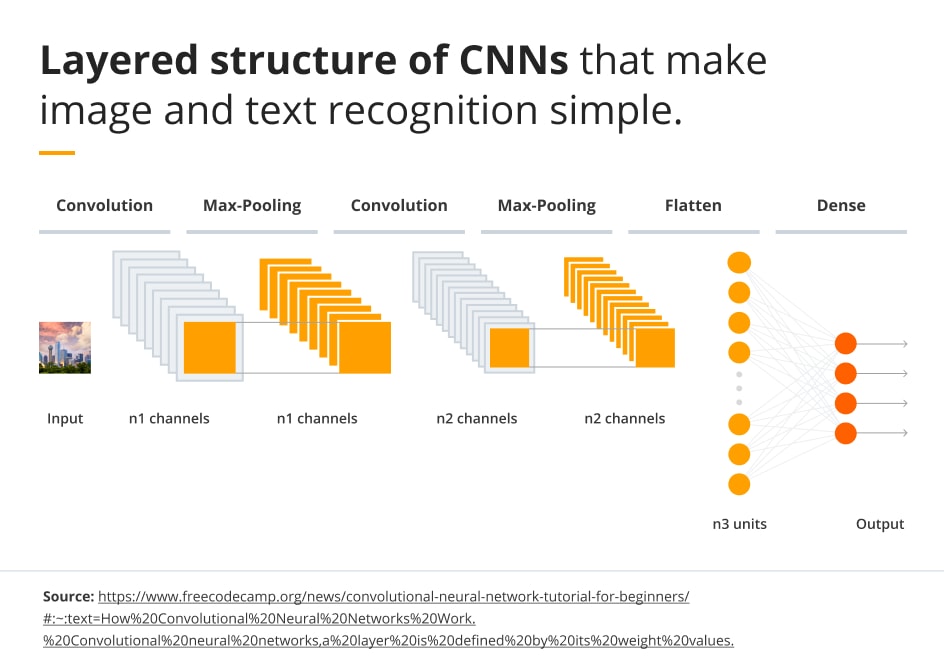

For future price forecasts, Convolutional Neural Networks (CNNs) should be used to more accurately forecast future prices and price movements. CNNs differ from recurrent neural networks (RNNs) in the way they process data.

While RNNs process information sequentially and take into account preceding inputs, CNNs process information simultaneously and build patterns from overlapping local regions of the data.

Compared to RNNs, CNNs display a superior ability to extract semantic information from texts which can be incorporated for better price prediction model performance.

Additionally, CNNs allow for reinforcement learning to be used to create improved trading strategies. The graphic below shows the layered structure of CNNs that make image and text recognition simple.

Reinforcement learning

Reinforcement learning is a type of machine learning algorithm that learns from its mistakes and rewards successes, allowing it to continually improve its performance. This type of algorithm can be used to improve trading strategies by utilizing real-time data and feedback from the market.

Reinforcement learning algorithms are able to learn how to respond in different scenarios and adapt their strategies accordingly, leading to more accurate and profitable trading decisions. In addition, these algorithms can be used to automate complex processes such as portfolio rebalancing or order placement.

Stock recommendation systems

Since the stock market is closely related to a country’s economic growth and encourages investments, being able to predict the value of stock prices and the stock market is vital to prevent economic losses and make relevant decisions.

In the future, researchers should focus on aggregating the sentiment analysis of stocks related information and the numeric value associated with the current and historical data values of stocks to better predict stock prices. By combining both information, more accurate and reliable stock recommendation systems can be built.

Nonetheless, deep learning-based approaches should still be used for efficient price extraction techniques. Furthermore, graphical approaches are reliable solutions that can be used to build better stock prediction engines based on specific data collection.

Research around graphical approaches should address the complexity and gradient of graphs with a large number of nodes since they indicate consistency.

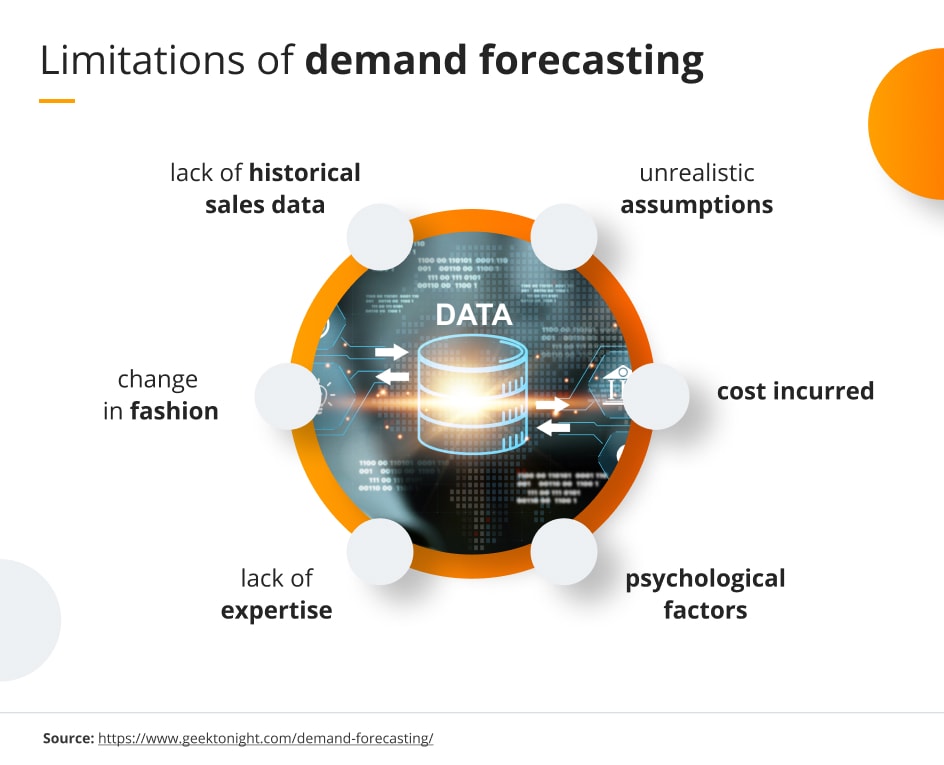

Limitations of forecasting

While price prediction and business forecasting are useful tools, they also come with certain limitations that must be acknowledged to avoid improper use. Any applications of business forecasting, including predicting stock prices and stock markets, can never be guaranteed.

As a result, it is important to understand what may cause inaccuracies in these models to better understand their capabilities.

Volatility of prices

Price predictions and business forecasts rely on existing data to make their predictions, meaning that any unforeseen events or disruptions will not be accounted for. Circumstances such as stock market crashes, economic recessions, or other external factors cannot be reliably predicted by models.

Not to mention, in the stock market, stock price is often highly volatile and may quickly change without warning. The volatile nature of any such business prediction places clear constraints on the current usability of forecasting. While it is a useful tool, businesses should be cautious about using it overzealously and over-relying on its accuracy.

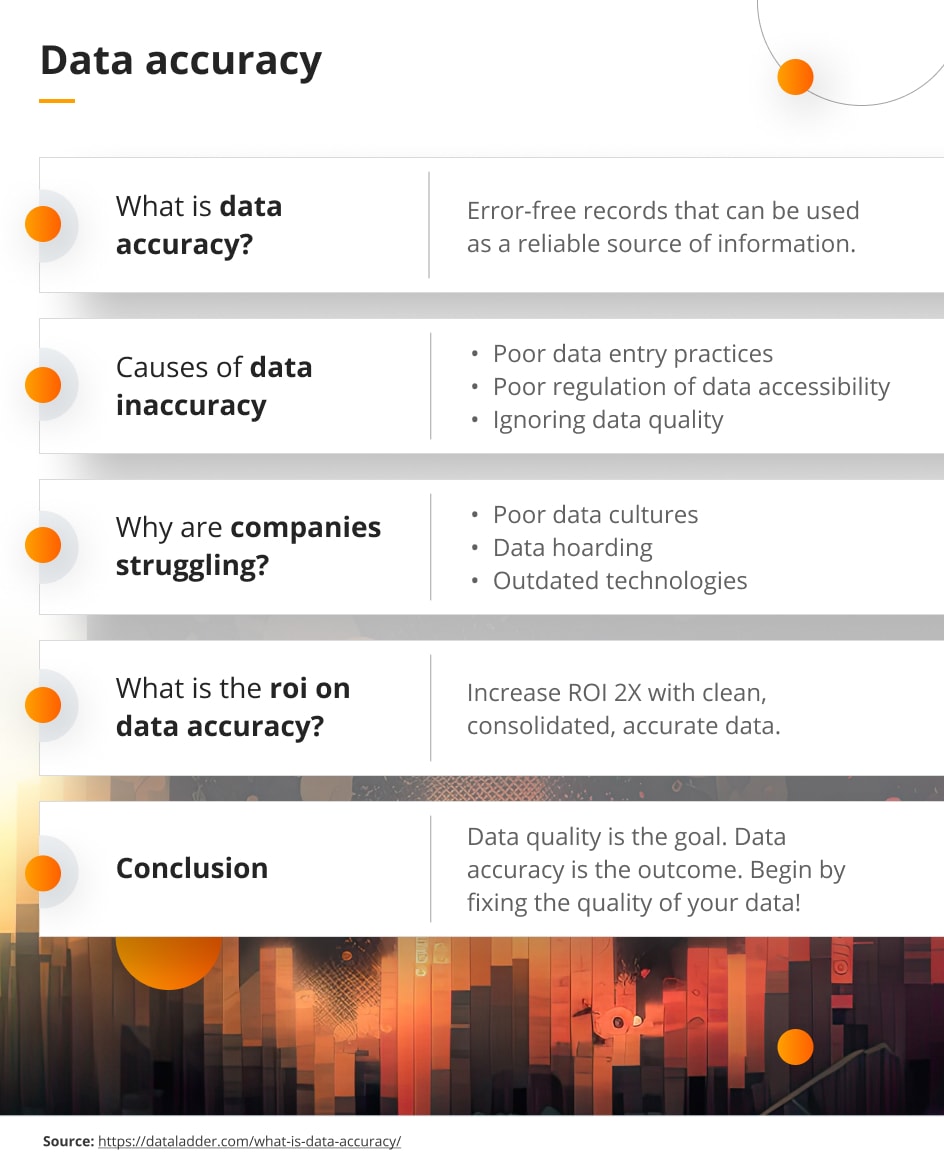

Dependence on quality data

The accuracy of predictions can vary depending on the quality and depth of the data used in creating them. Inaccuracies in data or changes to an environment over time can lead to unexpected results.

This can be especially evident in price predictions since historical price data from a limited set of sources may not accurately represent the most important factors influencing price movements, such as market influences, political instability, or supply chain disruptions.

Without access to accurate and comprehensive data about these multiple factors, it can be very difficult for businesses to achieve accurate price predictions through forecasting.

Additionally, inadequate data sets may not adequately represent demands in changing markets and economic situations, meaning business forecasts may miss out on opportunities or underestimate risk.

Conclusion

Price forecasting is constantly evolving in its accuracy, efficiency, and different capabilities, and its future continues to look bright despite current or projected limitations. AI models of price forecasting especially seem to be the trend of the future, as the viability of AI price prediction software will continue to be stable.

Overall, no matter any potential problems or inadequacies price prediction may have in the future, it is clear that its importance to companies can not be understated; businesses that want to either be successful or continue to remain successful must utilize price prediction tools or software.