The improvement of price prediction with AI

One of the best methods for companies to achieve success is to employ artificial intelligence (AI) processes in price prediction techniques, as AI can be used to not only enhance business forecasting in general but to enhance price and commodity prediction in different industries.

Introduction

Most companies need to gain significant profits in order to run and continue to succeed in today’s increasingly vast market. One tool that can be used to do so is price prediction, as this allows companies to accurately evaluate the price of a good or service by evaluating its characteristics and context surrounding it, allowing businesses to make optimal purchases, reduce costs, and gain more profit.

One of the best methods for companies to achieve success is to employ artificial intelligence (AI) processes in price prediction techniques, as AI can be used to not only enhance business forecasting in general but to enhance price and commodity prediction in different industries.

How AI enhances business forecasting in general

One purpose of AI is to help organize and supply information for data scientists or upper-level business management to make important business forecasting decisions through the use of different price strategies and predictive analytics.

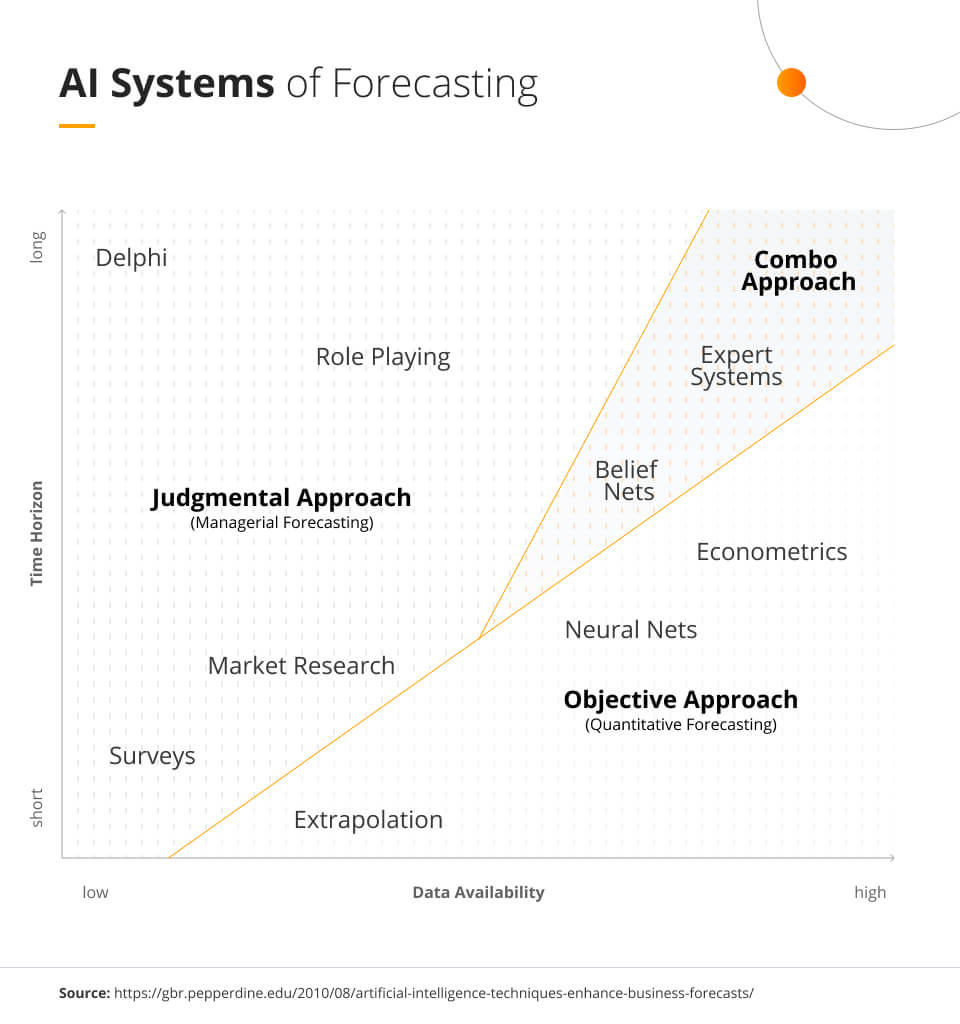

AI systems of forecasting

There are 3 major systems of business forecasting that use AI in a multitude of ways, such as in stock price prediction or analyzing the stock market in the future.

Neural Nets

The first one, Neural Nets, attempts to mimic the human thought process, specifically the human ability to recognize patterns. The architecture consists of a large number of nodes that serve as calculators to process inputs and pass the results to other nodes in the network. Neural net systems are useful in not requiring the set up of prior assumptions of possible relationships between a data point and a target variable.

As such, a useful application of neural nets might be in forecasting employee turnover by identifying and tracking relationships between factors such as tenure with the firm, managerial level, and gender. Another application of neural nets could include predicting stock prices based on factors such as time of year, stock market health, rate of growth, company size, etc.

Expert Systems

Another AI system of forecasting, Expert Systems, collects and sums all available knowledge and rules. In this case, knowledge is stored in a set of if-then rules obtained by gaining data from various data sets or through interviewing various experts. Predicting stock prices through the use of geographical location, gross domestic product, and collecting final predictions from multiple independent experts is an example of using expert systems in stock price prediction.

Belief Networks

The final AI system of forecasting, Belief Networks, describes the database structure using a tree format. The nodes represent variables, and the branches are the conditional dependencies between variables. Belief nets generate conditional probabilities for a variety of future outcomes using database techniques such as different machine learning algorithms and ML models. For example, estimating the chances of a product selling at a certain price point using information such as marketing and development team information and customer information such as customer concerns and complaints is one use of belief networks.

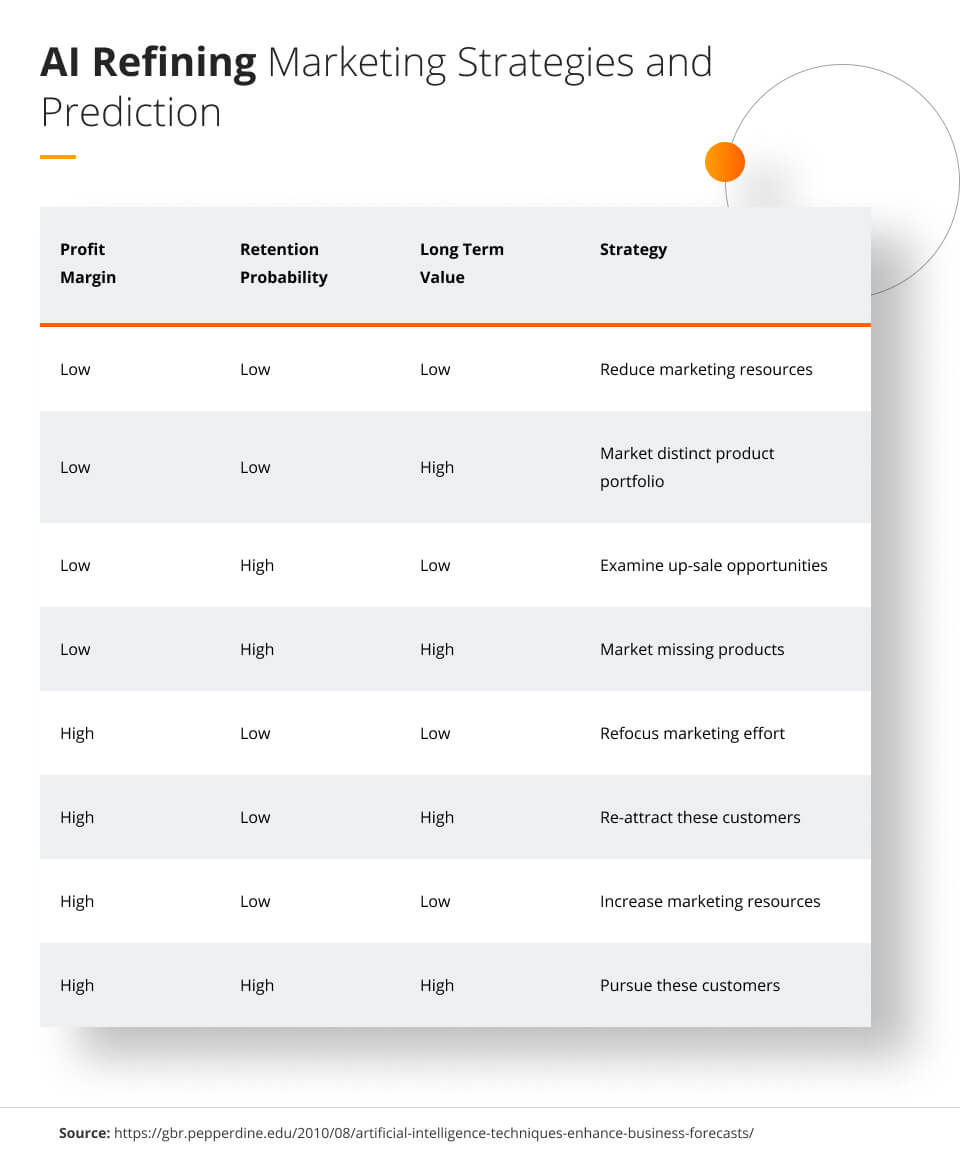

AI refining marketing strategies and prediction

These AI systems can not only be used for forecasting and forecasting classification but they can also be used for prediction. The following table provides a distinct explanation of how AI could be used to refine marketing strategies based on important customer behavior factors: profit margin, retention probability, and potential long-term value to the firm.

In this table, each of these factors is characterized as either low or high, simplifying it from a real-world scenario that would include more levels and factors. This table shows the appropriate strategy based on the given circumstances regarding the behavior of the group of customers. Customers can be easily characterized in such a qualitative manner, but quantitative forecasts can be similarly developed for businesses. In this manner, an AI system of forecasting can correctly account for market demands along with different customer behavior factors and aptly deliver a more accurate forecast.

Although AI can add great value to business forecasting, it is best used in combination with traditional forecasting, as AI can decrease differences and issues that may accumulate between managerial and objective approaches to forecasting. AI specifically excels at enhancing classical approaches to forecasting and making them more modern and pluggable into a non-physical version of forecasting.

How AI improves price prediction within industries

A specific aspect of business forecasting that has been dominating nearly every industry is price prediction. Price prediction uses machine learning algorithms to analyze price fluctuations and historical prices of a given product or service. By collecting input data, such as market trends and demand information, price prediction models use artificial intelligence to accurately forecast the price changes of an asset over time. Price prediction tools can be used effectively in any industry and have already become essential to the pricing strategy in some.

Airline and Hotel

Travel is one of the industries facing the biggest opportunities with price prediction powered by artificial intelligence. In particular, airlines and hotels are maximizing the usage of machine learning algorithms to accurately forecast future values. Through the use of machine learning models, businesses can leverage historical data as well as pricing data from competitors to ensure that their estimations are sound.

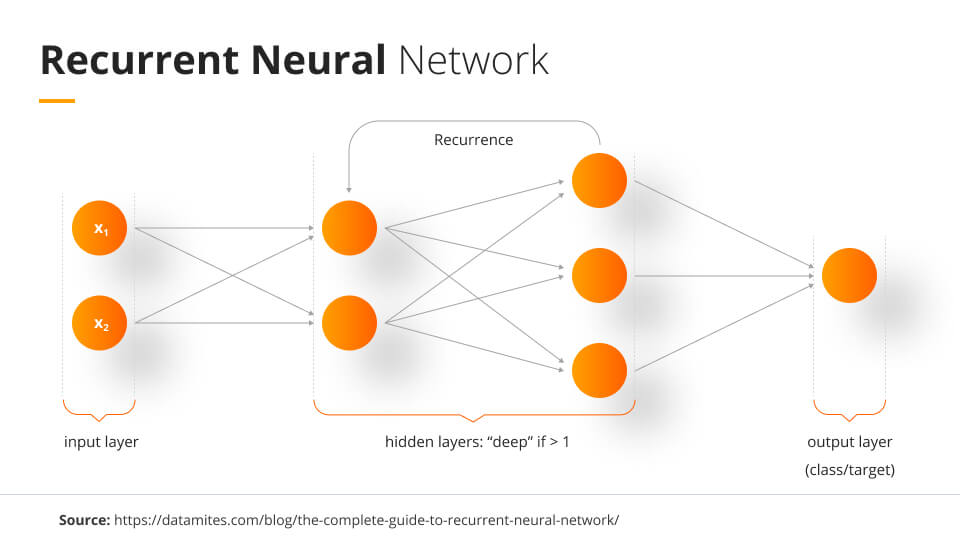

Recurrent neural networks (RNN) are leveraged by both the hotel and airline industries to determine pricing strategies. An RNN is a machine learning model that excels at taking sequential data and providing output based on patterns it learns from the data.

It possesses the ability to maintain state between sequences, meaning it can take previous input into account when creating predictions. While RNNs and other deep learning models can cause difficulties in implementation due to them being sensitive to overfitting, with proper training methods, they have the potential to drastically improve forecast accuracy.

Being on top of price prediction is especially important for the revenue management of airlines and hotels, as generating competitive price points for seats or rooms that fit market sentiment can drastically affect the quantity sold and profit margin. The real-time outputs of machine learning algorithms ensure that these firms never fall behind their competitors.

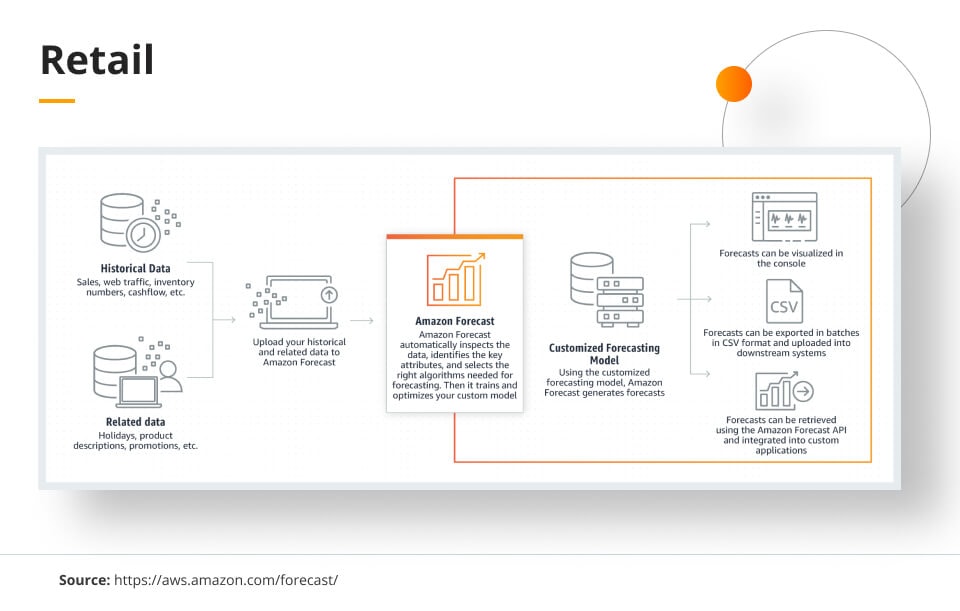

Retail

In the retail industry, price prediction plays an equally important role. Retailers are able to use the price prediction model to set prices that are competitive with other stores. This helps to ensure that their products remain attractive, even in highly competitive markets.

Additionally, retailers can also use the model to predict customer satisfaction with different prices and offer discounts or coupons for specific items. Machine learning models can also predict pricing trends over time and make changes accordingly to maximize profits.

Marketing Campaigns

While it may not be as intuitive as with specific industries, a price prediction tool can also greatly enhance marketing strategies. The machine learning capabilities of such a tool allow marketers to quickly and accurately assess the impact of different prices on their campaigns. This is done by leveraging data points such as past sales data, product offerings, and competition analysis to generate an accurate prediction of how a given price will affect sales. With this information, marketers can make more informed decisions about pricing strategies and improve a company’s performance by conducting data collection on the target market.

AI in commodity price prediction

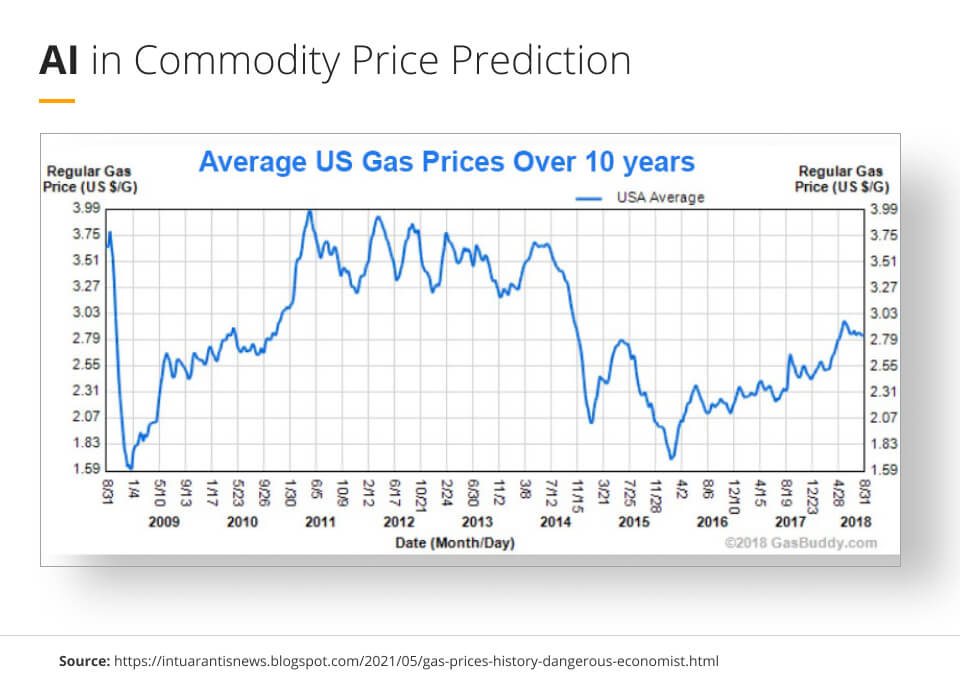

Commodity prices are highly volatile and unpredictable. A common example is oil prices. Oil prices have been highly volatile in recent years alternating between $100 and $30 a gallon. First, it is important to analyze the factors that contribute to this volatility. Then, we can learn how artificial intelligence (AI) and machine learning can be used to help us predict the unpredictable as accurately as possible.

The graph below shows the US gas prices over ten years. It is hard to ignore the rapid fluctuations and uncertainty associated with the prices.

Factors that drive commodity prices

Supply and Demand

Commodities respond to supply and demand fluctuations very closely. For example, a natural disaster could reduce the supply of a specific crop which could make prices for that crop very high even if they were at a lower price before. Similarly, if a specific country has a high demand for a certain metal, then the price of that metal will be driven up because of the general demand for commodities by everyone.

Commodity Trading

Commodities are usually traded on future markets based on future events. Therefore, their prices can be driven by speculation. If speculators believe the future price will be higher, they will purchase more future contracts, which will increase the price of that commodity. Therefore, when the price actually increases, it will be even higher due to the buying of future contracts.

Currency Fluctuations

Finally, currency fluctuations have a large impact on commodity prices. Since commodities are often traded in the global market, if the value of the US dollar is lower than the seller’s currency, it will take more dollars to buy the commodity. Since currencies are constantly fluctuating, the prices of commodities are also rapidly fluctuating.

Using statistical AI models to historically predict commodity prices

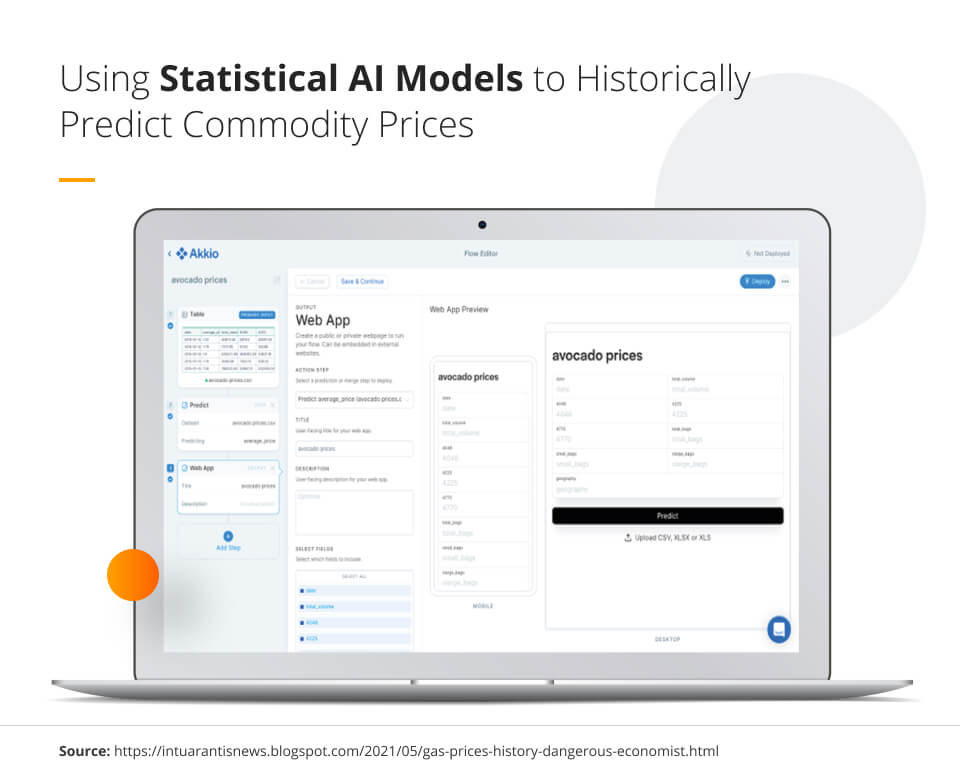

Businesses should be mindful of the volatility of commodity prices. The price of commodities determines how much a company should spend on planning and budgeting. Therefore, it is useful for a company to predict commodity prices to use its money wisely. Similar to the way stock prices are predicted, commodity prices can also be predicted with the use of AI and machine learning.

By understanding historical data and time series data on commodity prices and using statistical models, AI can be used to identify trends in price fluctuations to enable businesses to make the best decision about where and when to purchase commodities. Restaurants often use AI to predict the prices of products like meat and produce. In an industry where input materials are largely commodities, using AI can save these companies resources and maintain profitability.

The graphic below shows the Akkio web app being used to predict avocado prices. Akkio, along with other applications, is an efficient way to easily predict commodity prices. Therefore, it is vital for organizations to consider investing in AI services that use model training, construction quality, ML algorithms, and statistical methods to best predict the prices of commodities.

Conclusion

Artificial intelligence can make a difference for companies in an increasingly competitive market. While AI processes should be implemented throughout a company’s business operations, one of the first steps that should be taken by a business is implementing AI in their price prediction techniques.

Price prediction allows companies to not only make smarter business decisions regarding the pricing of products and services throughout the year but also allows them to offer customers forecasting tools that would increase customer purchases, satisfaction, and retention. Add artificial intelligence to a price forecasting tool, and companies should expect to find immediate profit and success.