The State of Digital Transformation in German Insurance Vertical

The European insurance market has gone digital. The significant technological changes accelerated by the COVID-19 pandemic include both: prominent players and mighty innovative startups.

As cooperative InsurTechs, partnerships within ecosystems, and vertical models are thriving, the future view on the insurance sector in Germany becomes incredibly interesting.

According to Liferay’s report, digitisation is at the top of the whole DACH region insurers’ agenda and one of the most relevant strategic issues. Customer loyalty expansion and multichannel contact are becoming central goals of the digitisation strategy.

Solutions like fully digital administration and contracting, intelligent recognition and processing of claims, AI-supported detection of fraudulent claims are within reach.

German InsurTech landscape

As reported by Capgemini, in 2020, there were 160 InsurTechs in Germany, which means the number has risen since 2018 by 42%. Berlin and Munich are the most significant locations of such businesses, but the scene is growing rapidly in North Rhine-Westphalia. What is crucial, cooperative InsurTechs dominate the scene: almost 85% of all InsurTechs rely on cooperation with insurance companies and brokers.

Overall, the newly recorded InsurTechs have a more collaborative orientation: 86% (83% overall analysis 2020) cooperative and 10% (13% comprehensive analysis 2020) competitive.

The majority of InsurTechs in Germany are still in the early stages of development. 68% of InsurTechs are in the seed and startup phase, only 3% have reached maturity, so they have been able to establish themselves on the market in the long term. They are a stabilised, established, and profitable member of the German insurance landscape.

Top business models

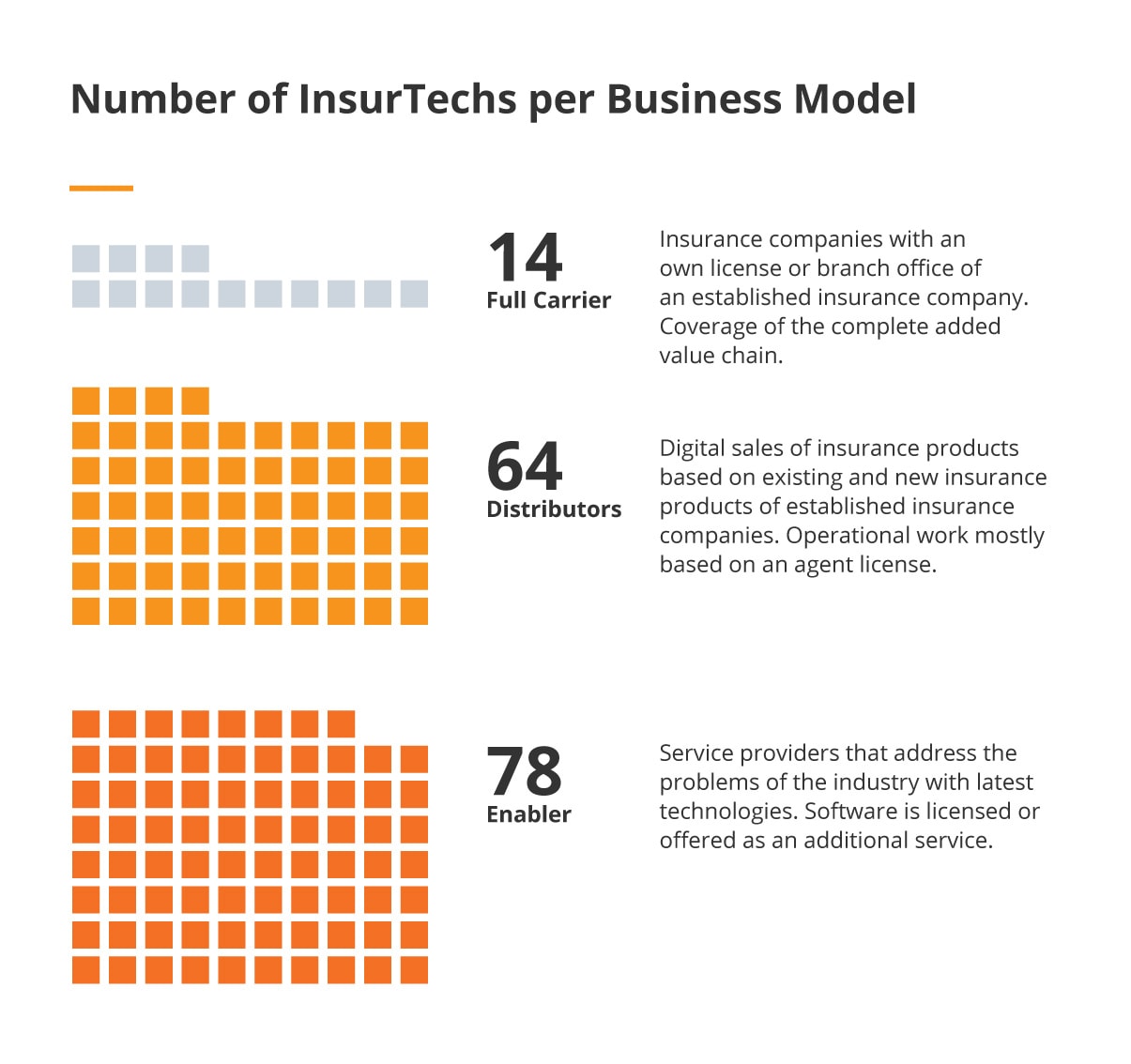

There are three primary business models in the German insurance industry: enabler, full carrier, and distributor.

ENABLER AS A GROWTH DRIVER

With 51% of InsurTechs, the digitisation partners of insurers and brokers are now the largest category in the InsurTech scene in Germany. InsurTech initiatives such as the InsurLab in Cologne, the InsurTech Hub in Munich or the InsurTech shipyard in Hamburg serve as a catalyst. Every second, InsurTech was lured into the insurance industry through one of these initiatives.

FULL CARRIER WITH HIGH-GROWTH BALANCE SHEET

The full carriers make up 9% of the InsurTechs in Germany. Their balance sheets are mixed: Despite large-scale advertising campaigns, the gross premium income in 2019 was mainly in the single-digit million range. The acquisition of customers at reasonably affordable costs is one of the dominant topics of these InsurTechs; They are unlikely to pose a real threat to established insurers in the medium term.

DISTRIBUTORS LOSE SIGNIFICANCE

Newly founded distributors are increasingly pursuing a specialised B2B approach or selling new insurance products in close cooperation with an insurance partner. The digital broker approach B2C hardly plays a role anymore in the startups: Wefox, Clark and the dominant comparison portals around Check24 only leave room to breathe for business approaches that specifically address niches.

The most common form of the business model in the German InsurTech sector is the enabler. Two-thirds of the “new” InsurTechs are included in this category. In 2019 it was only 50%. The startups with a new insurance focus, almost all classified as enablers, are of particular importance. The business opportunities in digitisation as a service provider for insurers are rated particularly well by the founders.

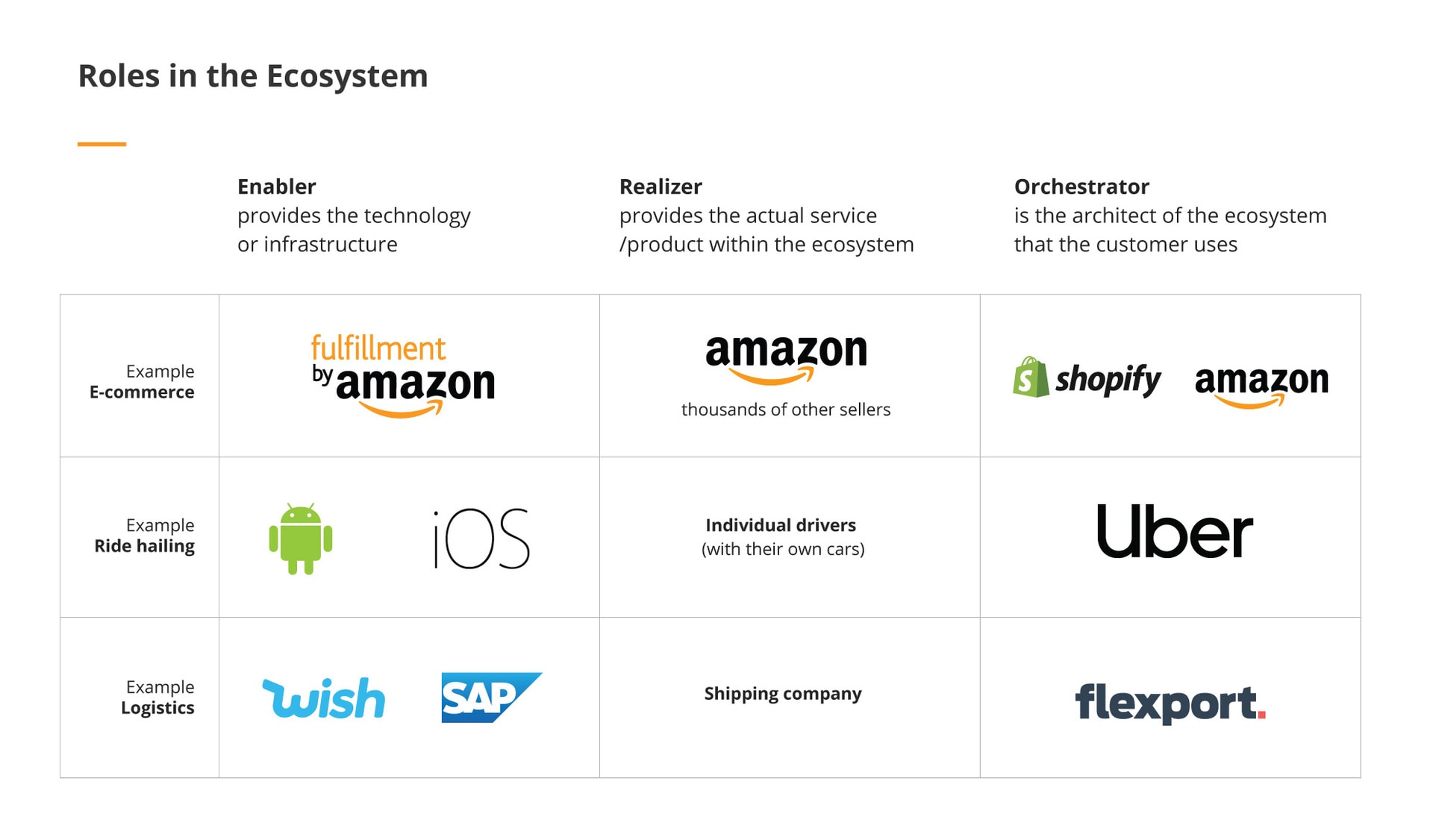

Ecosystems need verticalisation

Ecosystems have become a central component of the insurance industry in recent years. It is mainly because of the vision of its final state: an excellent, value-adding network of different participants who can jointly make a better offer for their customers than if they acted alone. But to develop an ecosystem in a highly changeable market and avoid getting bogged down in the development services, companies start to use verticalisation.

The rule is simple:

You can start with a part of an ecosystem that conveys a clear added value; the entry barriers keep low and dynamically evolves into an ecosystem. By focusing and optimising on a “vertical”, the customer promise is sharpened.

The parallel development of partnerships and acquisitions of companies creates significant added value for the customer. As a result, in the best-case scenario, a sustainable ecosystem geared towards the customer develops.

Successful examples

Examples of Shopify or Stripe show that the strategy “Come for the product / vertical, stay for the ecosystem” can lead to great success in the long term. The companies have focused on a “vertical” approach, placed the customer in the foreground and optimised the value proposition on a sustainable product and ecosystem side.

The latter was achieved primarily through continuous product innovations, partnerships, and acquisitions. The ecosystems were created almost organically – driven by the intention always to offer the customer the best possible product or service.

The insurance sector in Germany also starts to benefit from the vertical approach. The dynamic development in the field can be seen in both:

- end-consumer-related sectors (Getsurance, Lemonade, or Coya offer insurance directly to end customers via a digital interface)

- B2B segment (e.g. the insurance infrastructure solution from Element, the digital claims platform from Snapsheet or the solution to optimise Planck’s underwriting processes)

Allianz, the Baloise Group, and Generali are putting customer interface first by creating an ecosystem for their insurance products. All companies try to enter into partnerships with startups in various sectors to sell new, innovative products to customers through the ecosystem.

Allianz, with partners, builds a one-stop-shop ecosystem that provides solutions for crucial life moments.

The Baloise Group focuses on life mobility, home, financial security, and business services (a car subscription AboDeinAuto, pay-per-mile car insurance by detached neo-insurer Friday).

Generali also reaches different sectors with the partners in ecosystems:

- Mobility (Volvo)

- Living/ smart home (Google Nest)

- Travel (Expedia)

- Health & Wellness (Vitality)

- E-health (Sanofi, Capgemini and Orange)

A transparent tactic emerges from these three examples. All companies try to spread their risk and develop several projects simultaneously with the overarching goal: build ecosystems around the insurance core.

Find your tech partner

Insurance companies have an unprecedented chance to thrive as digital possibilities bring profits on many different levels. Better experience, multichannel service, and automated processes are the elements customers seek in the insurance sector.

Partnering with service companies that use the latest technologies to address problems in the industry and create customer-oriented solutions is the priority. Put your customers’ needs first, build an offer that fulfills them and watch your ecosystem bloom.