Machine Learning in finance: 6 ways to boost efficiency

Machine Learning in finance is not just a buzzword; it's a financial game-changer. In this article, we'll delve into the world of ML and uncover the six extraordinary applications of Machine Learning in finance that are reshaping the industry.

How Machine Learning is changing finance around the world

With the rapid adoption of Machine Learning, the world of finance is undergoing a profound transformation.

The technology, which combines complex algorithms with data analysis, can revolutionise decision-making processes across a variety of financial industries.

Machine Learning is redefining both investment strategies and risk management as a whole, ushering in a time of unprecedented change that will benefit everyone.

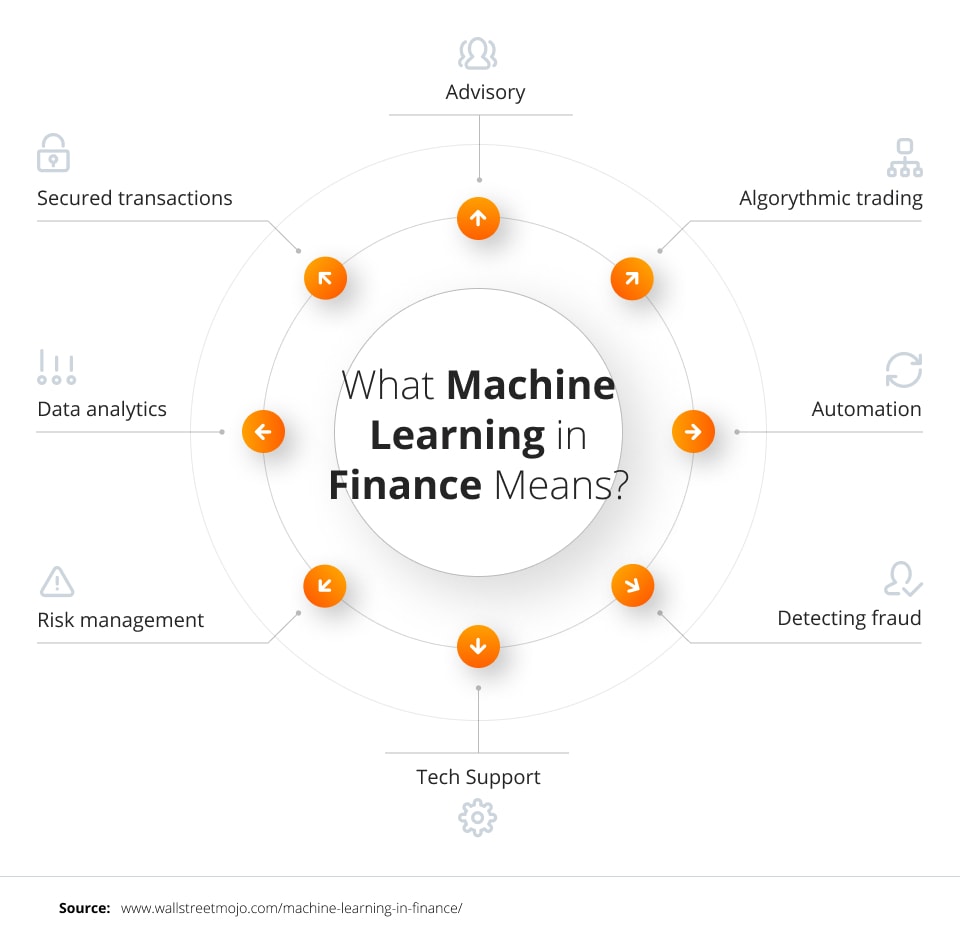

Applications of Machine Learning in financial services industry

Machine Learning has remarkably transformed the financial services industry. Leveraging algorithms and large data sets, it aids in risk assessment, fraud detection, and algorithmic trading strategies, enhancing customer understanding and investment management.

Data science helps businesses navigate uncertainties by tailoring financial services and optimising portfolios. To understand Machine Learning in a nutshell, in this chapter, we delve deeper into its most promising applications in the financial services industry.

Predictive power (prices and stock market forecasting)

Among the many uses of Machine Learning in the finance sector, one that stands out is its predictive power, especially in prices and stock market forecasting.

Machine Learning enables a deeper understanding of market dynamics, facilitating more accurate risk management. This, in turn, benefits financial institutions in making informed investment decisions.

Analysis of historical price data and external factors can be used to predict market movements with an impressive degree of accuracy.

As a result, Machine Learning is carving out its presence as a catalyst of change within the financial industry, redefining how stakeholders navigate the complexities of a dynamic marketplace.

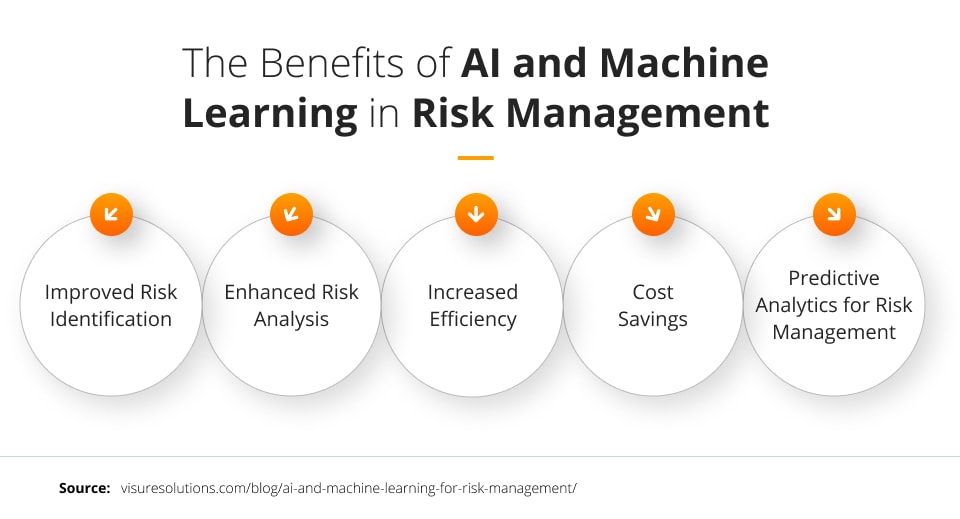

Risk management and prevention

The transformative potential of Machine Learning for business is most evident in the realm of risk management and prevention.

Financial companies are increasingly harnessing the capabilities of these advanced algorithms to navigate the immense volume of data, which often includes unstructured data, such as news articles, social media sentiment, and more.

This depth of analysis allows for more precise risk assessments, aiding in the prevention of financial crises.

Artificial intelligence-infused models are becoming the vanguard against threats, enabling proactive strategies that far exceed traditional risk models. Real-time data allows anomalies and patterns to be detected more easily and faster.

Staying one step ahead of potential risks protects financial institutions and the broader financial system as a whole.

Trading with Machine Learning algorithms

Machine Learning algorithms have contributed a great deal to the success of algorithmic trading in the financial services industry.

By ingesting and analysing gigantic troves of historical data, these algorithms can make split-second decisions, executing trades with a precision that surpasses human capabilities.

Financial services companies increasingly rely on these systems to optimise trading strategies, mitigate risks, and capitalise on market inefficiencies. In the high-stakes world of finance, the ability to process data at lightning speed is a game-changer.

Algorithmic trading, driven by Machine Learning, is at the forefront of this financial evolution, setting a new standard for trading efficiency and effectiveness.

Fraud detection and prevention

To manage model risk and detect anomalies in real time, UK financial services firms are increasingly turning to advanced algorithms. A Machine Learning system can identify suspicious patterns quickly, facilitating fraud prevention and intervention.

The algorithms adapt to evolving fraudulent tactics with agility, going beyond rule-based systems. As the guardian of trust, this technology protects the integrity of the financial industry.

Automating fraud detection processes enhances financial institutions’ security and streamlines operations, allowing businesses and clients to navigate the financial landscape confidently.

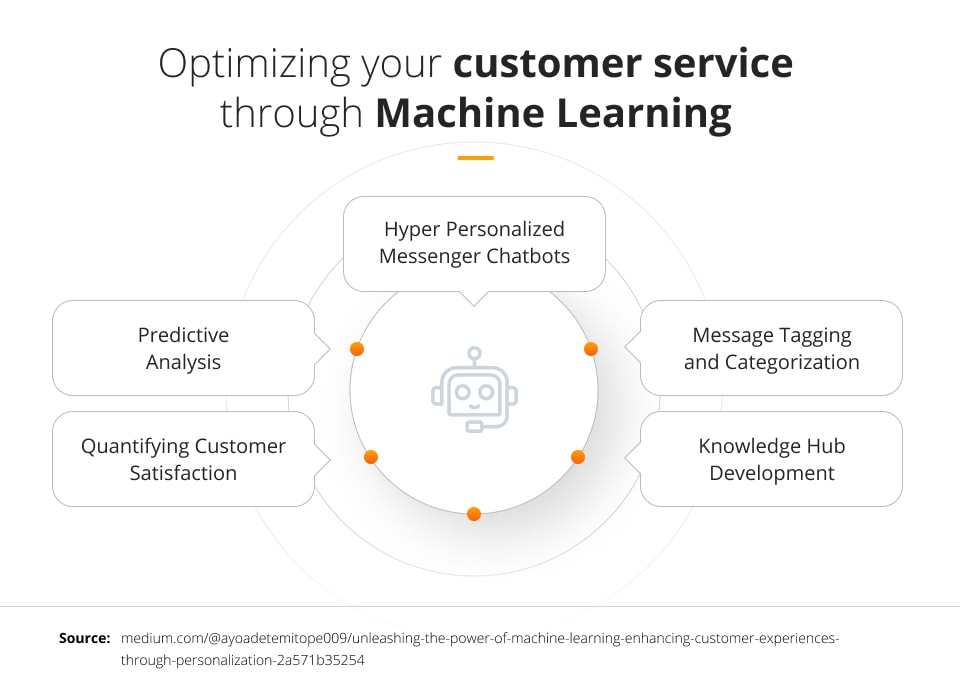

Customer experience personalising finance with Machine Learning

Machine Learning techniques are revolutionising financial services by personalising the customer experience.

Financial institutions are able to tailor their offerings to individual preferences through algorithms powered by deep learning. Elevating customer experience hinges on understanding the synergy between Data Science vs. Machine Learning.

In addition to reducing human error, Machine Learning enhances the precision of financial models, ensuring that financial advice matches each client’s needs perfectly. This is what personalised finance is all about.

Process automation in corporate finance

Through process automation, Machine Learning ushers in a new era of efficiency in corporate finance. Using deep learning algorithms, these algorithms can identify patterns and anomalies in data, improving accuracy and reliability.

Additionally, automating business processes minimises the potential for human error inherent in manual tasks, ensuring confidence and precision in the financial sector. Process automation in corporate finance is the future. It’s more than a PoC in Machine Learning; it’s an evolution in efficiency and precision.

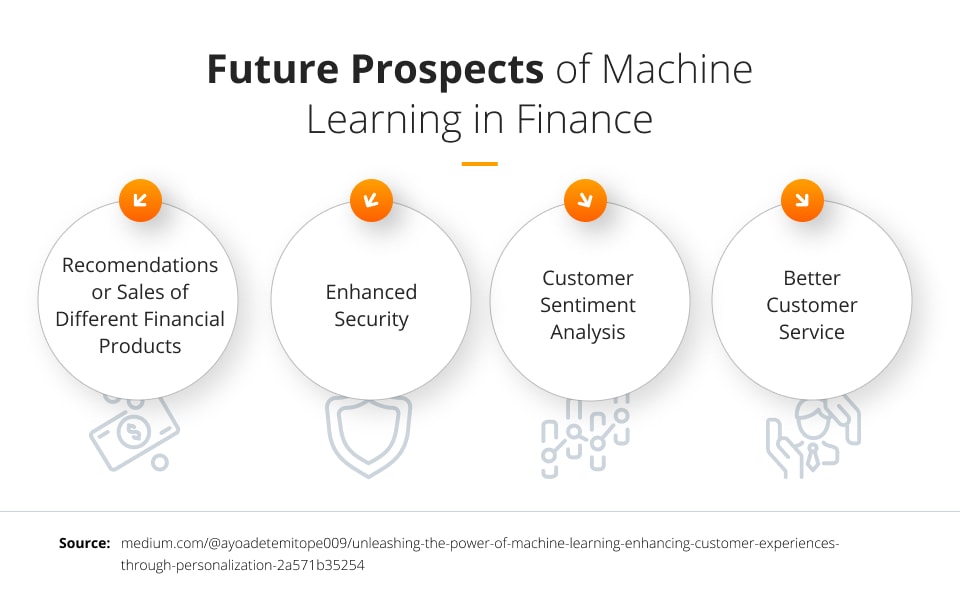

The future of Machine Learning for finance

Machine Learning has a promising and dynamic future in finance. We can expect to see even more innovative applications in the financial sector as technology advances.

With improved natural language processing algorithms, better customer communication will be possible, while advanced analytics will help to refine investment Machine Learning strategies as well.

Simulations and models involving complex financial data may benefit greatly from quantum computing. In addition, regulatory compliance and risk assessment will become increasingly automated, reducing the administrative burdens associated with these two processes.

How to use Machine Learning in finance to your advantage

Leveraging AI & ML solutions is paramount in the finance industry’s digital transformation. The linchpin lies in the judicious use of Big Data science in finance. These technologies empower financial institutions to analyse massive datasets swiftly, extracting invaluable insights for informed decision-making.

By integrating Machine Learning, financial organisations can optimise risk assessment, automated trading, and enhance fraud detection. Utilising predictive models, they can navigate the complexities of the market with precision.

The result? Improved operational efficiency and competitive advantage in a dynamic landscape. In the finance sector’s journey towards digital transformation, Machine Learning serves as the compass, guiding businesses to harness the full potential of data and secure their place at the forefront of innovation.