The role of insurance in emerging digital ecosystems

In the latest instalment of our IT Insights InsurTalk series at Future Processing, we interviewed Dr Evangelos Avramakis, Head of Digital Ecosystems at Swiss Re.

As an internationally recognised expert in the insurance field, Dr Avramakis is known for his ability to anticipate future industry and market trends, in addition to his expertise in emerging technologies and innovative business models.

‘76% of insurers agree that their competitive advantage will be determined not by their organisation alone, but by the strength of the partners and ecosystem they choose’Accenture“Technology Vision for Insurance 2017”

Following on from our discussion with Dr Avramakis, in this article, we explore the role of insurance in emerging digital ecosystems, how they are affecting the insurance landscape, the importance and potential impacts of these digital ecosystems, and how the industry can best prepare to stay on top of any impactful changes and developments in order to offer better, more personalised insurance products.

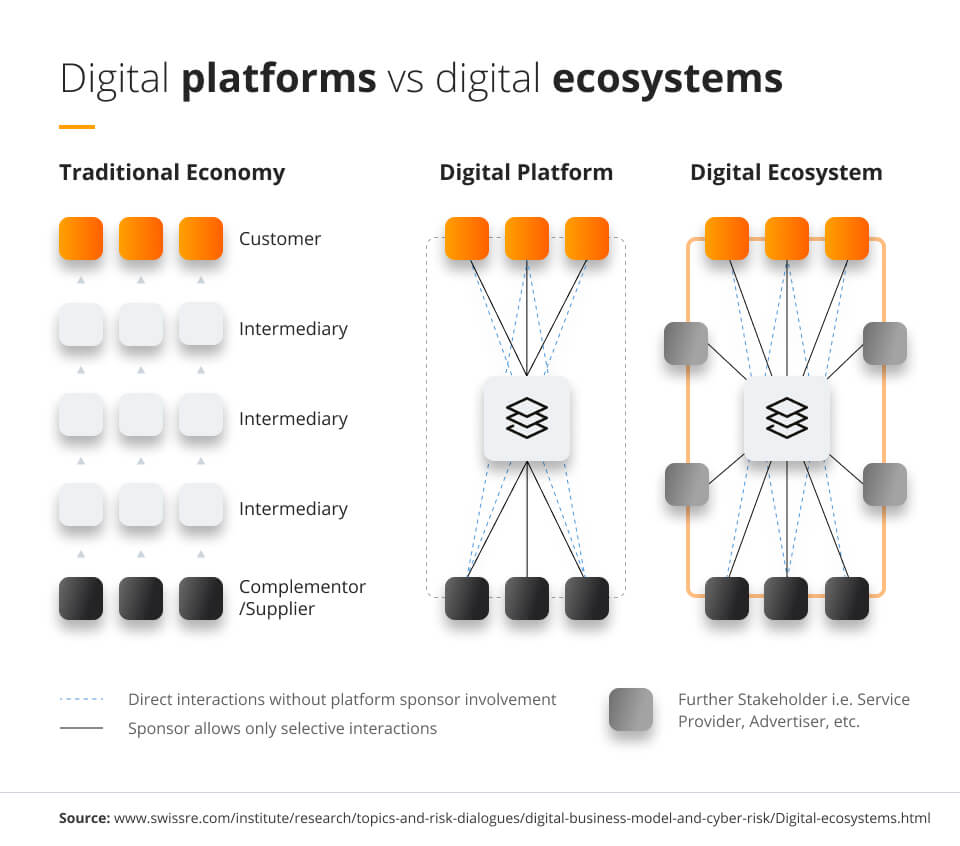

The difference between digital ecosystems and digital platforms

It can be easy to conflate digital ecosystems with digital platforms, but there is an important difference.

A digital platform is a system that is designed to combine the supply and demand of a particular market into a single platform (such as Uber). All the operations, systems and workflows are carried out on this platform, and there are no other contributors involved.

A digital ecosystem takes the concept of a digital platform further by collecting and analysing data to search for opportunities for growth and improvement from the view of the customer. Where digital platforms adopt an ‘everything under one roof’ approach, with a single company taking care of all operations, digital ecosystems incorporate a number of suppliers (known as complementors) who are separate from the ecosystem, but who work in collaboration with it to analyse the data, improve the platform and provide products and services to customers.

Complementors are extremely useful to incorporate into an ecosystem because they typically have a much closer relationship with the customer than the platform owners themselves. They understand what the consumers’ needs are and the types of products and services they require, which allows them to fulfil these needs on the platform.

Uber, for example, compliments its services with a range of other suppliers, such as public transport providers, which enables them to offer more extensive services as it leads them to create a better experience for their customers. All of these complementary services can be used through the Uber app, ultimately improving the business significantly.

The role of an ‘orchestrator’ in digital ecosystems

An orchestrator is the person responsible for managing the customers’ expectations, their journey through the platform and the stakeholders’ interests. They act as a sort of facilitator who considers both the consumers’ and stakeholders’ needs, but with a more heavily weighted bias towards the customers and their ultimate satisfaction.

The orchestrator must be excellent when it comes to customer relations management. Insurance companies don’t really ‘know’ their customers – they only know them via data on a screen, whereas a good orchestrator really learns who their customers are, what they want, how satisfied (or not) they are and so on. They use this data and information to gain insights into the customers’ needs and behaviour, which allows them to make changes to improve the platform and its products or services.

Customers are at the very core of most industries (not only insurance), and so the value brought in by these orchestrators is extremely high. That being said, while the orchestrator tends to be the main figure when it comes to collecting the increased revenues from the improved digital ecosystem, it’s not to say that the complementors don’t get anything. They too bring significant value, so the financial rewards are shared.

Does sharing the data collected by the orchestrator increase the value of a digital ecosystem?

In short, yes. Sharing this data with all stakeholders can add real value to the ecosystem, as it affords more opportunities for a greater number of people to analyse and interpret consumer data in order to make changes and improvements.

These not only benefit the customers, but all stakeholders alike by allowing the company to personalise their products and services more in a way that benefits and satisfies their customers. In fact, the collection of real-time and data transactional data alone offers a significant value to the orchestrator and all relevant parties involved.

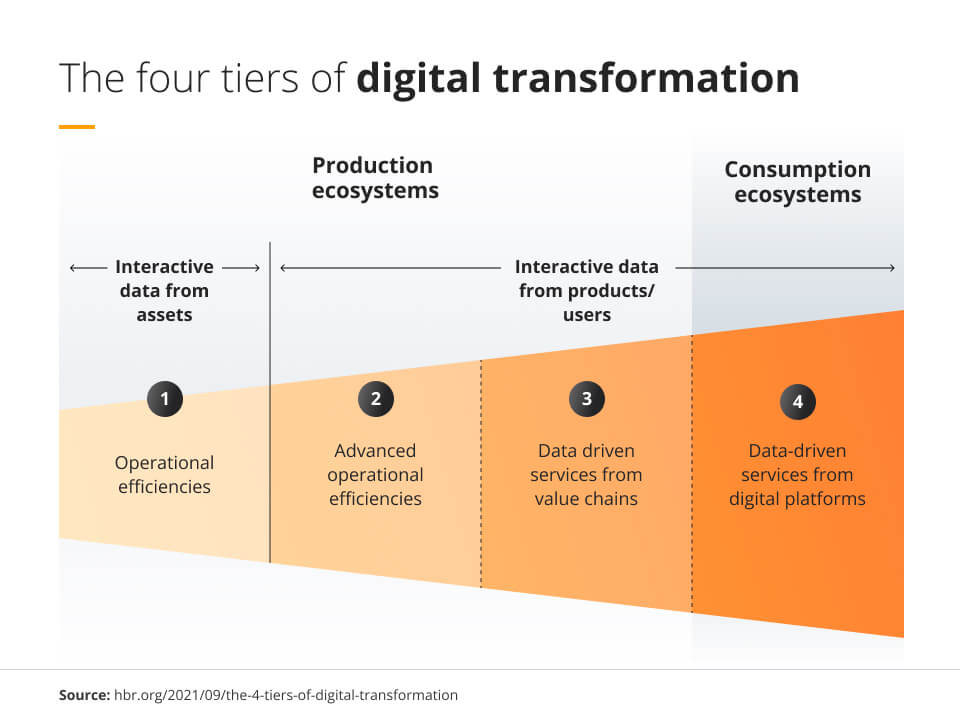

Harvard Business Review’s article on ‘The Four Tiers of Digital Transformation’ describes how episodic data is increasingly becoming interactive through the use of continuous ‘real-time’ sensors and tools. This allows companies to continuously track their assets and monitor their productivity through the constant stream of highly valuable data being collected.

How sharing data leads to greater personalisation

Traditionally, companies tended to base their products, services and processes on how the industry currently operated at that time. They would launch their products and then, over time, begin to analyse how their consumers actually use them and what aspects they were satisfied (or not) with. Only then would companies begin taking steps to personalise their products and services to better serve the customers. By reacting relatively slowly to consumer behaviour and preferences, changes and personalisation were slow, inefficient, and struggled to keep up with a changing market.

With the increase in data sharing between all stakeholders in digital ecosystems, this analysis can be done much faster and more effectively these days because there are more contributors looking at all the data. Insights are understood very quickly and taken on board to implement changes and increase personalisation. It’s a much more proactive approach than the traditional manner and can often provide a lot more value to the overall product.

The traditional way to analyse data and make changes is quite antiquated, and consequently, the more dynamic and proactive method of personalising products and making changes seems here to stay for the long haul.

It is important that when sharing data with various parties, companies get the consent of the customers, as without this consent, they are not able to share it. Consumers generally don’t mind consenting to data sharing, as long as they can see the benefit. If they realise that the reason for their data being shared is to provide them a better service, and not just to make the company more money, they are usually happy to allow it. This is a win-win because the customer gets a better product and better service, and the company is getting deeper insights.

The importance of looking at ecosystems through a non-industry-specific lens

In order to provide the best, most comprehensive digital ecosystems possible, it’s important to look at them holistically and not through the lens of a particular industry.

For example, in the insurance industry, the companies’ ecosystems largely exist away from anywhere the actual customer is. Of course, there are touchpoints where the insurance company interacts with the customer, but they are infrequent when compared to all the processes in place. The insurance company doesn’t have a close relationship with their customers as it closes deals through online sales, brokers, agents and so on.

The same is true of other industries (e.g. retail and health), there are few customer touchpoints and the ones that are there tend to change. This makes it hard to ‘plug in’ to the ecosystem if it is designed for one specific industry, highlighting the importance of a wide and holistic lens when it comes to creating the digital ecosystem.

As the touchpoints of various industries are changing over time, it’s important to think about whether the digital ecosystem is the same value proposition that can fit multiple industries. For example, a mobility producer like Uber doesn’t offer the same products and services as an insurance company, so the classical model might not fit in this case. In this instance, the digital ecosystem and its users will have to transition from a classical legacy system to a newer modular way of delivering the product that fits much better.

The industry that will benefit most from evolving digital ecosystems

At this time, it’s impossible to say if there is one industry in particular above others that is benefitting from evolving their digital ecosystem. In Europe, business has largely been conducted in the same way for some time due to established relationships and strong links.

In contrast, somewhere like Asia is a little different as they have only just begun to gain access to these types of digital services due to the prevalence of mobile smartphones, which have sped up Asia’s digital transformation considerably.

As the world transforms and moves towards more digital products and services, the question is:

These digital ecosystems are already being developed and used all across the world, and this is where insurance plays a key complementing role.

How businesses can cope with digital changes and not fall behind

Like any other change that occurs, adopting and developing digital ecosystems isn’t easy for any business. Technology moves fast, and so do customers’ expectations and requirements.

The reality is that no companies want to change, really. They spend lots of time and money developing their products and services, only to have to tear them all up and start all over again. Regardless of how unenthusiastic companies and individuals may be when it comes to change, change is necessary and it will occur, regardless.

Companies don’t have to be at the very forefront of innovation and change to be successful, but they should keep up with industry and technological changes at the very least. A good example is the rise of ChatGPT in 2023 and how this new tool has blown so many industries out of the water in an incredibly short space of time. Companies either need to get on board with generative AI or fall way behind.

If companies do not keep up with industry and technological changes, then it will be doubly difficult to catch up later down the line. Creating a culture change is hard in any business, let alone insurance where practices and digital systems are so firmly set in their ways. Nevertheless, now is the time for the insurance industry to take a good hard look at digital ecosystems and to invest in and embrace this change. They don’t have to be right at the cutting edge of the technological boundaries, but they should at least be adopting these digital changes and working within a digital ecosystem of their own.

As we have seen since 2020, digital changes and advancements have accelerated considerably, and this is probably the only aspect that doesn’t look set to change anytime soon.

Summary

Change is good. Digital ecosystems should be embraced and nurtured, especially in the insurance field, so that they are allowed to grow and develop. In this manner, we can look forward to more product personalisation, more bespoke insurance offers, and greater access to data-driven insights. With the help of complementors and orchestrators, insurance companies will have the ability to analyse ever more complex data sets to learn and understand their consumers’ behaviour, ultimately providing a better service and more relevant products all around.