10 European startups disrupting the tech industry in 2022

Although the history of entrepreneurship dates back to the 1920s, it wasn't until the 21st century that we started experiencing a massive outpour of innovative business solutions. Some successful ones have become essential parts of our everyday lives. If you've never used Airbnb, Uber, WhatsApp, MailChimp or Revolut, where have you been in the last 20 years?

But not all great ideas become reality. Interestingly, about 90% of new start-ups fail. Despite that low success rate, 65% of Brits are interested in opening their own company. It clearly shows that hopes of spectacular gains still outweigh the fear of a devastating financial failure.

So how can we judge objectively if a start-up is a worthwhile investment or just a short fling? There’s no right or wrong answer to that question.

But we’ve looked into some European companies disrupting their respective sectors with that special “something”. Here are 10 of them that we’re particularly rooting for in 2022.

Atom Bank

Mobile-first “challenger” banking focused on the customer

Remember when the only way to pay your clients was ordering a wire transfer directly at the branch? Atom Bank wants you to forget about that unnecessary hassle once and for all. Its founders built the UK’s first bank “for smartphone or tablet” with no physical branches at all.

Since the company was founded in 2013, it has been expanding its range of services provided on a mobile app to include mortgages, savings accounts and secured loans for small businesses. The company has already secured $741.6M in funding from 15 investors, amongst them the Spanish bank, BBVA.

Why they’re different:

It’s the first fully licenced, digital-only financial institution to directly compete with the “big four” in the UK.

Candao

Decentralized social metaverse proving that Web3 is for everyone

Tokenomics are revolutionising our perception of investments. Candao, a company with Polish roots but based in Cyprus, is one of the new players in this innovative realm of blockchain technology. Established in 2021, the start-up’s philosophy is maximising engagement and collaboration with the help of an AI ecosystem.

Their tagline, “People can, DAOs do”, emphasises the value building amongst the members. The platform’s products go beyond tokens, however. Dubbed an “overlayer to all other blockchain layers”, it also includes a feature pushing feeds to users based on their interests, an Amazon-style virtual marketplace and a secure P2P communicator.

Why they’re different:

Despite being a newcomer, Candao’s already been featured in prominent tech publications, i.e. Hackernoon.

Fruggr

Raising awareness of digital services’ environmental footprint

Air pollution produced by fossil fuels is an indisputable fact. Yet, we rarely talk about the environmental impact of our digital activities. The French start-up Fruggr, established in 2020, strives to change this paradigm by introducing a new trend: making digital better and more responsible.

Innovators have recently been forced to shift their attention to mitigating harmful environmental effects of some digital products (we’re looking at you, NFTs). This is exactly where Fruggr’s evaluation software can help. Not only do they propose measures to “decarbonise” the IT footprint but also offer solutions to communicate about it better.

Why they’re different:

Fruggr emphasises the social ROI and wants to make digital accessible, inclusive and ethical across all organisations.

GoCardless

Getting paid made easy

How many times have you been stressed out because of a late client payment? Or have you ever forgotten to set up a direct debit for a subscription service? GoCardless has you covered, so it won’t happen again.

No matter if you run a small, family business or are the CEO of a global corporation. In its 11 years of operations, the UK fintech start-up has nailed the concept of a collection system serving both one-off and recurring payments with fixed or variable amounts. And if the direct debit fails, their intelligent software will automatically schedule a retry.

Why they’re different:

If anything can speak to a company’s reputation, it’s their client base. GoCardless has already served over 70,000 businesses.

Intechnica

Leveraging technology to grow organisations

“Make technology make a difference” – Intechnica’s tagline perfectly summarises the British start-up’s approach to innovation. Since its founding in 2006, it already counts numerous retail, media, leisure and service sector businesses, as well as private equity firms into their success stories.

Intechnica operates on the assumption that many organisations fall behind not knowing how to effectively use technology to their advantage. That’s why, apart from software engineering and practical applications of machine learning and artificial intelligence, they also provide comprehensive consulting services.

Why they’re different:

They’re planning to work on visual image recognition software for the protection of children in the future.

Lightyear.cloud

Cutting-edge SaaS products for accounting and bookkeeping

The UK start-up poses a straightforward question, “Why use 4 apps when 1 will do?”. Their purchasing and accounts-payable solution is definitely “the one”.

Established in 2017, Lightyear.cloud is all about a customer-centric approach and intelligently automating your business processes. They are 100% true to their philosophy that good software should be easy to use. They’ll just seamlessly integrate with your tools, eliminating the need for manual data transfer.

Why they’re different:

In the case of a financial audit, you can grant access to your cloud-stored account history to external teams and auditors as well.

Mind Foundry

The intersection of AI research and innovation

When academia and technology cooperate, good things happen. This Oxford University platform, combining scientific research with tech innovation for high-stakes applications, is proof of that thesis.

Mind Foundry envisions a world in which humans and AI work together on solutions to the world’s most important problems. Therefore, since 2016, they’ve been working with the government, public sector and insurance providers on tackling the challenges the future brings.

Why they’re different:

In the past, they investigated the use of smartphones to record and track the spread of malaria by “listening” to mosquitoes.

Railsbank

Creating a richer finance experience with brands

It’s becoming increasingly difficult to stand out from the crowd in the financial services sector. Clients no longer want to just manage their money. They’re after personalised experiences that will make their journey on the chosen platform seamless and uncomplicated.

Railsbank, founded in 2016, does just that. Its embedded finance experience platform enables businesses to create a vertically integrated financial ecosystem whose ultimate goal is to impress, converting one-off users into loyal customers.

Why they’re different:

Fraudulent activities within the financial sector in the UK have significantly increased in the pandemic. Railsbank responsibly educates its clients on being extra vigilant.

Thought Machine

Cloud-native core banking

Imagine still using the computer you bought 20 years ago. No matter how many updates you’d install or how much you’d upgrade its motherboard, it just wouldn’t work properly. So you’d need to buy a new one anyway. Now imagine that the same thing happening to banks because some of them still rely too much on an outdated IT infrastructure.

This is the problem Thought Machine wants to solve. Instead of holding on to legacy IT, the UK start-up was established in 2016 to build banks from inception to production. That way they will be easily able to keep up with the 21st-century technology and their customer’s service excellence expectations.

Why they’re different:

Thought Machine is currently undergoing a rapid expansion, hiring new talent. And that is always a good sign.

Vodeno

The world’s first banking platform based entirely on Google Cloud

So you have a great idea for the next big thing in financial services but don’t know where to start. Or do you want to switch to more modern solutions for your already existing business? Or maybe you’re just an e-commerce enterprise looking to broaden its product portfolio. Vodeno, established in 2018, is a great tech partner in all those cases.

The Polish company’s comprehensive Banking-as-a-Service platform will help you create the right product for your clients, following strict regulations in the sector. And since it’s API-enabled, any transition from your current solution to their cloud will be a walk in the park.

Why they’re different:

It’s a ready-to-use solution for both retail and SME banking.

The ones to success

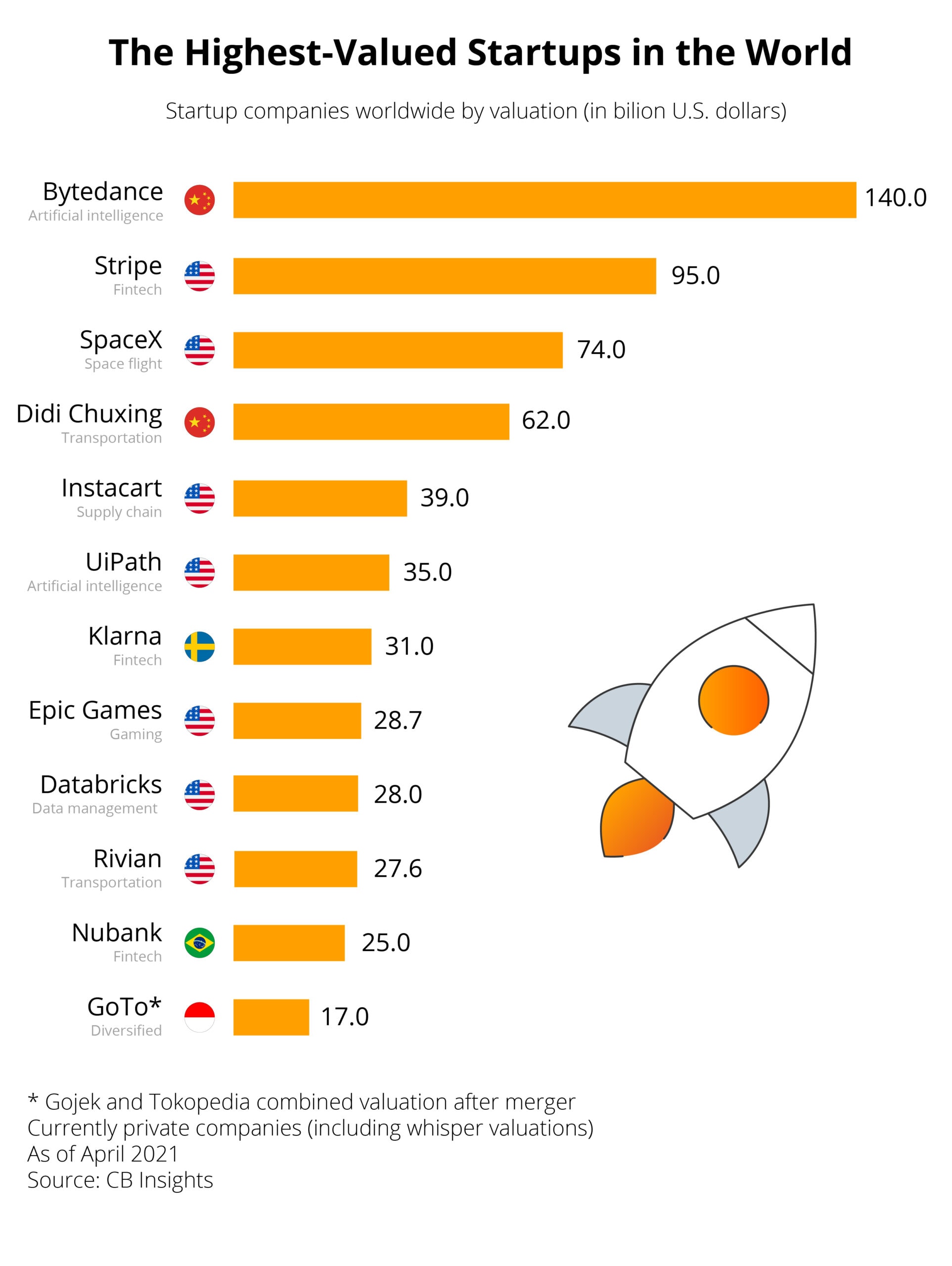

Statistics show that three new startups are invented worldwide every second. Most of them will fail in the first year due to their product or service mistiming.

The 10 European companies we’ve presented above did their research right. That’s why they’re making waves in the tech industry right now. And we’re very much looking forward to seeing what they’ll do next.