How is NLP transforming finance, FinTech, and banking?

Natural Language Processing is one of the hottest topics in the tech world. Today, we look into how it is transforming finance, FinTech and banking industries and we check when is the best time to invest in this technology.

The rise of Natural Language Processing in financial institutions

Before we dive into the world of finance, let’s look at what Natural Language Processing actually is.

In short, Natural Language Processing (or NLP) means the ability of computers to understand, interpret and generate human-like language, both written and spoken.

It is designed to understand the meaning of our languages as well as sentiment and intent of particular words, all thanks to a complicated combination of rule-based modelling of human language with machine learning and statistical models.

Apart from communication with people, it also allows to turn unstructured data into databases.

Recent years saw an unprecedented rise of Natural Language Processing in all industries, driven by advancements in technology and a growing understanding of the benefits it brings.

Today, it is used in automated customer service and support, in sentiment analysis, fraud detection, data analysis and risk management, to name just a few of a huge amount of its use cases.

Finance and banking is one of the industries that heavily rely both on data and on their customers. As such, it is a perfect world for the use of NLP.

The insurance industry also greatly benefits from this technology – read more about it here: NLP in the insurance industry: top 5 use cases and benefits.

Thanks to NLP, financial institutions can handle and analyse vast amounts of unstructured data and provide the best customer service.

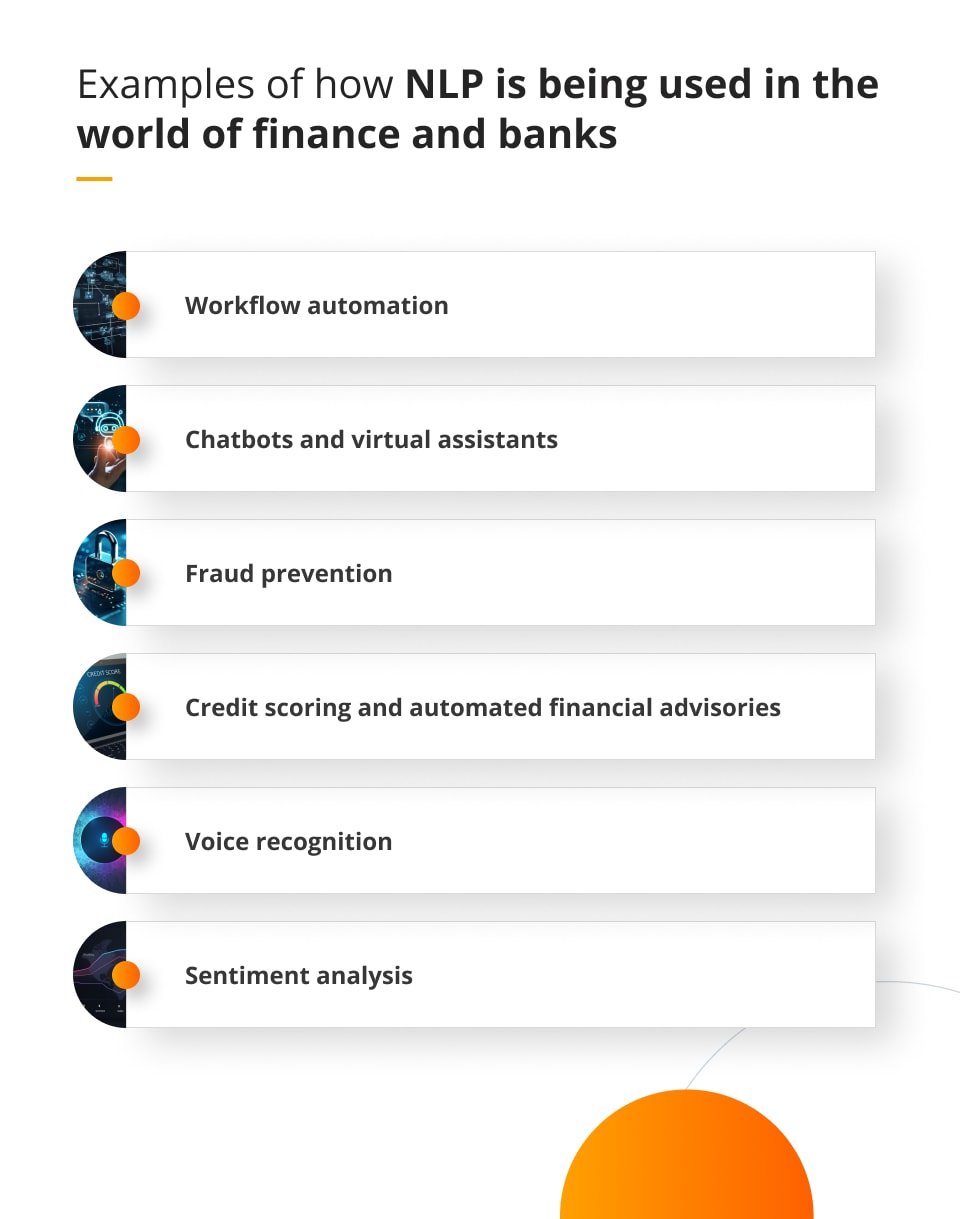

The convergence of NLP and finance services: use cases

Such a union between NLP and the financial world has led to a great number of innovative solutions. They all enhance efficiency, customer experience and decision making processes within the whole industry.

Workflow automation

NLP has a significant impact on the workflow automation within the financial industry. It contributes to the document processing and data entry and validation, reducing manual effort and minimising errors.

It also helps in customer onboarding by analysing customer conditions and extracting relevant information, which improve accuracy in identity verification.

It can also be used in automated report generations, market analysis and communication analysis, as well as in fraud detection.

Chatbots and virtual assistants

One of the most common NLP use cases are NLP-powered chatbots and virtual assistants providing continued customer service.

They allow 24/7 customer support, answer routine queries, assist with simple inquires and streamline customer processes.

Thanks to the introduction of chatbots customers have a continuous access to a source of answers to their questions. What’s more, because of the advancements in technology, chatbots are increasingly more able to engage in natural conversations, allowing customers to feel more taken care of.

Fraud prevention

NLP is often employed to analyse patterns and detect anomalies indicative of fraudulent activities.

Thanks to this, financial firms can enhance security by quickly identifying and preventing potential fraudulent transactions, effectively protecting both customer and themselves.

Credit scoring and automated financial advisories

Natural Language Processing has been increasingly integrated into credit scoring and automated financial advisories by analysing non-traditional data sources, such as social media, emails, and online activity, to gather additional information for assessing creditworthiness.

It is also used for analysing sentiment from textual data to understand the borrower’s attitude, financial behaviour, and overall credit risk.

What’s more, NLP algorithms can analyse customer data, preferences, and financial goals to generate personalised investment and financial planning recommendations.

Voice recognition

Voice recognition technology allows financial sector to interact with users through spoken language, offering a more convenient and secure means of communication.

Biometric authentication of customers during phone-based transactions or interactions with customer support enhances security and streamlines authentication processes, while voice-activated banking enables users to perform banking transactions, check account balances, and carry out various financial activities through voice commands.

Sentiment analysis

Financial services industry often employs NLP to analyse new articles, social media and other textual data to gauge market sentiment. Such information can be valuable for making investment decisions as well was for managing risks.

Predicting market shifts with NLP

The use of NLP in predicting market shifts enhances the capabilities of traders, analysts, and investors by providing valuable insights derived from textual data.

While it’s a powerful tool, it’s essential to combine NLP with other quantitative and qualitative analyses for a comprehensive understanding of market dynamics.

Additionally, staying aware of the limitations and challenges associated with NLP applications in finance is crucial for making informed and prudent investment decisions.

Document classification and streamlining

A great example of use of NLP in finance is document classification. Financial professionals deal with a huge amount of documents, ranging from regulatory filings and contracts to research reports and internal communications.

NLP algorithms are employed to automatically categorise and classify these documents based on their content, helping streamline document management workflows.

When it comes to streamlining documents, NLP algorithms are applied to extract and summarise key information from unstructured text, which saves time and reduces the risk on manual errors associated with data extraction.

The advantages and benefits of NLP in finance services

The advantages and benefits of using NLP in the finance industry are numerous:

- It saves time and effort.

- It significantly reduces the amount of work with data entry, document processing and customer inquiries, minimising at the same time the risk of human error.

- It streamlines processes.

- It enhances customer service, allowing for a more customer-friendly environment.

Thanks to NLP, financial firms can be more efficient in information extraction and sentiment analysis, and can improve their complaint and risk management. NLP allows them to increase their security, fraud detection and prevention processes.

Another important benefit of NLP in financial sector is the cost reduction it brings by minimising manual efforts and improving overall operational efficiency.

Also, NLP enhances accessibility, making financial services more inclusive for individuals with diverse needs and preferences.

Last but not least, NLP insights can inform the development of innovative financial products and services, ensuring there are aligned with customer needs and current market trends.

Why is it the best time to invest in NLP solutions for financial industry?

You may wonder when is the best time to invest in artificial intelligence in general, and in NLP solutions in particular.

The answer is simple: it’s best do it now because of the growing data volumes, regulatory changes and the ever expanding demand for personalised services. Financial institutions that embrace NLP can gain a competitive edge and stay ahead of their competitors.

If you are wondering how to start or which are the best solutions you can apply, do not hesitate to get in touch with our team.

We will be happy to analyse your current situation and, based on our vast experience in working with financial services and FinTechs on AI and ML development services, we will come up with a solution that will help you achieve your goals!