The future of vehicle claims

The insurance industry is undergoing a radical digital transformation. At the forefront of these digital technological advancements is vehicle claims handling. Emerging technologies such as AI, telematics and automation are driving this change and vehicle insurance companies around the world are shifting the way they work.

Introduction

At Future Processing, we are big proponents of digital transformation across all industries and we recognise the value that digital solutions, automation, AI and improved tech have on our world.

In this article, we delve into the issues commonly encountered by consumers during the vehicle claims process, examining how the pandemic has accelerated the adoption of digital solutions. In addition, we explore the evolving expectations of customers who seek seamless and effective claims experiences.

In our quest to understand the future of vehicle claims, we also consider the insights and ideas put forth by industry expert Bill Brower. Bill is the Vice President of Industry Relations with Solera Inc., a global provider of risk and asset management software and services for the automotive and insurance industries.

We recently invited Bill Brower to be a guest on our IT Insights: InsurTalk interview, ‘The future of claims’, where we discussed the current state of the claims industry and what the future looks like for Solera Inc. and vehicle claims.

Join us as we navigate this transformative landscape, predict the trends that await us in 2025 and beyond, and uncover the keys to a streamlined claims journey for all.

The problem with making insurance claims

Until very recently, the methods and processes involved in making vehicle insurance claims haven’t changed very much. Usually, the customer is required to engage in multiple conversations where they repeat personal details and information about the incident. An in-person damage assessment would be necessary, delaying the time it took to successfully complete the claim. There are many handoffs, making the process long-winded and frustrating.

During our recent interview with Bill Brower, Bill discussed his own first-hand experience recently when his own daughter was involved in a road traffic accident and he assisted her through the claims process.

My experience in 2022 was no different than it would’ve been in 1995. And I say that because there were many handoffs, there was no AI being used to help process the damage estimate, there were multiple trips to the shop to get the claim processed, multiple conversations…it was surprising to see that the process hasn’t changed in all those years.Bill BrowerVice President of Industry Relations at Solera, Inc.

Multiple handovers and conversations cause customers a lot of frustration. Each time they speak to the insurance company, they reach a new agent who needs to hear the details all over again and the customers have to send documents again and again to different departments.

This traditional method of processing insurance claims has been more or less the same forever and involves very little automation or digitalisation. These factors have frustrated customers immensely, which has been a huge problem for insurance companies.

In Price Waterhouse Cooper’s 2020 survey of Covid-19, consumers were asked interesting questions about what insurance buyers actually want now. Importantly, 41% of insurance customers reported that they are likely to switch their providers due to dissatisfaction with their provider’s technical capabilities.

Insurance providers need to keep their customers satisfied or they risk losing them altogether. This notion has got the insurance industry around the globe thinking about how best to serve their customers effectively.

Covid-19 – How it changed the landscape of insurance claims

The restrictions caused by Covid-19 forced the insurance world to go digital. Not being able to meet people face-to-face, insurance companies didn’t want to put their staff at risk by sending them out to claims in person. Because of this, the entire insurance industry was forced to go digital, especially damage assessments.

In our interview, Bill Brower explained how virtual estimating skyrocketed in 2020. Bill estimated that the U.S. Insurance market went from around 10% of claims being conducted virtually pre-Covid-19, to almost 100%, literally overnight.

Insurance companies had no choice but to make this digital transition, and although it wasn’t easy, it was a great success. Bill reports that Solera’s customers were extremely satisfied with these new digital processes.

The interesting thing was that customers loved it when it [the digital transformation brought on by Covid-19 restrictions] happened. They were getting their estimates faster and they were able to get the cars into the shop more quickly.Bill BrowerVice President of Industry Relations at Solera, Inc.

Covid-19 was the tipping point for digital and virtual claims. Customers made it very clear that they wanted this transition, and they were happy to use new technology. Instead of fighting against it, insurance corporations embraced it, automating their claims processes and operations.

What is the current state of the insurance market now?

As Bill Brower touched upon in our recent interview, although insurance companies have digitalised and automated many aspects of their business in terms of claims and damage assessments, there are still many flaws. Insurers have adopted new technologies, but the processes they use have not effectively adapted to leverage these capabilities.

The challenge lies not in insurance companies’ reluctance to update outdated technology, but in recognising that technology alone is not sufficient. Merely having the most advanced tools available does not guarantee progress if processes are not allowed to evolve effectively.

Today, insurance claims involve a significant amount of data. However, the handling of this data and the number of steps in the process have not kept pace, resulting in a heavier workload and slower workflows for everyone involved. Consequently, customer service may suffer, falling short of its potential.

Making insurance claims today, even with all the digital tools and automation available, still involves numerous touchpoints, handoffs and other time-consuming and frustrating practices. In essence, the processes are relatively similar now than they were even 30 years ago.

The ‘bolt-on’ approach to new technologies

It is common for insurance companies to add technology to existing processes – sometimes it works, but a lot of times it just leads to more problems. Attempting to automate processes that were not originally designed for automation can lead to numerous missteps.

Adopting digital methodologies and automation requires companies to view their processes more holistically and not through the lens of a narrow scope, which leads them to simply add technology to their legacy systems without thinking of the customer experience as a whole.

What does the modern customer want?

These days, a great number of consumers not only want, they expect a full digital service.

Customers want to be able to use an app to upload images of their claims, quickly and easily fill in the basic details, and use digital tools to transition smoothly through the claims process. They don’t want to tell the same story multiple times to people in different departments. They don’t want to meet in person with a damage assessor, wasting time.

Touchless claims

Consumers spend their time interacting with flawless digital systems every day. When a customer buys a product from Amazon, they almost literally don’t have to write anything – they simply select the product they want, edit the options, make sure the payment and delivery details are correct and they’re done! This is a great example of ‘touchless claims’.

Potentially no employee involvement. Technology handles the entire claims process, including damage assessment and electronic customer communication. A system audit determines if the claim gets approved. If so, it is paid automatically without human intervention.Definition of ‘Touchless Claims’Bill Brower, Future of Claims 2021 LexisNexis Risk Solutions Report

Touchless claims allow the consumer to engage in a pain-free and effective experience when using their insurance company’s app to make claims. They are given a range of options to select, moving them smoothly and easily through the process. The idea is that there is little-to-no writing involved, and certainly no need to speak with multiple insurance agents on the phone!

A real-world example of touchless claims

Bill Brower outlined his visions for the future in our recent interview and his 2023 The Future of Claims is Touchless article where he described how a fully automated touchless vehicle claims process could work:

By scanning the QR code that is pre-loaded with the consumer’s personal information and then using the app to carry out their touchless claim, the customer will have already provided the insurance company with almost all of the information required.

This saves both the customer and the insurance company from needing to actually speak as they will be able to communicate via the app.

By following this model, many claims could be resolved entirely through the app. When the insurance company needs more information, the consumer could connect with an insurance agent via the app, and the agent will have full access to all of the customer’s personal information and claim.

This will reduce the time it takes to successfully make the claim and drastically increase customer satisfaction in the process.

The role of AI in touchless insurance claims

The use of AI in insurance claims is based on providing more capability for the claims professional. Traditionally, the customer calls the insurance company and speaks to someone who takes the loss report. Then they might speak to an adjuster, then an appraiser and so on. This is a long-winded process.

The future use of AI will be focused specifically on collaborating information and eliminating these handoffs to multiple personnel.

AI can be utilised to streamline and take the pain out of making an insurance claim by smoothing out the claims process, collating information and processing it.

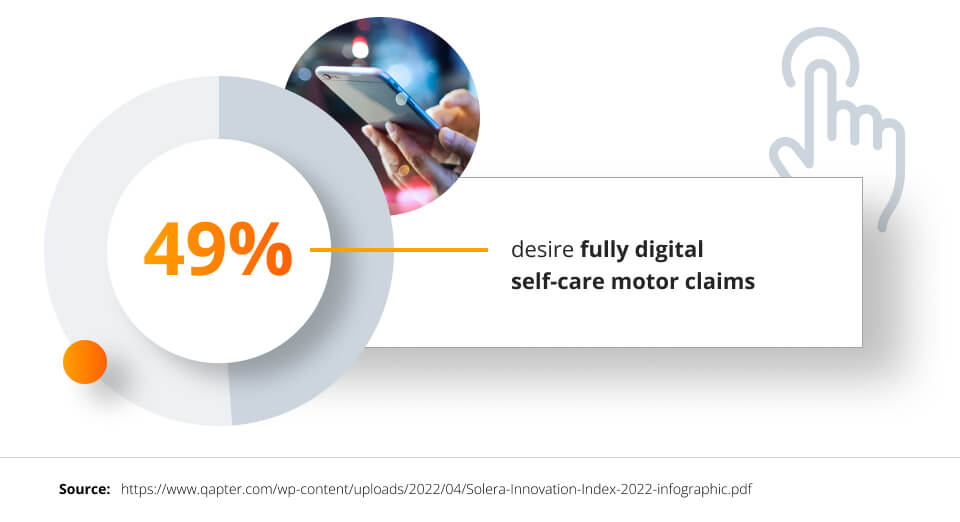

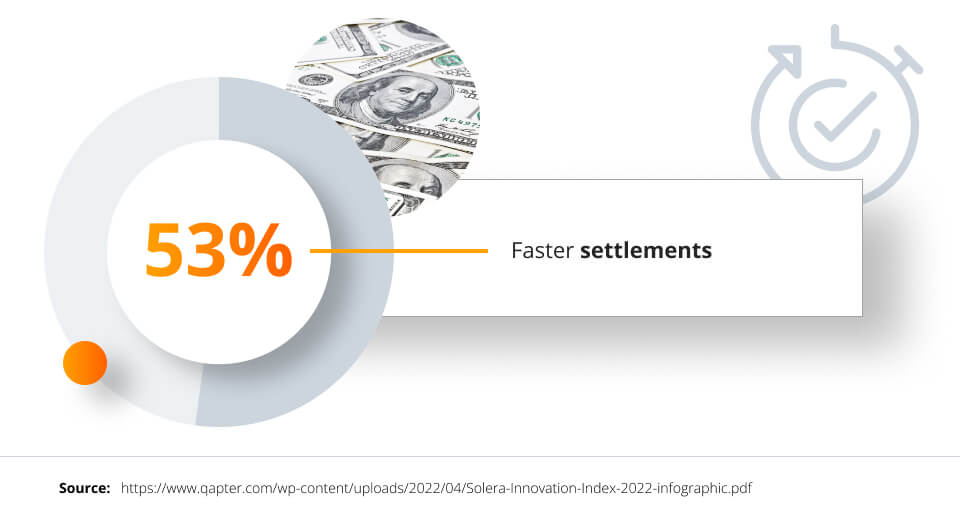

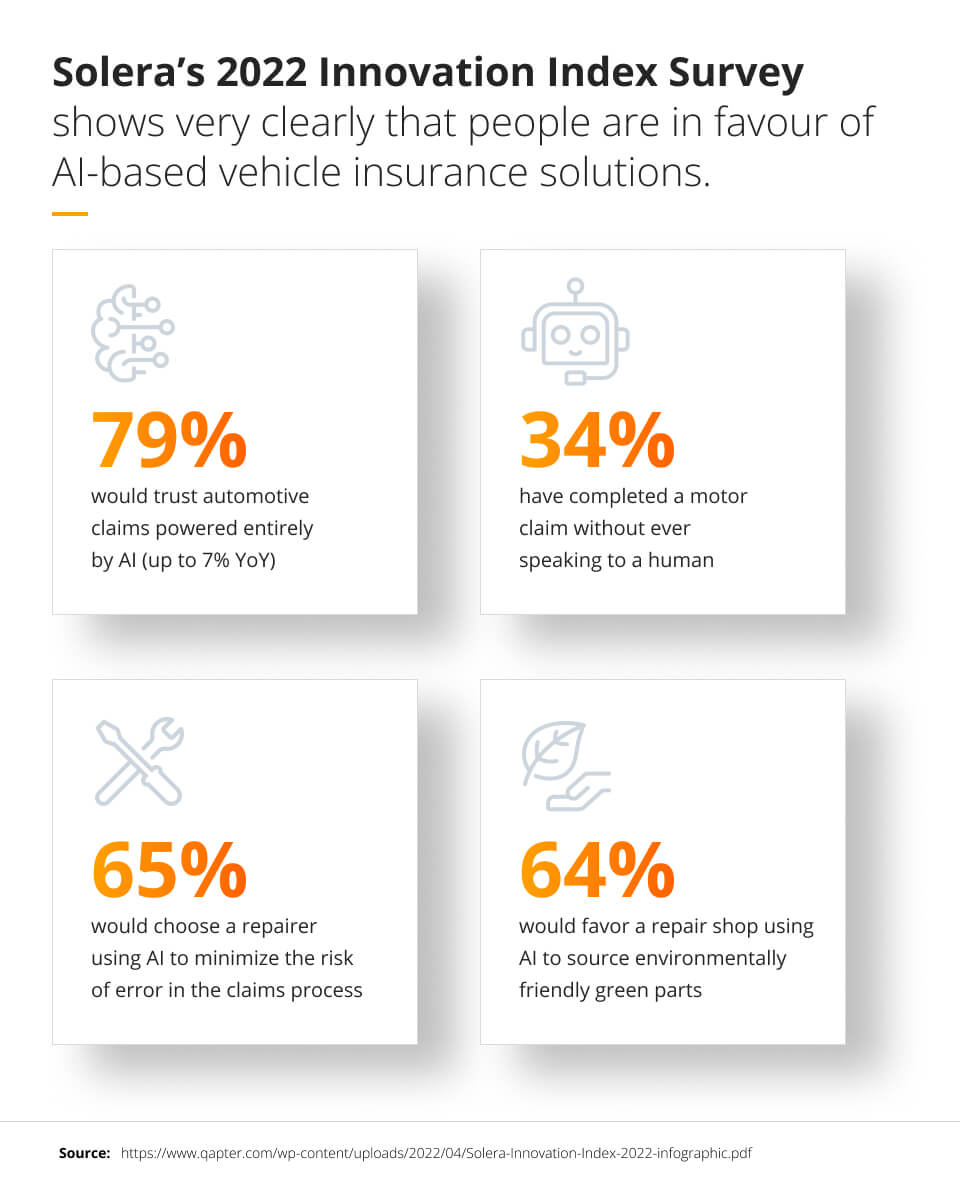

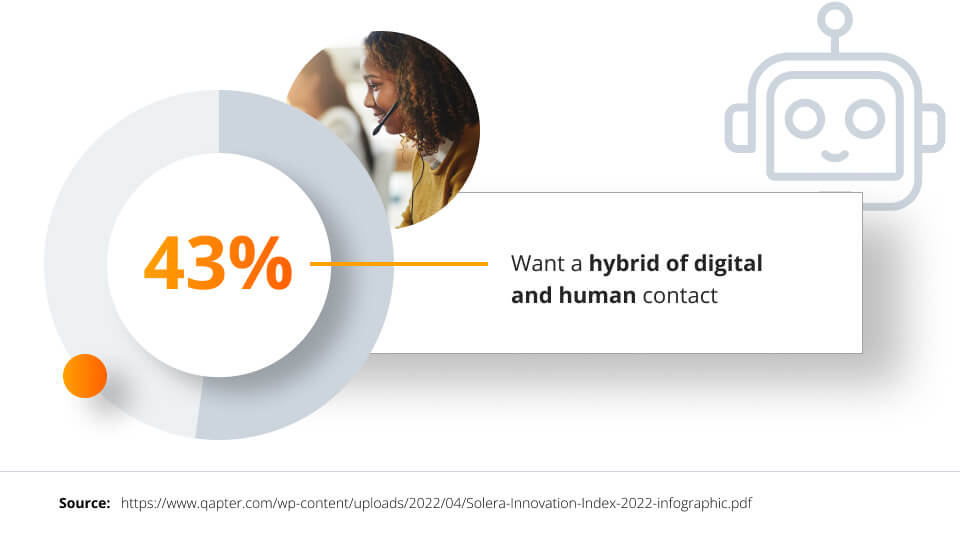

Solera’s 2022 Innovation Index Survey shows very clearly that people are in favour of AI-based vehicle insurance solutions.

A hybrid solution

While AI will undoubtedly improve the customer claims experience immensely, it’s unlikely to fully replace the need for human input altogether. In our interview, Bill Brower made a clear case for this hybrid model from the view of a customer:

Personally, I would like to speak with someone in the claims process… so if you have the ability for both [AI touchless technology and human communication] to work, then maybe I could report my claim with the QR code and an app, and I can get my car into the body shop and get things started, then perhaps I do want to talk with a claims person about what’s the impact to my premium, my cost or other questions that I might have about the claims process.Bill BrowerVice President of Industry Relations at Solera, Inc.

Combining fully automated AI technology with human communication may well be the most effective method of modernising insurance claims. AI can assimilate and organise all the necessary information, and humans can be there on hand to cover complex situations. Having a human touch also gives consumers the comfort of knowing that a real person is accessible when needed.

Solera’s 2022 Innovation Index Survey found that 43% of consumers want a hybrid of digital and human contact when completing their automotive claims. The report went on to highlight that as many as 70% would actually consider switching providers for a faster claims experience, and combining AI with well-informed human communication in a hybrid model would certainly provide that.

Predicting 2025 claims trends

It is clear that the claims automation awakening that was brought on by the events of Covid-19 have been highly successful. Currently, insurance companies are looking to refine and develop their strategic roadmaps to complete the digital transformation revolution in claims handling from traditional methods to touchless.

Bill Brower predicted a number of trends for 2025 and beyond in his comments in the LexisNexis Risk Solutions 2021 Future of Claims Study, including:

Summary

While the insurance claims industry hasn’t yet achieved the perfect solution balancing AI, digital systems, hybrid working models and automation, it’s well on the way.

By adopting a different approach to the integration of technology and processes, we could make touchless claims a reality within a few years. The necessary tools already exist, and customers have clearly expressed their preference for touchless claims. Companies that proactively enhance their customers’ digital experiences today will reap the benefits of improved customer service and reduced operating expenses.

If you would like to know more about touchless claims and the insurance claims market, follow this link to watch our interview with Solera Vice President of Industry Relations, Bill Brower.