ESG and Digital Transformation in Business

An ethical investment portfolio must take a joint perspective on ESG and Digital Transformation integration for business decisions. Successful companies greatly benefit from carrying out ESG and DT change processes together. Those who carefully choose the right path and the best suited IT partner, stay ahead and win.

Many business decision-makers ask themselves: How is it possible that this particular investment paid off so well or didn’t pay at all? Why does this particular business stay ahead of the competition? What makes an investment worth the risk in these uncertain times?

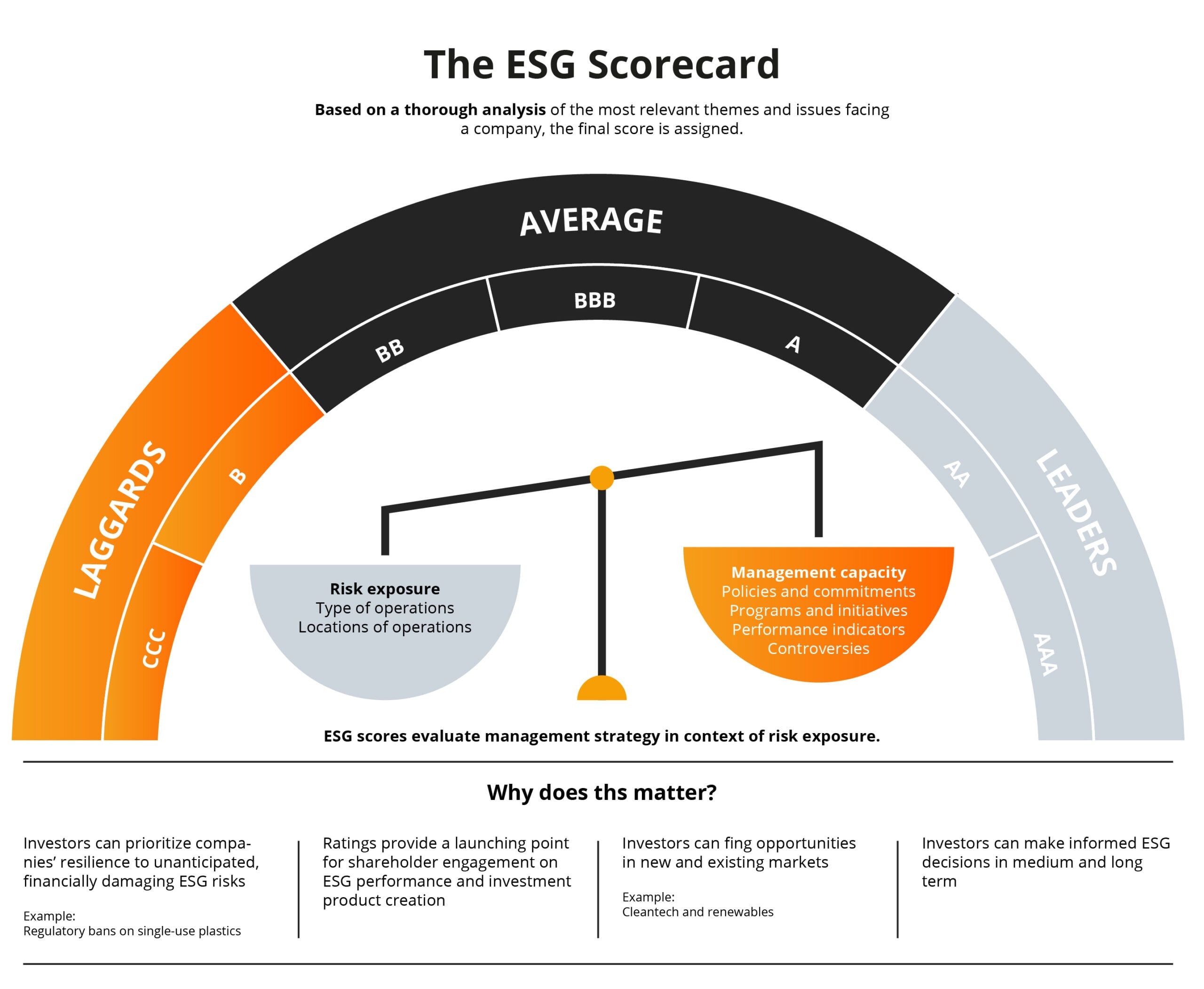

Let’s explore the topic of ESG investing – a framework for reporting, a point of reference for investors, regulators or employees, and a set of crucial ratings to take into account when making big business decisions for now and for the future.

What is ESG?

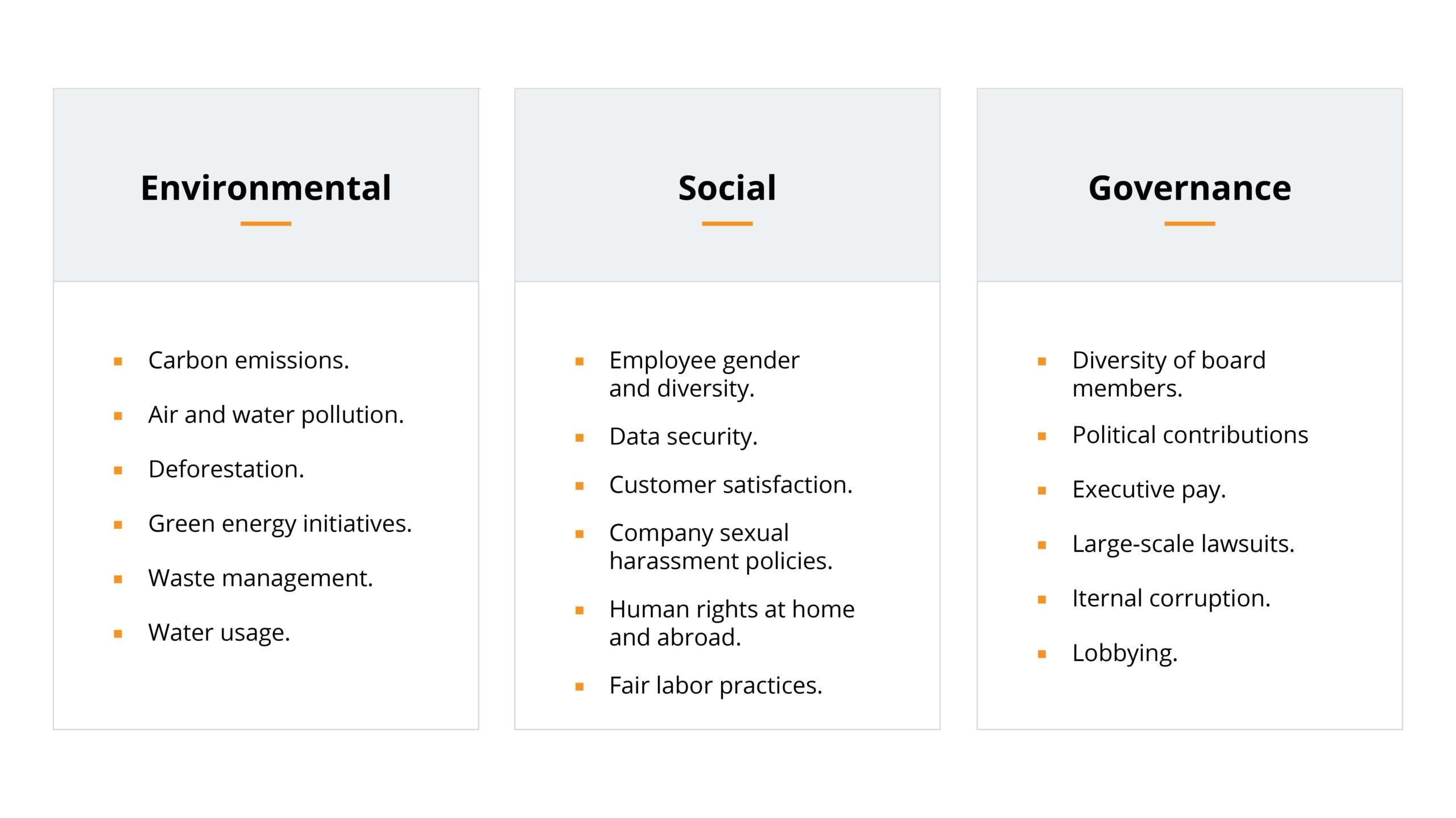

ESG stands for: Environmental, Social and Governance, and it is a set of guidelines essential in socially conscious investments.

ESG ratings are an increasingly popular way for investors to evaluate companies they might want to invest in. Let’s see the in-depth ESG definitions from two different perspectives:

ESG in Business: Investors’ Perspective

According to Investopedia: ESG investing criteria are a set of guidelines for a company’s activities that socially conscious investors use to screen potential investments.

Environmental (E) criteria concern how well a corporation manages the environment.

Social (S) criteria focus on how it interacts with employees, suppliers, customers, and the communities in which a business operates.

Governance (G) includes topics connected with the leadership of a corporation, executive compensation, audits, internal controls, and shareholder rights.

ESG in Business: Internal Business Operations’ Perspective

ESG is used as an operational framework as part of both the enterprise risk management systems and value creation. When properly used, ESG provides three separate lenses for senior management and the Board of Directors to develop plans and performance measurements (KPIs) for non-financial impact.

Further, ESG provides metrics for optimising business operations and corporate governance, resulting in increased sustainability, resilience and longevity.

The popularity of socially responsible investing continues to increase over time as a way of business evaluation in the area of promising investment directions.

On the other hand, it can be extremely helpful in avoiding investing (or investments in) companies that create financial risk connected to their environmental practices. That leads to a wide variety of products and services on the global IT market that helps strategically employ ESG ratings and rankings.

Areas of ESG business actions

ESG ratings and rankings help companies measure success of digital transformation and how their investments perform in certain categories.

Environmental factors refer to the conservation of the natural world, social factors include how people are treated inside and outside the company, and governance factors refer to the ways business is run.

Here are some examples of areas to look at in each category:

ESG Considerations and Trends That Could Change Companies’ Strategies

As there is a heated worldwide discussion on reasons and challenges connected with ESG, it is crucial to emphasise that the ESG changes are derived from 3 major trends:

- Increased scrutiny from investors acting in the finance industry to direct funds according to ethical and environmental metrics. For example, issues concerning child labour and carbon and methane emissions in the entire supply chain.

- Customers and stakeholders vote with their wallets according to the business impact on the environment, society and employees, and adopting forward-looking management practises such as diversity in the executive management ranks.

- Reaction to regulatory pressure on disclosures and streamlined reporting to parallel current financial reporting considered by IOSCO and national regulators.

ESG Benefits: Why is ESG important for the future of business?

Stakeholder Relations

While the focus on ESG criteria is relatively new, the role of stakeholders in enterprise management is attributed to Edward Freeman, who highlighted the role of the broader community impacted both positively and negatively by a business.

Stakeholders can be active participants in the business e.g., employees and customers, or passive participants, e.g., local communities.

The moral, ethical and social roles of companies can be traced back to the Age of Enlightenment.J.J. Rousseau

Licence to Operate

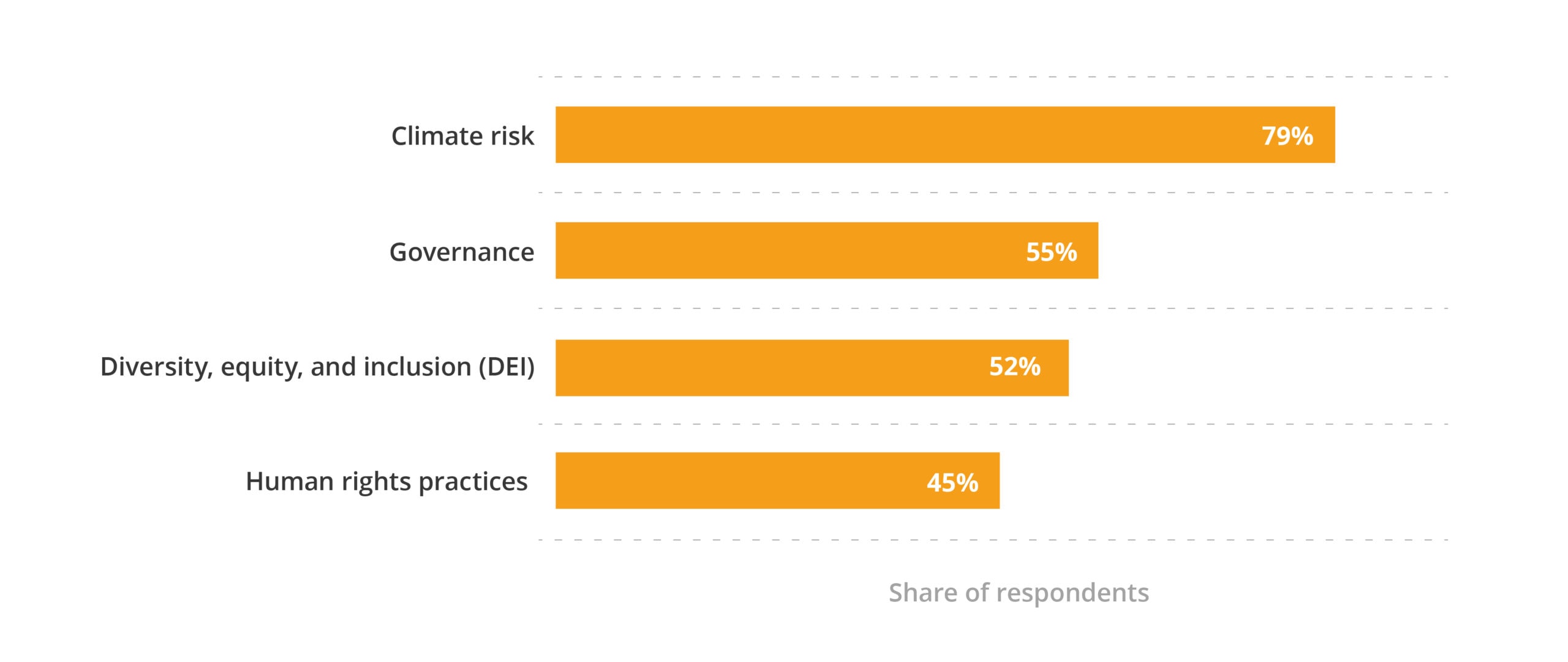

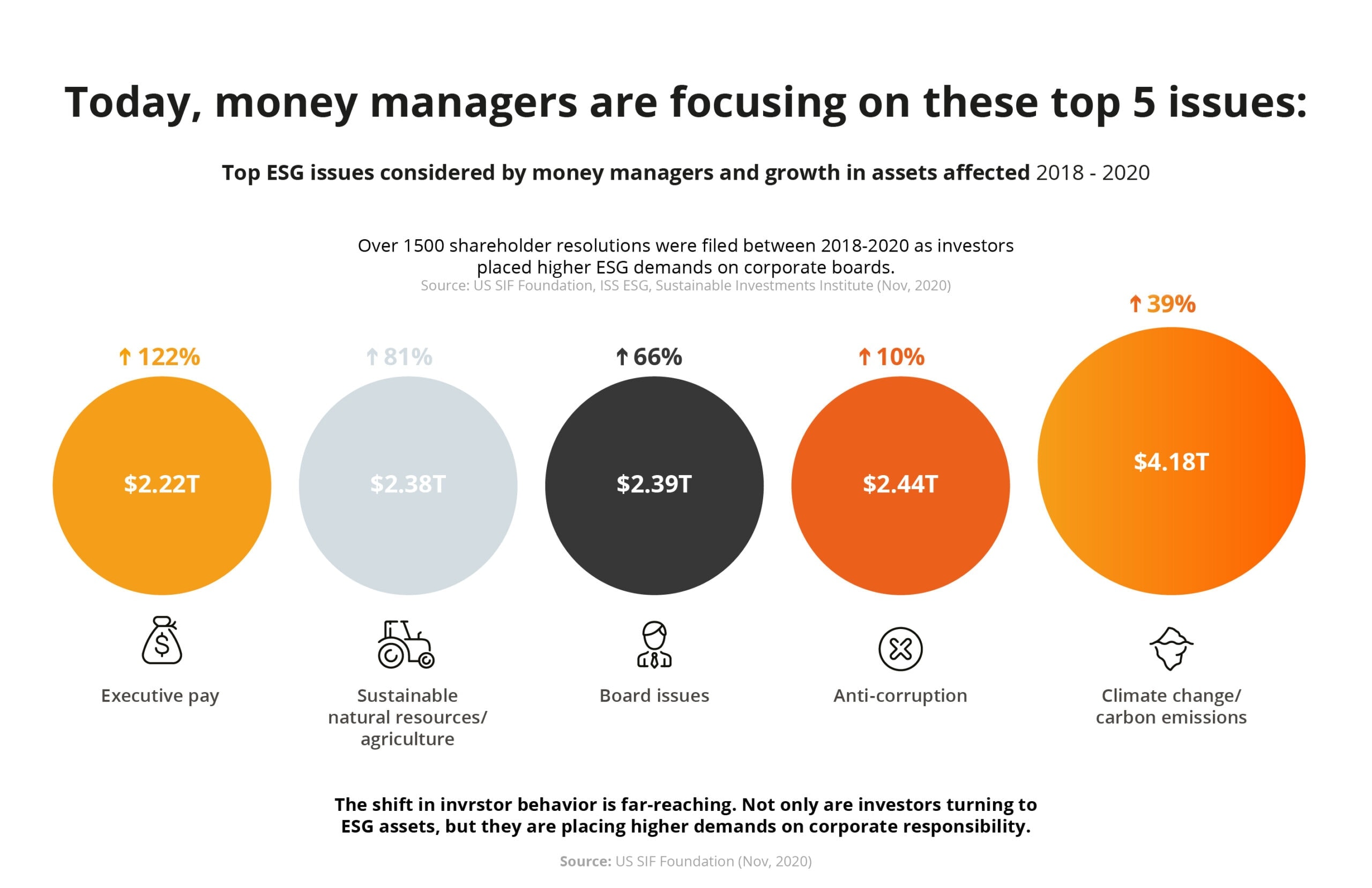

As shown by Statista, for ESG investors controlling large pools of assets under management (AUM), the environmental and transformative governance risks are top-of-the-mind in directing investments based on ESG ratings and rankings.

As of 2021, climate risk was the most relevant environmental, social, and governance (ESG) factor for the decision-making of institutional investors worldwide. 79 percent of the respondents stated that this factor is a top risk or opportunity factor. Governance followed, with 55 percent of the investors surveyed.STATISTASource: https://www.statista.com/statistics/1204036/top-esg-risks-and-opportunities-for-investors-worldwide/

Easier Growth

It seems way easier for companies to enter new markets and expand their operations in the existing markets if they have a strong ESG investing approach. Countries with well-developed economies and eco-friendly business regulations will perceive ESG-compliant companies as better investors.

Effectiveness And Cost Reduction

Companies that switch to more sustainable methods of production tend to be more efficient and reduce their costs.

For example, Nestlé will invest up to USD 2.1 billion by 2025 to fully replace plastic packaging with sustainable solutions. It will cut carbon footprint and also avoid non-compliance costs in countries with strict policies regarding plastic packaging.

Talent Magnet

There is no wonder that modern companies with good ESG scores attract great talent and specialists who highly value sustainable business actions and investments. The younger generation of employees seeks meaningful goals in companies that are aware of their impact on the future.

The trend is even stronger when companies provide a clear digital transformation strategy to current and future employees. A strong ESG business approach can also prolong retention as a clear sustainability agenda helps maintain an internal sense of pride and belonging.

Digital Transformation

Remove the barrier to digital for your business

Make strategic, planned, organisational change through adoption and modernisation of technology.

Is ESG delivering stakeholder value?

The financial industry consensus is that companies leading in ESG ratings and rankings provide better and more secure returns when measured in economic terms.

To answer the question in more detail, study after study has shown that two important factors play a role in how ESG is reflected in a company’s stock:

When ESG-related news is material for the company’s performance. In other words, it affects financial metrics such as productivity increase, reduction in work accidents, as well as cost avoidance and cost savings. For example, a company replacing cheaper and environmentally friendly packaging will have a financial material impact reflected on the company’s balance sheet. In another case, a company removing the use of plastics in the cafeteria will not likely see a change in its stock price.

Bad ESG practices are penalised. While stories of the Good Samaritan cross cultures, the reality is that companies are penalised for bad environmental or social behaviour, while good companies do not always get benefits. In everyday business news, we hear about companies that saw large drops in valuation due to environmental damages or employees being subjected to sexual harassment, discrimination, or abusive management practices. More recently, companies which fail to protect their data assets during digital transformation and suffer cyberattacks such as ransomware receive lower ESG ratings.

(Un)measured impact of ESG pays off

As mentioned, good ESG practices are not directly and immediately rewarded, hence economists, stockholders, and media are less able to measure the impact on stock performance. We can assess the indirect influence on other business-related KPIs, like employee satisfaction and productivity, employer hiring, and retention.

This reflects how strong ESG policies are associated with excellent management practices. Positive media coverage of environmental awards, stockholder devotion to green brands and activist investors are among the other indicators.

But most importantly, phenomena such as the outbreak of the COVID-19 pandemic or climate change make us all realise that we are not the earth’s owners and rulers. That is why ESG investing is gaining even greater significance, as companies have the responsibility and resources to take positive actions that can pay off on many different levels.

Furthermore, when good ESG practices are also aligned with successful digital transformation, companies benefit from new business models, new markets and the latest digital technologies.

ESG and Digital Transformation: challenges and opportunities

An ethical investment portfolio must take a joint perspective on ESG and Digital Transformation integration for business decisions. Successful companies greatly benefit from carrying out ESG and DT change processes together. Those who carefully choose the best suited Digital Transformation partner and the right path stay ahead and win.

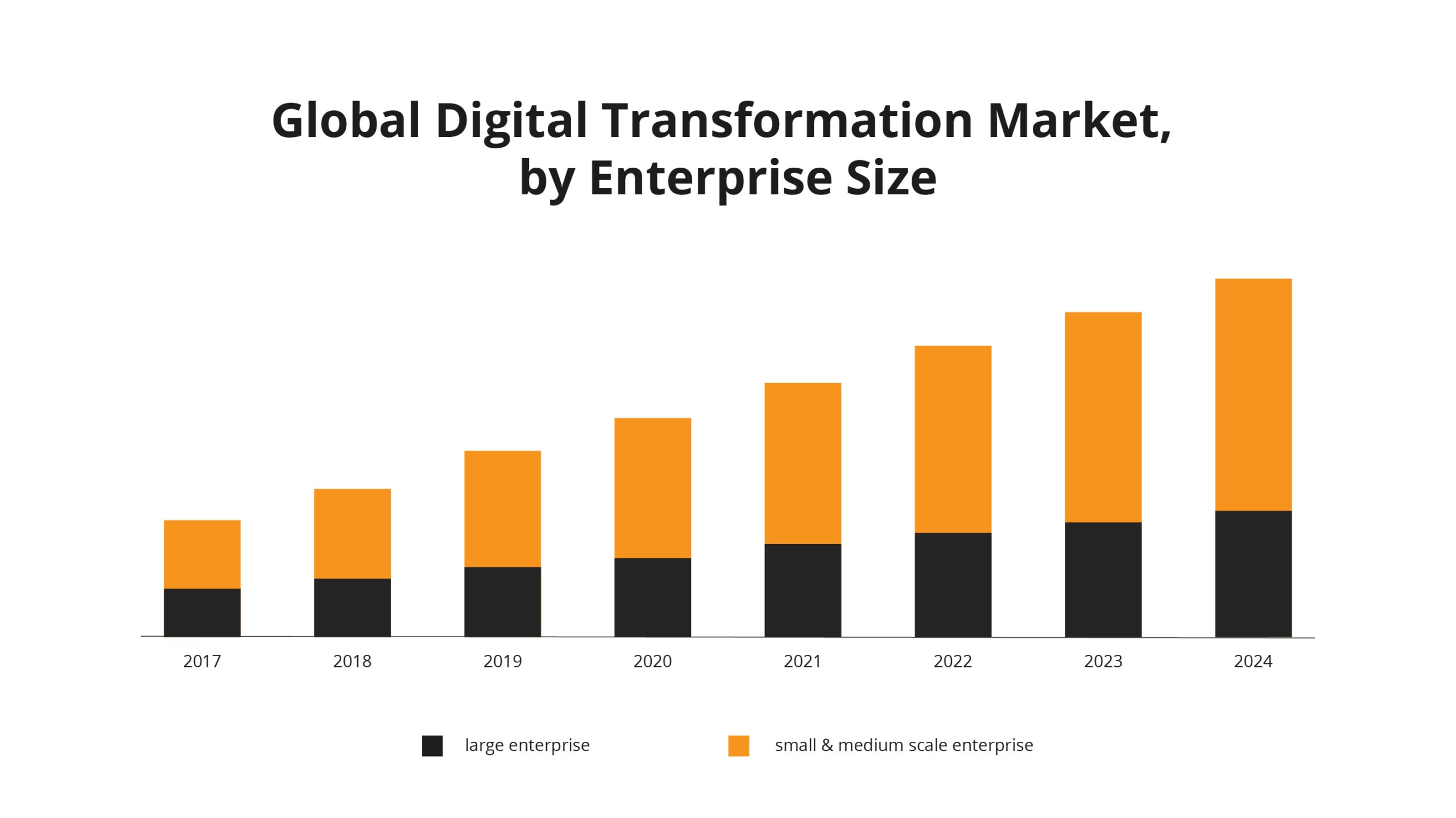

TThe digital transformation market is fast expanding as digitalisation technology offers new business models, fuels societal changes, and delivers tools for sustainable ESG. The COVID-19 pandemic has only intensified major changes, requiring many business owners to adapt fast to the new reality.

International Data Corporation (IDC) predicts digital transformation spending will reach $1.97 trillion in 2022 and a staggering $6.8 trillion globally by 2023. Furthermore, 30% of top 2000 global (G2000) companies will allocate a capital budget equal to at least 10% of revenue to fuel their digital strategies, IDC says.

The reality of most DT projects’ ROI

As many IT experts encourage businesses to deep dive into digital transformation initiatives, the inconvenient truth is that 70% of DT projects fail to return the investment. It can happen for different reasons, connected with the lack of alignment, insufficient in-house talent or specific metrics, inadequate tech infrastructure, and a shortage of qualified IT partners or cultural deficit.

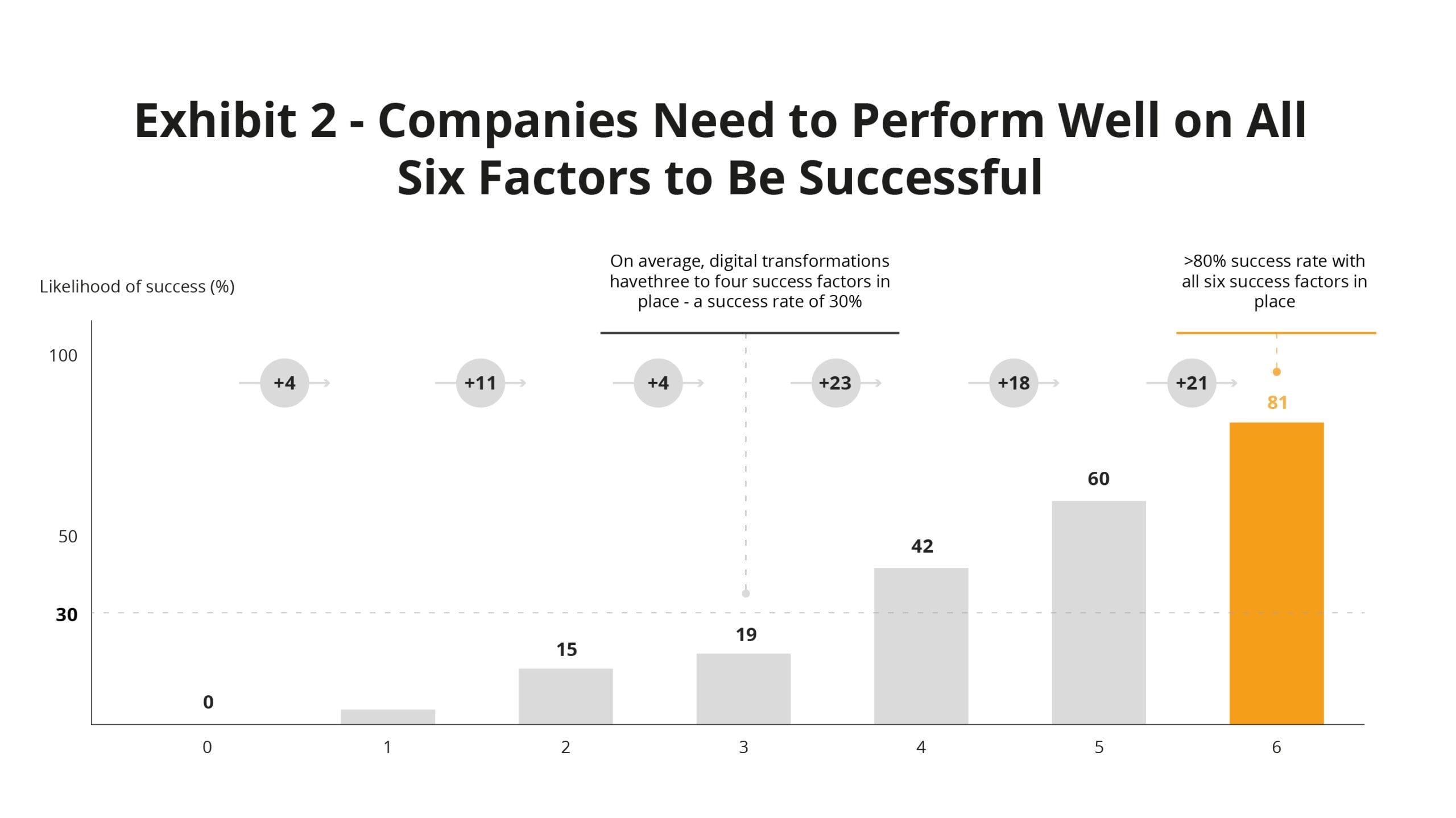

BCG has completed a study of 825 executives who implemented digital transformation in their companies covering all industry sectors and types of digital transformation.

BCG identified 35 factors, grouped into 6 categories that “reflect commitment, strategy, approach, governance, financial and people resourcing, and technology enablers.”

The success score is calculated based on the percentage of predetermined targets met and value created, the percentage of targets met and value created on time, the success relative to other transformations, and the success relative to management’s aspirations for sustainable change.

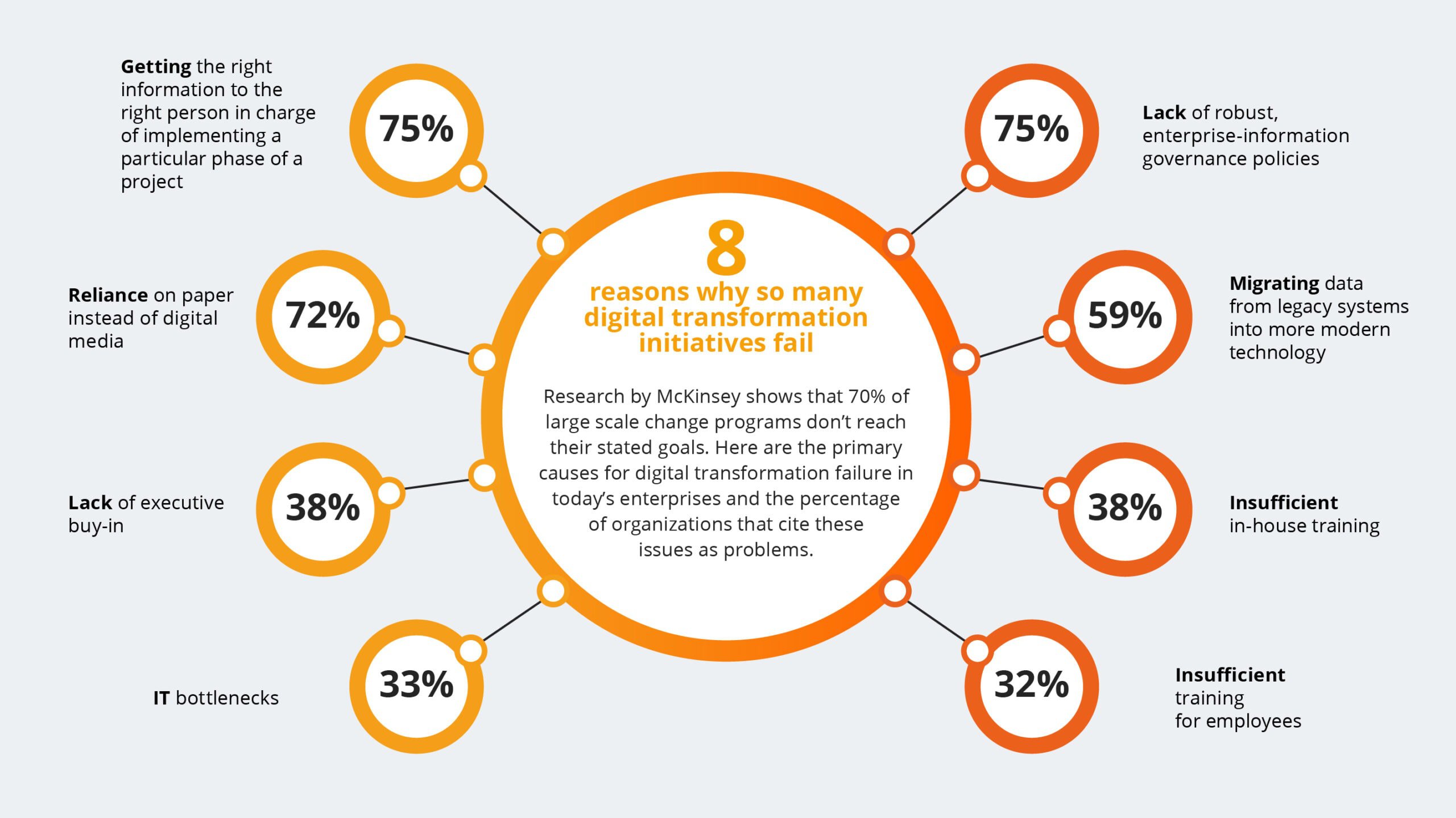

8 Factors Causing Digital Transformation Failure

More detailed failure analysis of DT projects identified both key internal factors and their contribution to unsatisfactory transformation results.

Here are the main reasons why digital transformation doesn’t work out. Every business owner should be aware of them before they start to work out the DT strategy.

To start, it is essential to learn from other companies experience and check internal factors and involve IT partners and consultants:

Getting the right information to the right person in charge of implementing a particular phase of a project (75%)

Reliance on paper scanning as the most important form of capturing information (72%)

Migrating data from legacy systems into more modern technology (59%)

Lack of robust, enterprise-information governance policies (75%)

Insufficient training for employees (32%)

IT bottlenecks (33%)

Lack of executive buy-in (38%)

Insufficient in-house talent (38%)

As a result, in addition to hiring IT experts, it is critical to review internal tech infrastructure, the board’s and workers’ attitudes toward changes, and in-house IT professionals who may accelerate your digital growth.

Digital Transformation and ESG: dimentions and ratings

One thing is awareness of risks, but we need to remember how important ratings and rankings are in both: planning and reviewing investments. ESG and digital transformation both have metrics and methods for assessing their maturity.

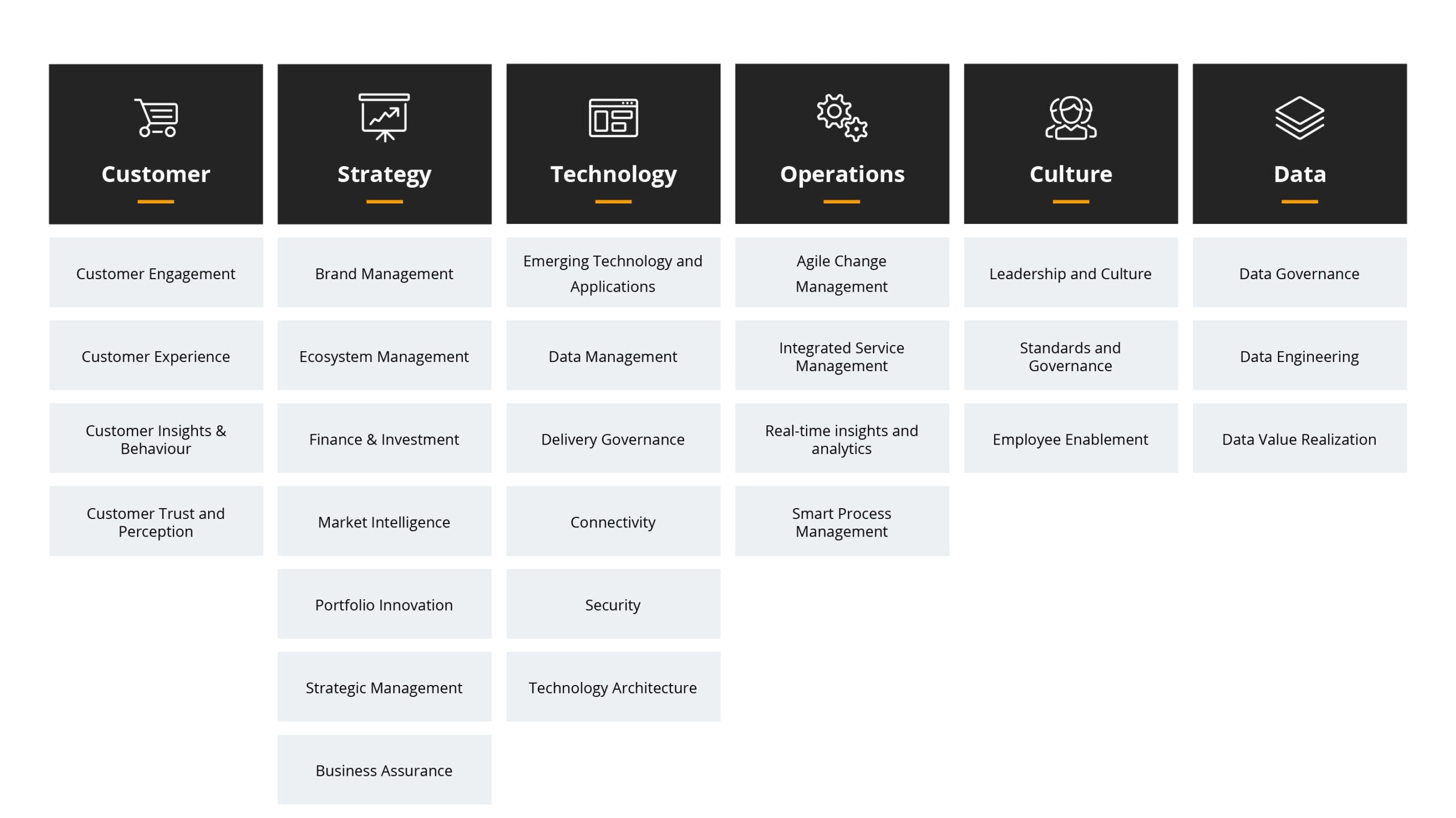

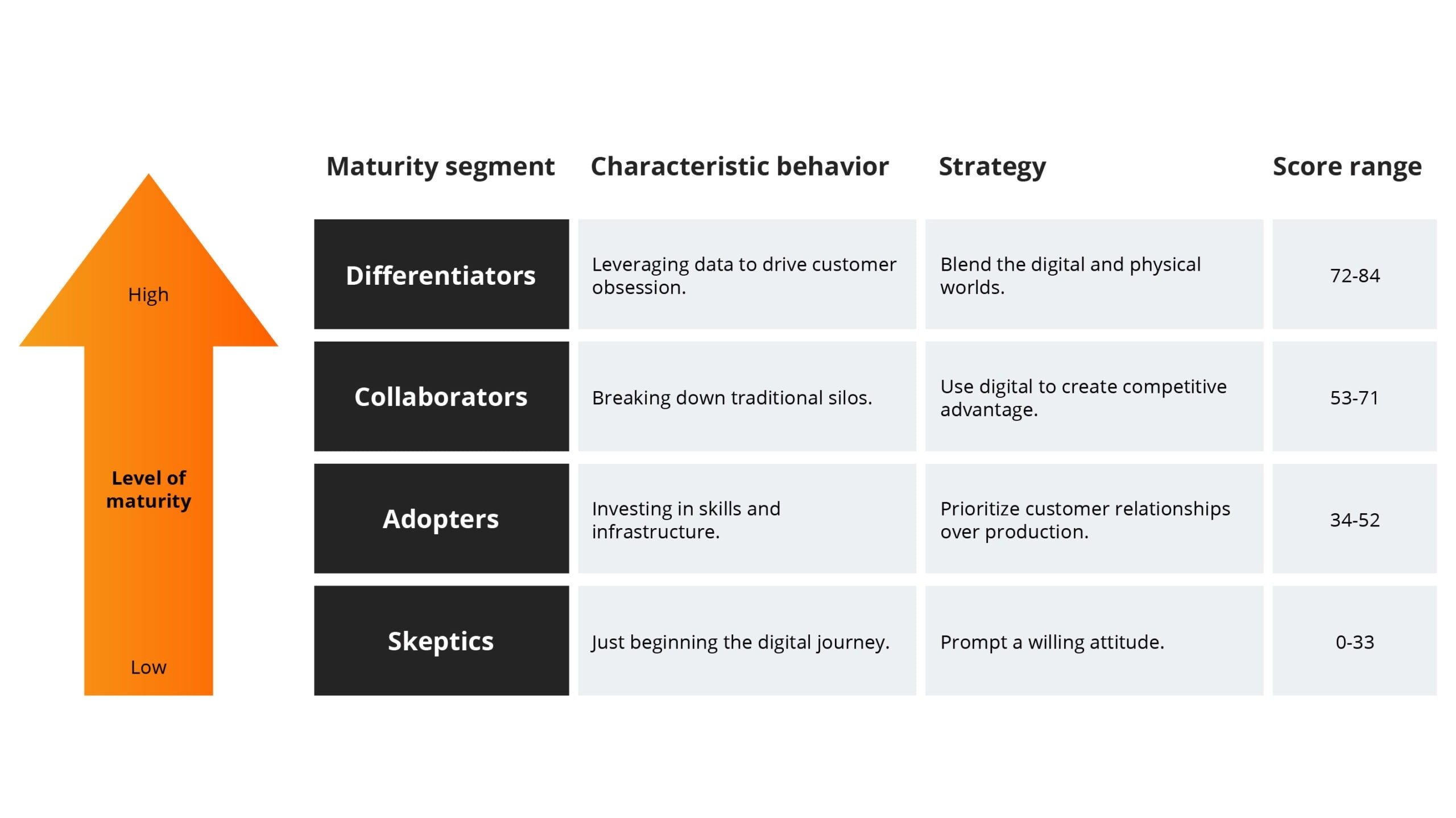

There are 6 dimensions in which we can assess the maturity of a DT project:

Make strategic, planned, organisational change through adoption and modernisation of technology.

The smallest number of enterprises in the study, the Differentiators, report strong revenue growth and tend toward pure-play or heavily online-focused retailers, who are consistently more skilled than average at all the marketing and eBusiness functions. These digital transformation experts are seamlessly blending the digital and physical worlds.

The most important characteristic of Collaborators is not industry or business size, but the fact that companies in this category are substantially more likely to interact internally and externally to allow practice and innovation with digital.

95% of Collaborators prioritize their brand’s entire customer experience over the success of any one channel.

More Collaborators claim great coordination and continuing contact between marketing and IT than any other area. In comparison, the fewest Collaborators said their IT staff handle marketing initiatives as transactional, one-time requests.

ESG investments risks are incomplete without adding DT risks

ESG ratings impact corporate financials more than many would expect. How is it possible? As much as one-third of investments in 2025 will be based on ESG ratings and scores. However, $3.7 trillion of global digital transformation investments in 2026 will be missed in ESG reports and rates.

Most large companies are already reporting on ESG metrics; however, few add digital transformation metrics are added to corporate financial or ESG reports.

While financial managers are laser-focused on corporate sustainability tracked by ESG ratings, they mostly fail to consider the DT as the major predictor of corporate resilience and longevity.

Investment risk planning: ESG & Digital Transformation included

March 2020 has shown every business in the world that not everything can be planned, and much less can be predicted. Even though people initially thought the limitations and challenges connected with the COVID-19 pandemic would soon be over, we will be facing an unknown “new normal” in which DT will likely play a major role.

We have no influence over unforeseen global destabilisation, societal trends, or shifting necessities of the moment. The be found in the McKinsey report. The study contains further information on recent behavioural shifts that will impact company decisions.

It is widely accepted that executives and boards of directors must lead businesses on a narrow path between creating economic value and mitigating risk. To perform these difficult tasks and make better investment choices, companies need to carefully analyse both: current and future DT and ESG transformations.

The whole analysis should be carried out a few years ahead to plan for risks accordingly. We also need to remember that investors, stakeholders, corporate executives and boards of directors demand actionable ESG and digital transformation plans for major risks and sustainability.

Choosing a qualified IT partner to succeed

The essential decision to make before we start planning DT and ESG changes is choosing the experienced and well-qualified IT partner of both processes. In addition, joining peers in forward-thinking industry consortiums provides additional value to risk mitigation planning.

The expert team to cooperate with the company will evaluate risks, and work out the strategy for both transformations. Best-suited IT partners will support sustainable changes from the stage of consulting and collecting requirements to adapting the existing systems or building brand-new ones.

Choosing a qualified, experienced and fully reliable IT partner can contribute to the success of Digital Transformation and ESG changes. A team of experts will:

make ESG and DT plans actionable, as major risks and sustainability analysis is demanded by investors, stakeholders, corporate executives and boards of directors;

evaluate key potential risks (internal, as well as external);

work out the right strategy for both processes and correlated changes;

factor-in all current requirements and regulations;

provide support on different stages of implementation and further.

There are a lot of preparations we need to make before taking the first crucial step towards DT and ESG changes.

Every decision-maker should focus on an in-depth analysis of the company’s ‘as is’ situation. It should include employees’ mindset, challenges and obstacles to be removed, and opportunities to be leveraged.

As a result, the implemented solutions will be more likely to succeed but will also contribute to the overall improvement of business and related success of investments.

The best IT partner is also the one who engages in the company’s workflow, asks as many questions as needed, looks into many different areas to trace potential risks, listens attentively to employees and has demonstrable experience in designing solutions for individual needs from scratch.

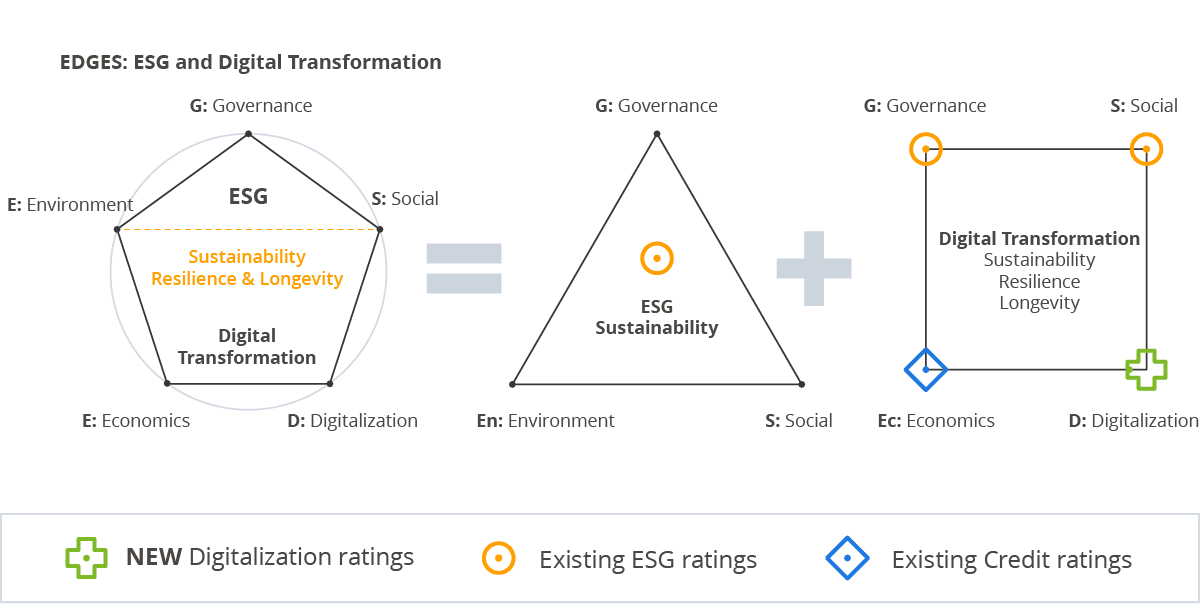

AKFI’s framework to integrate DT with ESG

As a global industry consortium that connects with enterprises to develop actionable DT and ESG plans to protect stakeholders from catastrophic risks, AKFI developed a unique framework – EDGES™.

Sustainability

Resilience

Longevity

Starting with a page from Peter Druker’s famous dictum:

If you can’t measure it, you can’t manage it. If you don’t measure, then how do you know how you are doing?Peter Druker

This is the primary function of the EDGES methodology.

It lays the groundwork for tools and dashboards that track the twin journeys of ESG sustainability and Digital Transformation. EDGES is AKFI’s solution for journey planning, as managers and directors face increasing pressure from stakeholders to reveal their Digital Transformation and environmental, social, and governance (ESG) strategies.

Companies currently provide separate reporting on financial results, ESG, and, on occasion, Digital Transformation. That leaves stakeholders, financial analysts, and management with the task of piecing the puzzle together.

We can imagine the challenge as a large bag of puzzle pieces, some of which are redundant and some of which are missing. Everyone is playing catch-up as the jigsaw is put together!

So what is missing in the puzzle?

Digital Transformation reporting, if done, delivers only the digitalisation of IT, the implementation of AI&ML solutions and IoT by businesses. Many times, it is simply a press release. This is the “D” area.

As a result of this, Digital Transformation is missing three other key transformation elements: economic, social, and governance.

The internal economic impact on processes, and external economic impact on profitability and economic development of communities (cities, regions, countries).

The social responsibility toward employees reskilling and cultural transformation.

The business model transformation leading disruptive innovation and to XaaS (Everything as a Service).

ESG Example: Ford has learnt a lesson

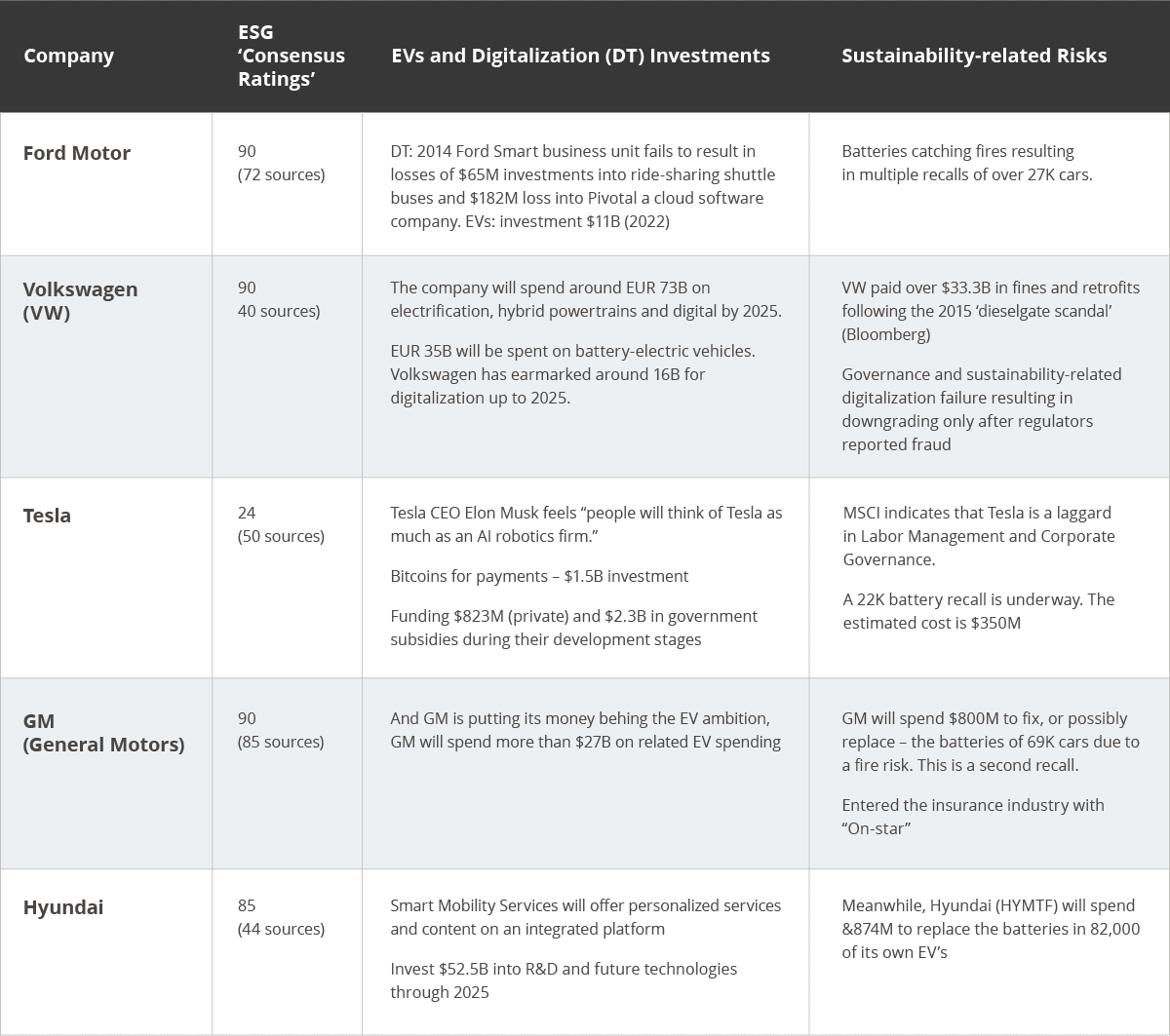

When it comes to integrating ESG and Digital Transformation, the car industry presents a number of examples and case studies. The car industry disruption is marked by the development of electric vehicles, or eVs for short.

The list included newcomers such as Tesla and BYD and the current car manufacturers such as Volkswagen, Ford, GM, Toyota and many others. Together these companies are investing over a hundred billion dollars in the next few years.

Disrupters like Tesla have shaken up thinking about how digital can be integrated into the vehicle experience, so the car becomes an integral part of the digital world. In fact, the vehicle may well become the device itself.

At Ford, the journey to electric vehicles began early. Henry Ford began work on a low-cost electric automobile in 1914. Turn the clock back a century, and Ford is again in the news with their attempt to lead the development of electric vehicles.

This time management had to learn the hard way how ESG and DT risks should be combined in electric automobiles. Let’s take a look at the entire sequence of events.

THEN: Ford Smart Mobility Digital Transformation Failure

It all began in 2014, when Mark Fields, then-president and CEO of Ford Motor Corporation, announced the company’s big aspirations to transform into a “personal mobility” company. Mr. Fields chose to build new digitally-enabled cars and smart mobility solutions in a fresh new category named Ford Smart Mobility, putting innovation at the forefront of Ford’s plans.

It was meant to be the first stage in Ford’s transformation into a product and mobility company.

A lot went wrong from the planning stage. Instead of combining Digital Transformation culture, employees, and stakeholders, Ford started by isolating them. Thousands of miles separated the new company from Ford’s headquarters.

While Ford was pouring billions of dollars into the new eV sustainability project, other parts of the company were experiencing quality issues.

As a result, the value of Ford’s stock plummeted, and Mark Fields was forced to resign.

NOW: Ford Integrates ESG And DT

Ford’s board of directors and new executives decided to take a bigger step and consider all of the risks that come with combining Digital Transformation and sustainability goals. To have a complete picture, they integrated ESG and DT into a broad strategic plan of the company’s future.

This is how Ford’s first Integrated Sustainability and Financial Report saw the light of day and started this time on the twin journey of sustainability and Digital Transformation.

Two core elements underpin everything we’re doing to ensure our mobility solutions benefit cities and citizens: focusing on the real-world experiences of our customers to help make movement more accessible and seamless improving the safety, efficiency and sustainability of the overall transportation ecosystem

While Ford’s electric vehicle journey began with Henry Ford’s first cars, many other companies have had similar eV teething problems. As Digital Transformation technology replaces the gas (petrol) engine, there are numerous examples of how high-level sustainability goals can be achieved.

Many of these risks could be avoided if DT and ESG were better integrated from the start of the planning process.

ESG & DT Should Be Inseparable

When planning, investing, and reporting, ESG and DT practices demand in-depth scrutiny. Those who want to prosper in the digital world must think about all risks in sustainable business.

A well-thought-out Digital Transformation provides companies with sustainable digital journeys that are customised to their needs. They require a comprehensive digital strategy and a compelling business case, both of which can only be established through unbiased industry collaboration.

A trustworthy IT partner’s engagement helps avoid the bumps in the road ahead. Finally, among the many risks that firms must face, there are numerous opportunities for value creation and innovation.

The question remains, when are you ready to start engaging in the ESG and Digital Transformation integration in your company?