How to analyse your market – an example from Future Processing – part II

This article is a continuation from a previous post in which I presented my point of view on the changes I have recently noticed in the IT sector.

In the first part of the article, I spoke about some aspects we focus on here at Future Processing when evaluating the current market situation.

I mentioned a few places we check for data specific to our industry as well as more general macroeconomic information. In this part, I continue with tips on what to monitor and provide a summary along with market predictions.

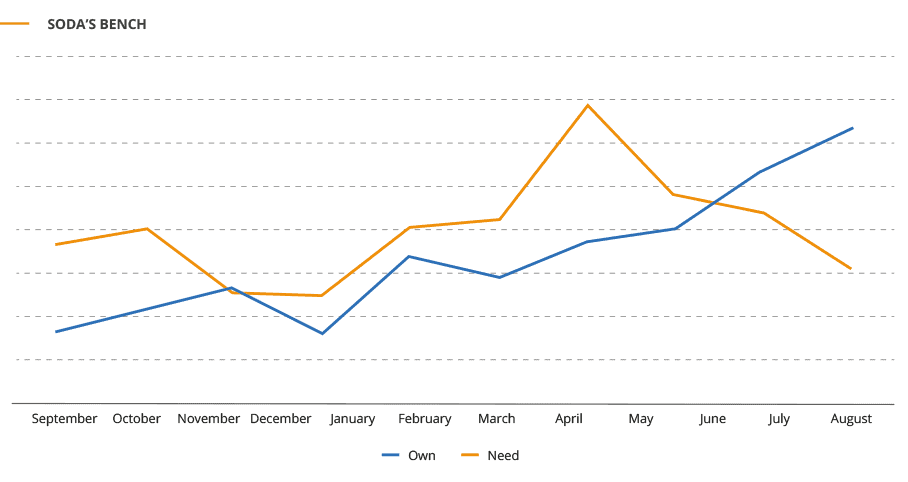

The SoDA bench

One of the benefits of being a SoDA member is access to the SoDA bench. This is a place where SoDA members share information about:

- ‘OWN’ – their own bench, i.e., inactive employees that could support other companies in their projects;

- ‘NEED’ – the skills that a company is lacking and seeking now to complete a project for a client.

As a result, companies help each other, and all sides reap their own benefits from the partnership. Another benefit of the SoDA bench, perhaps not so obvious at first sight, is that it helps in following market trends, which, in turn, can help us in our decision-making process.

Below, you can see an exemplary graph showing how the SoDA bench has functioned in recent months (actual data are available only to SoDA members).

How can we interpret the data?

In September 2021, a market revival began: SoDA member companies had more projects than the workforce to carry them out. The peak took place in March; you can see that then the trend is changing. This might mean a beginning of a long decline in demand for services. Additionally, you can observe changes in relation to a particular technology. In the future, some other variables may be added (line of business, location, etc.).

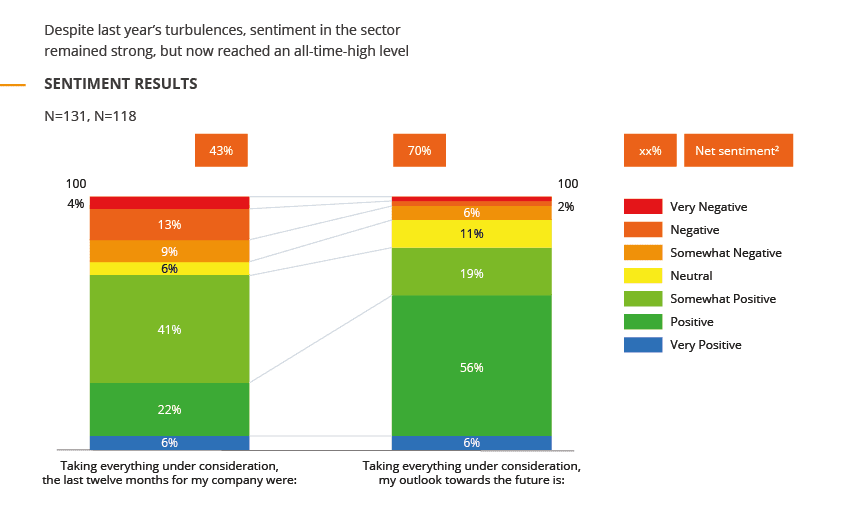

The SoDA mood barometer

SoDA conducts mood surveys among the member companies. The studies that have been performed so far can be found here. This is another useful source of information on what has already happened and how companies assess the future. The next study is planned for September 2022.

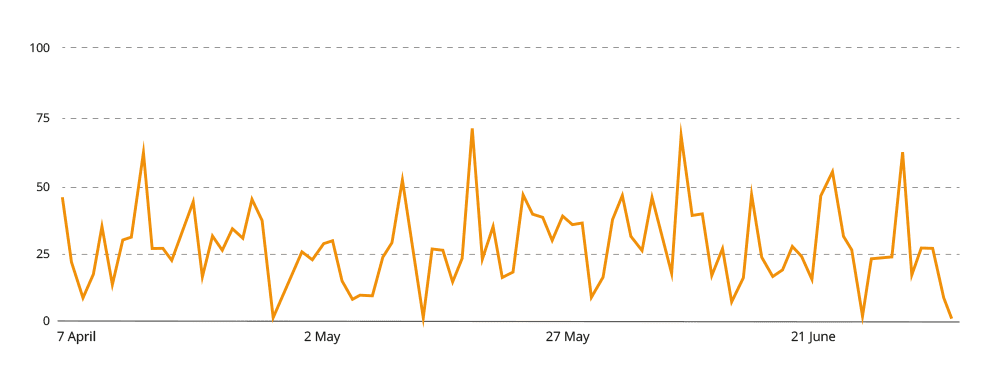

Google Trends

We all use search engines daily – and most of us use Google. It turns out that this tool can tell us a lot about changes in the market. This proves particularly useful if you know what you’re looking for.

Using Google Trends, you can see how the interest in the “software development services” phrase has changed in the US:

Also, using Google AdWords and similar tools, you can monitor the cost-per-click for phrases. Normally, when the economic situation changes, these costs rise, because companies desperately search for new sales opportunities, as their existing channels no longer work. As a result, the demand grows, and the service price goes up alongside.

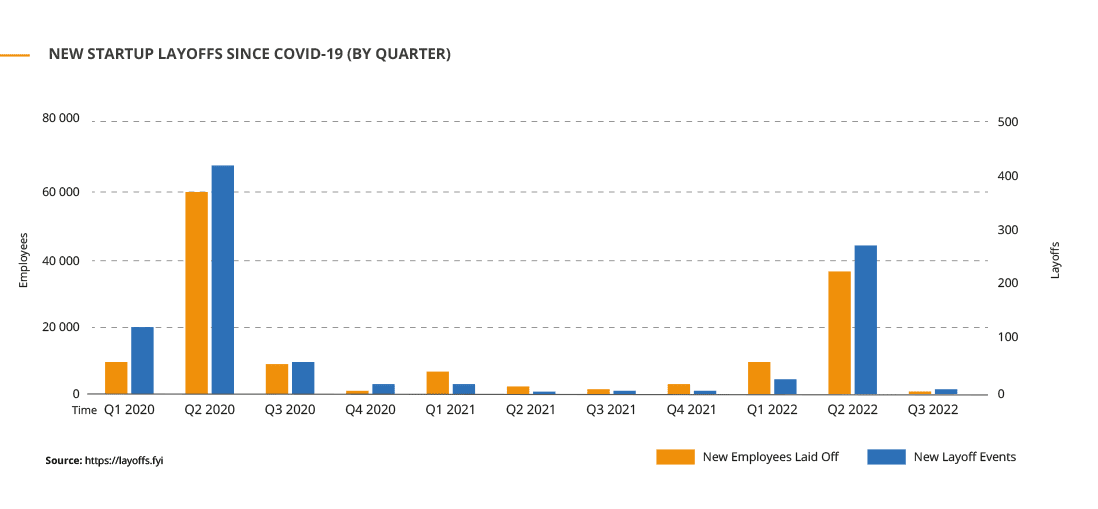

Dedicated websites

Another free source of valuable data is the websites that present current information about layoffs in given sectors. The most popular website of this type, commonly used, especially in the US, is called Layoffs.

It was created to monitor the changes triggered by the pandemic but, as you can see, it also shows current changes: e.g., in Q2 2022, there was a visible market change.

Obviously, there are more sources of this kind: you just need to find those that will provide you with the most useful metrics.

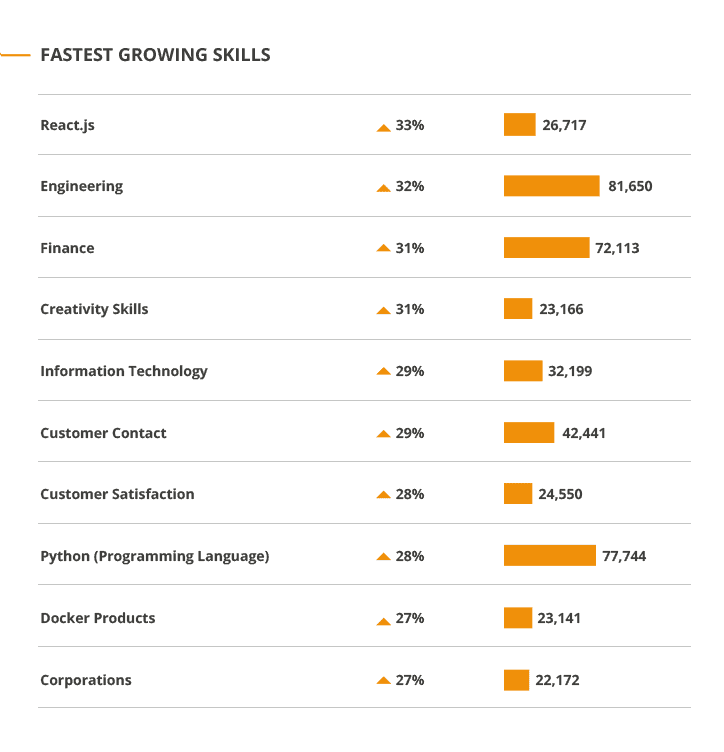

Industry platforms

Recruitment websites can also serve as a valuable source of market knowledge. LinkedIn is the most obvious example, but there are also other, local websites, such as Polish JustJoinIT.

If you use the premium versions of these tools, you gain access to a person who will share general trend information with you. I think this is worth it: you will learn which sectors are seeking employees and which sectors have slowed down. You can also find out where companies seeking new hires in each country are from and whether something is changing in this respect as well (perhaps other clients withdraw, suspend their offers, or perhaps they increase their job offers, etc.).

Moreover, websites of this type often publish insightful reports based on large datasets (LinkedIn) and offer access to valuable information as part of their standard service fee.

Clutch is another example, quite popular in the IT community. You can monitor the trends related to the quantity and quality of sales leads acquired by means of Clutch as well as more general market trends. However, in the case of Clutch, remember that the platform’s algorithm is changeable which can affect the results.

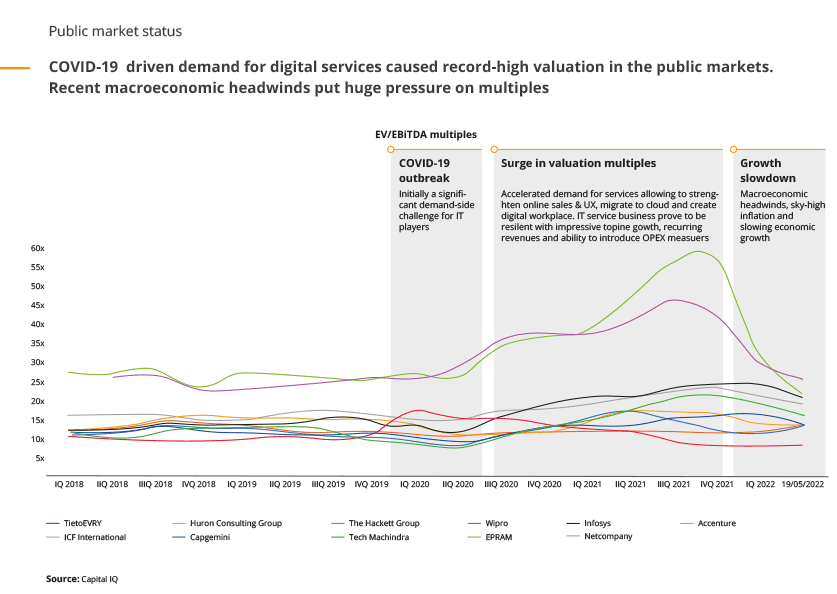

Consulting companies’ reports and the situation on the M&A market

A separate category of market information includes paid and free data provided by the most popular consulting companies and their reports (Gartner, Deloitte, PWC, etc.). Here’s a sample report about the current situation compared to the situation from several years before for the IT sector.

This is another example related to the M&A market situation. In this case, the bigger the market revival is, the more transactions for higher prices there are.

Spontaneous recruitment applications

One of the simplest indicators we observe is the number of direct recruitment applications on our website. It’s not completely unbiased, though, because it can be strongly correlated with the marketing campaigns run by our company.

Still, if you know what is going on and when, and you can filter this information appropriately, spontaneous recruitment applications are a trend worth keeping an eye on. In the case of the huge demand for employees, the number of spontaneous applications will drop, while in the case of a larger supply, there will be more applications than usual.

Collaboration proposal from similar companies

I remember very well how frantically companies tried to find new projects in Q2 2020. I read lots of comments about that on LinkedIn as well. Such queries can provide useful information indicating possible changes in the market, too.

If we observe more queries about collaboration than usual – i.e., companies from our sector want to know if we have an excess of projects and need additional skills – this means that such companies have problems with sales, their benches grow, and they look for new distribution channels.

Increased interest in marketing and sales services

When the market situation worsens, companies often become more interested in sales and/or marketing services. This is because their existing sales channels run dry and to respond to this in a thoughtful manner, they begin to seek improvements in their sales departments to acquire new clients. This can be observed on dedicated portals, knowledge exchange groups, and at industry meetings.

Summary

Some people say that it’s best to start panicking first, before others notice what is going on. There is some truth to it, also in terms of business. If you forecast possible market trends accurately and in advance, you can make better decisions for your company, which, at the end of the day, will increase your profits and stability. That’s why it’s so important to monitor the market situation and spot the moments of change.

As you’ve just read, to do this, you need to gather and analyse data from numerous sources: in terms of both hard statistical data and soft data based on conversations with people. Look towards the future but look back to the past, too. Look at the industry together with the general market environment and economic situation. Evaluate financial data as well as possible changes in legislation.

This will help you build your own process of evaluation, adjusted to your business. As part of this process, you will learn certain recurring patterns that will allow you to take suitable action.

What we can see today

Based on the collected and discussed data, you can try at drawing conclusions about the current situation and forecasting the future. Remember that you still have no crystal ball, and your forecasts may be wrong: this is all about probability.

How do evaluate the situation on the market and in our sector?

After 2008, we entered the so-called era of cheap money, which led to a situation where companies had easy access to money and investment.

As a result, companies tried to invest money quickly, because their competitors would do the same. That meant that a few start-ups arose and plenty of ideas were realised, even though they didn’t have a proper business justification.

Then, during the pandemic, people would hold on to the money they had and didn’t spend it. On the other hand, they received “free” money as a result of certain political decisions. Consequently, when the pandemic began to withdraw, that money started to fuel the economy in a tangible way.

Besides, there was a supply shock: people wanted to spend the money they’d saved but they were unable to because there were supply shortages caused by the supply chain disruptions due to the pandemic. That was accompanied by the semiconductor crisis.

These, in short, are the factors that have triggered inflation in the world. Additionally, the base effect (zero or nearly zero inflation before the pandemic) made the Consumer Price Index rise drastically in a number of countries.

What is more, there were turbulences related to energy resource prices caused by political events as well as the weather (weak winds in Europe in winter resulting in lower energy supplies from wind power stations).

Next, Russia attacked Ukraine, which led to further surges in energy prices, and that, obviously, fuelled inflation even more. Bear in mind that we are dealing with other huge changes in the world currently. The world is getting divided into two blocs again. The first bloc is headed by the United States and the US dollar, whereas the other bloc, consisting of China and other countries (BRICS), wants to become independent from the USD.

Consequently, there is a lot of uncertainty on all the markets now. Although technically there is no recession yet, there are more and more opinions that this is just a matter of time – and that’s just a self-fulfilling prophecy. It’s a good moment to remind ourselves that by definition, recession occurs when real GDP decreases for two subsequent quarters. There is also a view that we might be facing a situation where the GDP is not increasing but it cannot keep pace with inflation.

So, what is the market situation about right now?

Well, nobody can say for sure… From my perspective, the hard data about the current situation do not suggest the onset of recession, but we must take the changing circumstances into account: cut-off access to cheap money and cheap energy (I’m thinking about Germany in particular, as a country which relied mostly on cheap energy sourced from Russia as an element of its competitive advantage).

As a result, companies may be unable to transmit costs to customers or they will start losing to their competition, which may lead to an economic slowdown and recession. However, these conclusions are not based on numerical metrics but on predictions concerning these metrics in the future. In other words, we are observing one-off, random events which are so powerful that they might trigger change that is not indicated by the metrics used habitually.

Another question arises here: does the war in Ukraine affect the clients’ decisions about business location? I think there is some impact, but it isn’t significant. What matters most to our clients is the impact of the increase in employment costs in Poland and the region. As a result, they search for more affordable options in India and other countries in Asia. As far as the war itself is concerned, and what it may bring, it seems that the West, in its broad understanding, would like it to end in a peace treaty.

When it comes to Poland, I worry about the value of our currency. Apparently, the government is willing to sacrifice it “for the time being” to maintain the GDP increase and employment rates at all costs. From the perspective of exporters, such as Future Processing, this is no bad news. The risk is that the Polish zloty exchange rate will get out of control, and we will become a victim of a speculative attack. This might damage the image of Poland as a possible market. Consequently, clients might decide they don’t want to risk working with Poland-based businesses.

This prediction may be miscalculated: it might happen that Poland won’t receive these funds this year. To my mind, the government is playing a risky game: therefore I’m worried about the PLN exchange rate and its impact on us.

Let me end with an important note: raising interest rates is not meant to overcome inflation in Poland but is aimed at strengthening the zloty (to stop our debt from becoming larger). This is because the Polish government is parallelly following its pro-inflationary policy (the additional pension benefits, tax cuts). In such conditions, raising interest rates won’t change inflation but it might preserve the value of the national currency.

On the other hand, inflation is favourable for the government because it makes the old debt lower. So, we might expect the euro/dollar parity this year, and their value at slightly below PLN 5. Ultimately, in the long term, the US dollar shouldn’t be as powerful in relation to the euro, but so far, the situation in Europe and the European Central Bank’s policy are not helping, so I think that the dollar might be even more expensive than the euro this year.

In this environment, the zloty won’t have any chance of making up for the losses, unless the National Recovery Plan funds really show up: they might help improve the zloty’s position in relation to the euro and the dollar. What’s more, the impact of the war on the currency is huge: take a look at other countries, especially those that joined the euro and cannot make decisions about their monetary policies. In Estonia, for instance, inflation is over 20%, which is caused by the lack of impact on its monetary policy, dynamic growth, the elimination of the second pillar of the pension system, and the impact of the war.

To wrap it all up – I think these are the possible scenarios for this autumn and winter:

- 70%: Market stabilisation and the following recovery – what I understand by this is inflation slowdown, lower material prices, and rising stock market prices.

- 25%: The onset of recession – that is, the current problems will grow and there will be actual GDP declines in many countries.

- 5%: Deeper crisis – the recession will grow into a major crisis.

I think that what this means for our sector is that the currently observable slowdown will continue if autumn and then there will be a revival in Q4 2022/Q1 2023.