Analysing market situation – a how to from Future Processing – part I

You get what you measure – that’s one of the principles I follow in business. Learn what is worth measuring and why. Here's my point of view on the changes I have recently noticed in the IT sector.

Every company faces the challenge of evaluating the current market situation in the most accurate way possible to be able to make the right business decisions.

The same applies to our industry, which has experienced extremely varying market circumstances in recent years. In Q2 and Q3 of 2020, we saw a violent slump: some companies resorted to staff reductions, while most organisations stopped hiring new employees.

However, in Q4 2020, a boom for IT services began. Companies competed in terms of digitisation ideas and our sector experienced the outcomes of that rush up until the end of Q1 2022: this means that we went through 18 months of dynamic growth, which was reflected in the labour market situation and the growing costs.

In Q2 2022 and at the beginning of Q3, we can note a distinct slowdown, which results from the uncertainty related to the global macroeconomic situation. It can be said that the situation is still pretty favourable, but everybody worries that it will get worse: and that’s a self-fulfilling prophecy.

It’s hard to evaluate now whether the slowdown is a short-term phenomenon or a beginning of a long-lasting change: as a result, it can be expected that companies will cautiously look out for what happens next.

In this article, I’ll show you how we do this at Future Processing and what aspects we focus on based on data specific for our industry as well as more general macroeconomic information.

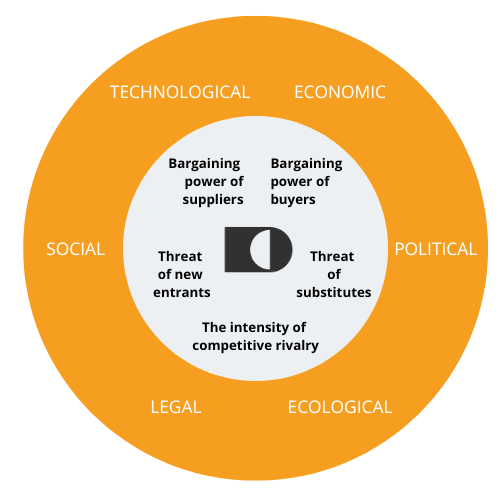

General market environment

At Future Processing, we evaluate the general market environment quarterly (or as the need arises). One of our colleagues prepares the necessary data. The goal of the analysis is to examine the current situation and its impact on our business.

As part of our analysis, we check the data connected with relevant current events, e.g.:

- The number of Covid cases in particular countries.

- The war in Ukraine.

- The new lockdown in China.

Next, we look at key economic issues related to our country and the countries where our clients come from. For instance, the most interesting topics related to Poland in Q1 2022 include:

- The impact of Covid restrictions on running a business.

- The planned regulations concerning remote work.

- The expected inflation rate and its consequences for us, especially in terms of its growth rate.

- The cancelling of WIBOR (Warsaw Interbank Offered Rate) and the launch of the POLONIA reference rate.

- The Polish Deal 2.0

- The return rate of bonds

- The costs of work in Poland

- The dispute between Poland and the EU

- The PMI for Poland

While analysing the markets of our clients, we look out for:

- The Manufacturing PMI and the Services PMI

- The ZEW index

- The current and planned interest rates

- The Gartner report on the forecasted IT spending

Based on this information, we assess the risks and opportunities for the company. At the same time, this information helps us understand the current and future economic situation on a macro scale as well as the impact of regulations on the way the company operates.

By following the news about SoDA’s activities, SoDA member organisations that are smaller in size can also draw their own conclusions concerning the ongoing changes and their possible impact on business.

The sales and recruitment process

One of the individual metrics that every company can make use of is the sales process length.

Usually, every organisation has a sales model that defines the average length of the process of making a deal with a new client. When the market situation worsens, sales cycles tend to get longer, get stuck or stumble, or even fail more often than not. This is one of the aspects that can be taken into account in a market change analysis (the change of the time necessary to complete a sales process or the effectiveness of completing a sales process).

In the same way, you can monitor the length of recruitment processes. In this case, data may be harder to come by, though, because such processes also take place among the competition. Still, you can observe candidates who take part in a couple of recruitment processes and who delay giving their answer because they are waiting for a response from other companies as well: this may take longer than usual when companies fight for employees.

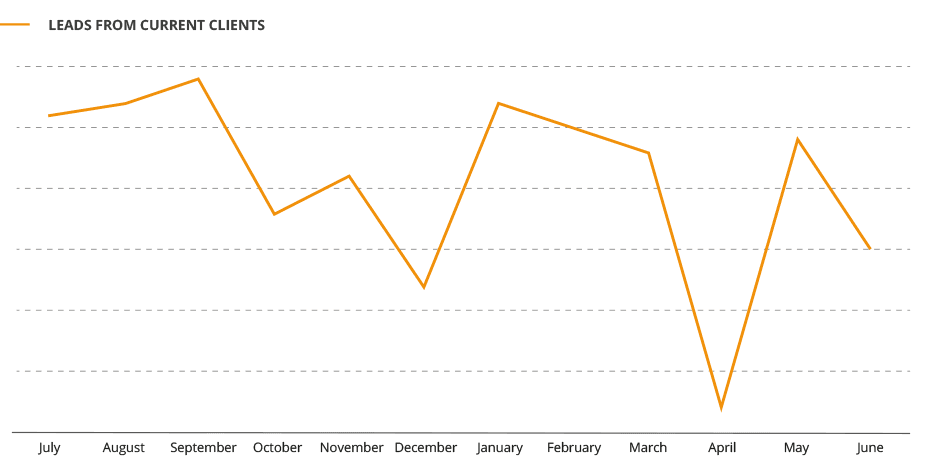

The current clients’ leads

At Future Processing, we pay special attention to the sales leads of our current clients, as this gives us information about the business situation in our portfolio and may give us a hint about the general market sentiment.

The wisdom of the crowd

Another area we concentrate on is the knowledge our clients and partners have. Hard data and economic forecasts may serve as a useful introduction to a conversation with our network, aimed at obtaining more insight into selected subjects.

Clients

Our company cooperates with dozens of clients from various countries. Moreover, we have a number of partners and employees operating in a variety of markets. This is why a casual chat can provide us with plenty of valuable data. How are things going in your country? How is your business doing? What are your predictions for the future? These are some of the simple questions that may help.

There is no rule of thumb: you simply need to talk to people on a regular basis, connect the dots, and share the information you have, too. As a result, you will regularly obtain useful information about a given country, sector, or technology.

Specialists in the industry

Industry experts may be a valuable source of information. I think it’s a good idea to follow people from various industries: this way, you can build your own view on what’s happening in the world and how it can affect you.

For example, I follow people with extremely different approaches to the market: there are those with a bold attitude to the stock market as well as those who say what is worth short selling and why.

I believe that it’s worthwhile to follow stock market speculators, especially those who have experienced bankruptcy at some point, as they usually have a good sense of the markets, and their deductions tend to be more accurate than analyses by financial institutions.

The LinkedIn network

Following people on LinkedIn routinely is also a good idea: if your network is extended and international. This way, you can spot the signs of market change from a number of directions.

For instance, I was able to pick up information about layoffs in the US: something that I’d had no idea about before showed up on my feed at the end of Q2 in 2022 (I followed the #layoffs hashtag).

Partner companies

Organisations such as SoDA offer access to numerous companies in the industry and that can be beneficial. We can build positive and open relationships with other member companies. Apart from the benefits connected with our ongoing partnership, these relationships are valuable in terms of the market situation evaluation.

Thanks to the network of contacts in other companies in our sector, we can verify our own observations, learn more details about selected subjects, or notice a change in trends.

No matter if you’re a member of an industry organisation such as SoDA or not, you can build your own network of partner companies and share information about the current market situation in your sector with them regularly.

Backtracking – a quarterly review

The analysis of hard data regarding past events is another valuable source of information.

For instance, what we do in our company is sum up every quarter in detail and discuss typical financial data (revenues, costs, profitability) as well as other aspects that are crucial to our business (voluntary employee turnover, job offer acceptance rate, changes in remunerations on the market, the number of sales leads, etc.).

These data concern our company directly and allow us to assess the condition of our business and the performance of our goals. But there’s more to that: they also point to what might happen in the future. Therefore, we need extensive data, not only financial details. We track the trends and check how our results correspond with our forecasts. By analysing differences, we can find out what is changing and why – and, consequently, we obtain data that shows us what might happen in the upcoming months.

For example, a company oriented towards strong increases is ready to bear higher costs of employing new talents, which at the same time lowers the rate of return, even though the new hires generate higher revenues. Simultaneously, another company may grow at a slower pace and focus on improving the rate of return. So, both companies measure the same aspects, but they will interpret the data differently because they have different goals.

Make sure the data you analyse is properly standardised. For example, in our experience as a service sector company, March is usually the best month in the first quarter because of the highest number of working days and a lower number of holiday days and sick days. That’s why before comparing March with other months, we need to check what the actual revenue to working day ratio is in a given month. This way we are able to assess whether our business is actually growing or if it’s just “the March effect”.

This is the end of Part 1. Visit the blog again next week for Part 2 of the article covering tips on what to monitor and a summary with market predictions.